- Oh, the modest rebound of Bitcoin! 🚀 While the mining stocks took a rather… enthusiastic dive. 🤿 RIOT lost a paltry 16%, while the highfalutin computing stocks like Core Scientific (CORZ), TeraWulf (WULF), and Bitdeer (BTDR) decided to join the party by plummeting a whole 30%.

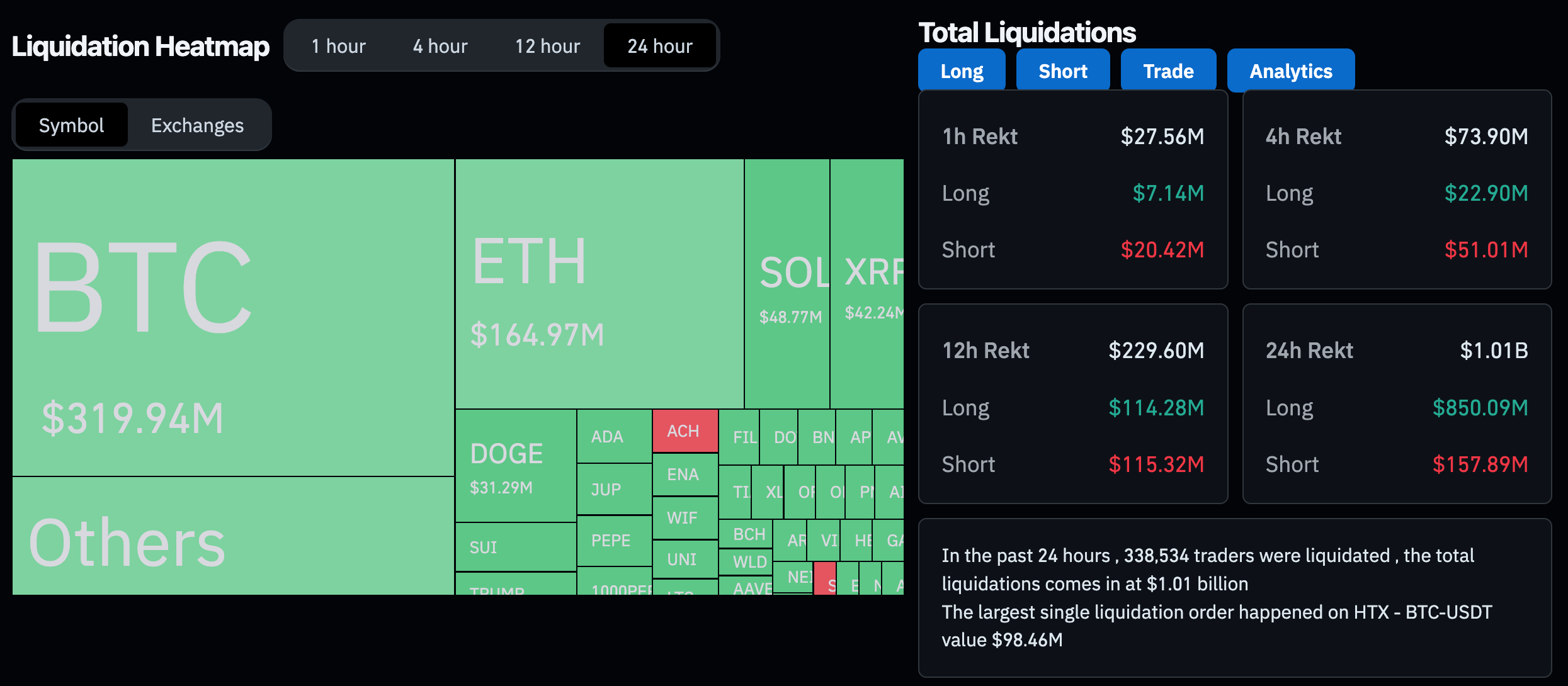

- In a rather dramatic turn of events, the market’s grand exodus wiped out a billion dollars in leveraged crypto positions. It’s as if crypto and tech stocks are joined at the hip. 💑

- Traders, ever the fickle bunch, now turn their gaze to the Federal Reserve’s next move and the earnings reports of tech’s titans. Will they or won’t they? 🎭

Bitcoin, that grandest of cryptocurrencies, managed a feeble bounce from its daily nadir, while the poor mining stocks could not reverse their rather precipitous plunge. Chinese AI startup DeepSeek has cast aspersions on the miners’ data center value, proving once again that the only certain thing in life is uncertainty. 🤷♂️

The largest cryptocurrency was last seen trading at the princely sum of $101,500, up from its earlier low of $98,000. Yet, it remains down a modest 3% over the past 24 hours. The CoinDesk 20 Index, that barometer of all things crypto, fell a rather ungraceful 5.6%, dragged down by the double-digit losses of AI-adjacent tokens render (RNDR) and filecoin (FIL). Solana, that hub of crypto AI agent tokens, also took a tumble over 10%.

The sharp descent liquidated nearly a billion dollars of leveraged derivatives positions across crypto assets, as CoinGlass data so helpfully illustrates.

The Nasdaq, that bastion of tech stocks, closed the session a rather unimpressive 3% lower, with Nvidia leading the charge downwards with a 17% plunge. In a single day, $465 billion of its market value vanished like a magician’s rabbit. 🎩 Today’s little dance also reinforced the rather cozy relationship between bitcoin and tech stocks, as noted by the ever-observant Goeffrey Kendrick of Standard Chartered Bank.

The broad-market pullback was not kind to crypto-adjacent stocks, with Coinbase (COIN) and Galaxy (GXY) ending the day 6.7% and 15.8% lower, respectively. MicroStrategy, that bastion of corporate bitcoin holding, managed to hold up relatively well with a mere 1.5% decline. A testament to resilience, perhaps?

The Crypto Mining Stock Debacle

The mining stocks took a rather enthusiastic dive, with Riot Platforms (RIOT) and MARA Holdings (MARA) plunging 8.7% and 16%, respectively. Such drama!

Miners that had pivoted to high-performance computing for AI training infrastructure fared even worse. Core Scientific (CORZ), TeraWulf (WULF), Bitdeer (BTDR), Cipher Mining (CIPH), and Applied Digital Corporation (APLD) all endured a rather unpleasant 25%-30% decline. It seems the crypto markets and AI supply chain-linked stocks needed a little ‘event’ to trigger a profit-taking correction. Such is life in the fast lane.

Market participants, ever the eager beavers, will focus their keen eyes on this week’s Federal Reserve meeting and the earnings reports from tech’s behemoths. Will they exceed expectations? Only time will tell. 🕰️

The Monday selloff may just be the perfect opportunity for altcoin investors who missed the last crypto rally. Higher-beta crypto tokens like solana (SOL) have taken quite the beating, after all. 🥊

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- George Folsey Jr., Editor and Producer on John Landis Movies, Dies at 84

- Why Sona is the Most Misunderstood Champion in League of Legends

- ‘Wicked’ Gets Digital Release Date, With Three Hours of Bonus Content Including Singalong Version

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- An American Guide to Robbie Williams

- Not only Fantastic Four is coming to Marvel Rivals. Devs nerf Jeff’s ultimate

- Leaks Suggest Blade is Coming to Marvel Rivals Soon

- Why Warwick in League of Legends is the Ultimate Laugh Factory

2025-01-28 01:33