TL;DR

- The meme coin hit a $2 billion market cap, rebounding to $13 after Binance and Bybit allowed trading services with it.

- With 88% of supply in one wallet, MELANIA’s centralization raises manipulation risks amid high volatility.

MELANIA on the Run

The soon-to-be President of the United States, Donald Trump, along with his wife, Melania Trump, have recently stirred up quite a storm in the cryptocurrency world. Notably, they introduced their own meme coins, which surprisingly gained massive popularity.

The Melania Meme (MELANIA) was recently born, and just a few hours later, its market value skyrocketed to nearly $2 billion. In the same short span, its price soared past $13, only to dip down again below $7.50.

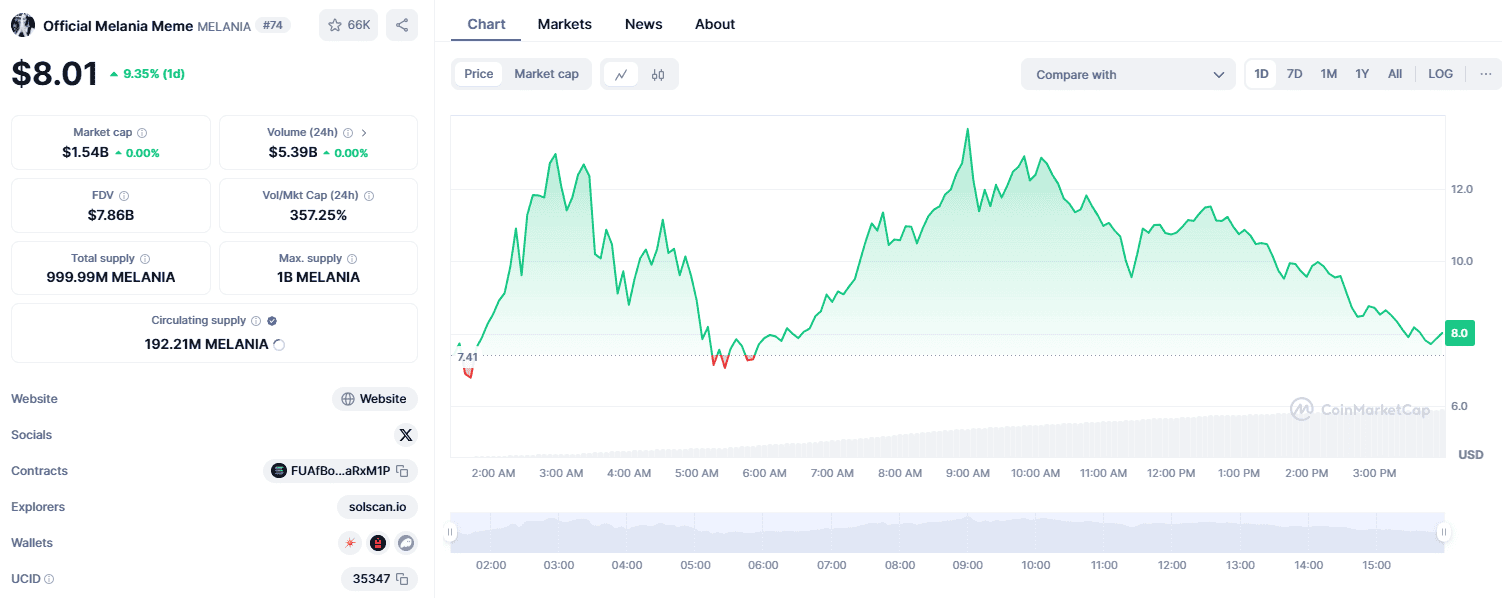

Since that dip, the valuation of MELANIA has been trending upward once more. It surpassed $13 again, and its market cap exceeded $2 billion, making it one of the top 100 largest cryptocurrencies. However, following another correction, the asset is currently ranked at the 74th position (according to CoinMarketCap’s data), with a value of approximately $8.

Melania’s previous rally might have been boosted by Binance and Bybit, as these platforms enabled trading for the meme coin. Binance introduced MELANIA/USDT perpetual contracts that offered up to 25 times leverage, while Bybit launched a similar offering but with up to 50 times leverage.

These financial tools enable traders to venture into token price predictions without actually possessing them, and they can be retained for an unlimited period. However, they present a substantial reward opportunity but also carry considerable risks stemming from leverage and potential liquidation issues.

The backing of two major cryptocurrency trading platforms tends to positively influence the values of associated assets, primarily through enhanced liquidity, easier access, and elevated credibility.

Beware the Risks

While Melania’s token may appear attractive, it’s crucial for investors to remember its volatile character. This volatility could potentially lead to substantial losses.

As a crypto investor, I’ve noticed an alarming fact about this meme coin: 88% of its total supply is controlled by just one wallet. This high concentration of ownership suggests less decentralization, which could make the project more susceptible to manipulation. Since large holders can easily impact market performance by selling off their coins en masse (for instance), it’s crucial to be aware and exercise caution when considering investments in such projects.

Individuals should join a trend or invest money only after thoroughly investigating it, and make sure they’re prepared to lose what they put in.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-20 17:12