What to know:

- Trump may announce crypto as a policy priority, Bloomberg reported late Thursday.

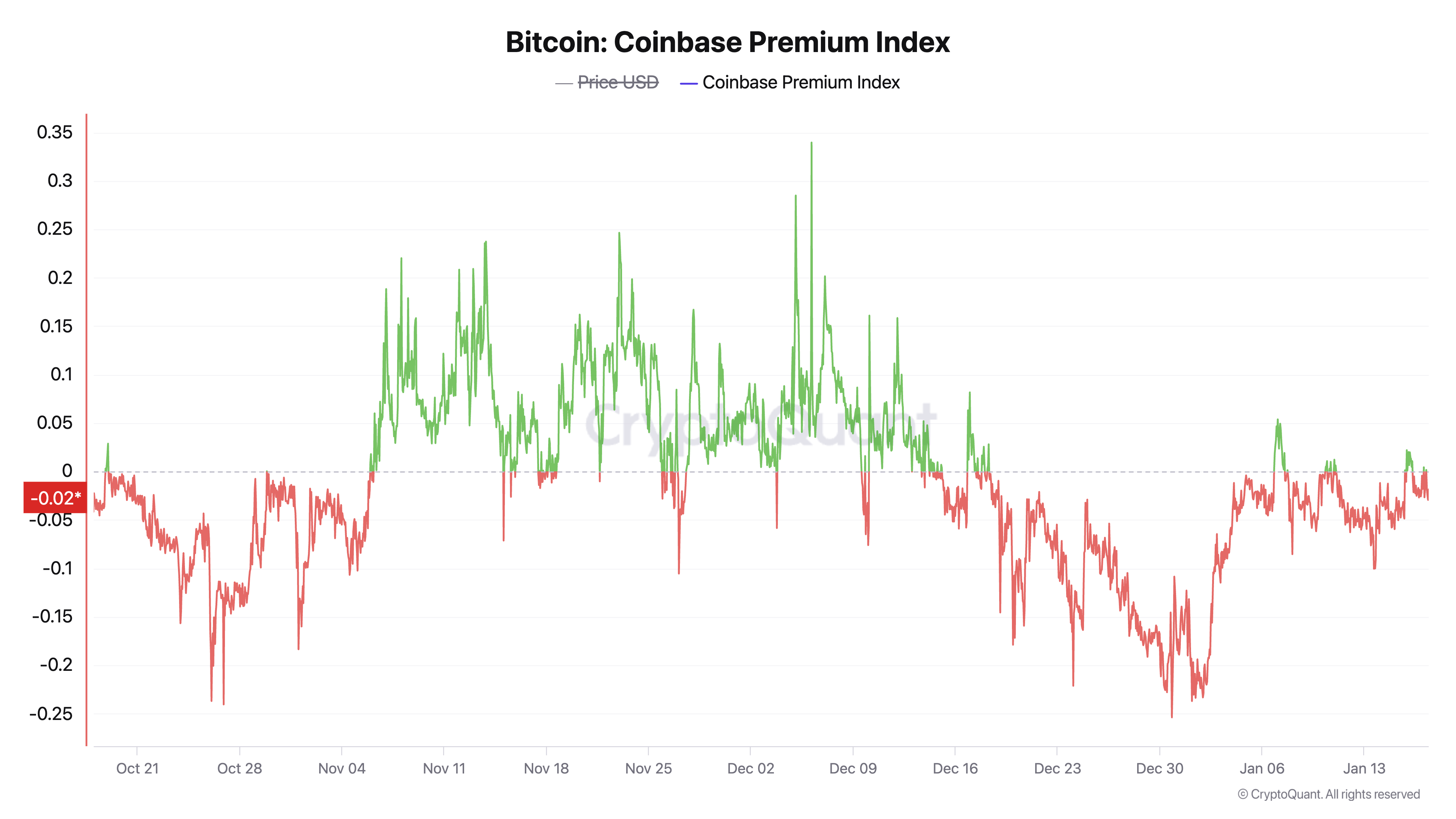

- BTC‘s Coinbase premium remains muted, signaling lack of excitement among stateside investors.

- The premium soared during the November-December price rally.

If current media reports are accurate, it seems that conditions for cryptocurrency couldn’t be more favorable in the United States, the world’s biggest economy. However, one significant marker suggests that American investors aren’t overly enthusiastic about crypto at the moment.

On Thursday, I learned from Bloomberg that as an analyst, it appears President-elect Donald Trump is planning to take a significant interest in cryptocurrency. He might even declare it a national priority or imperative and establish a team within his administration dedicated to this field. Furthermore, there’s a possibility he may announce the formation of a crypto advisory group whose role would be advocating for the policy objectives of the digital asset industry.

The report emerges at a time when there’s significant anticipation about Trump potentially declaring an executive order advocating for the establishment of a strategic Bitcoin reserve, right from his first day in office.

Previously critical about cryptocurrencies, Donald Trump expressed interest in the sector prior to the November elections, sparking optimism for lenient regulations and a broader acceptance of digital assets. On Friday, the crypto community is hosting the “First Crypto Ball” in anticipation of Trump fulfilling his campaign pledges once he assumes office on January 20th.

A presidential decree announcing the establishment of a strategic Bitcoin reserve and making it a top policy concern could markedly diverge from the predominantly skeptical Biden administration, during which various departments have initiated over 100 regulatory actions against the crypto sector.

As a researcher examining the crypto market, I’ve noticed an interesting trend: Bitcoin is currently trading at a slight discount on the Nasdaq-listed Coinbase exchange compared to Binance Holdings, a global bourse. This disparity suggests that domestic demand for Bitcoin might be somewhat subdued within the United States.

According to a chart from CryptoQuant, there are fluctuations in the Coinbase Premium, a tool that compares Bitcoin‘s price on Coinbase with its price on Binance.

In the period between November and December, Bitcoin’s price climbed from approximately $70,000 to more than $108,000, with American investors playing a significant role, as suggested by the persistent price differential on Coinbase during this timeframe.

Despite anticipation for favorable advancements within the U.S., there hasn’t been a similar surge in bullish prices on Coinbase as of yet. It’s possible that the enthusiasm stemming from Trump’s presidency was already incorporated during the rally between November and December, leaving U.S.-based traders on the lookout for whether the new president will follow through on his pledges.

At the moment of my observation, Bitcoin was exchanging for approximately $101,600. Over the past few weeks, prices have predominantly oscillated between roughly $90,000 and $108,000, as indicated by CoinDesk’s Index data.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-17 09:02