What to know:

- XRP is chalking out gains at the fastest pace since early 2018, according to the RSI oscillator.

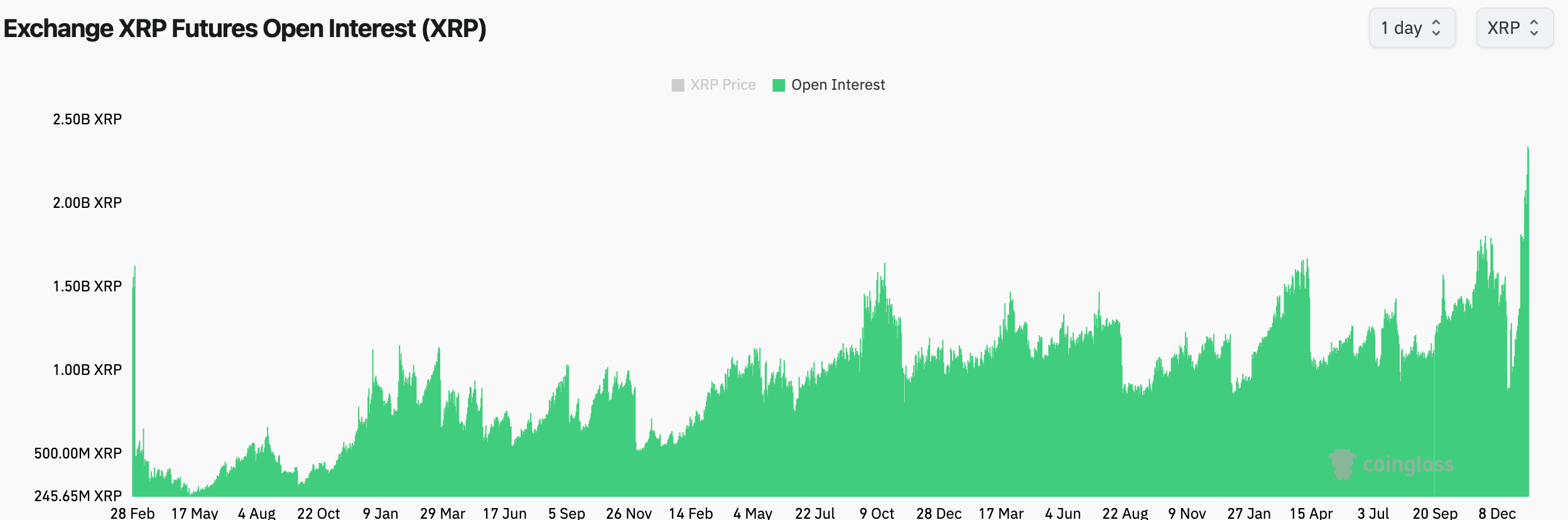

- Record open interest in perpetual futures and positive but measured funding rates point to healthy bullish positioning.

As a researcher studying the digital currency market, I am observing an intriguing trend with Ripple’s XRP, a payments-focused cryptocurrency. Despite not reaching new price peaks during the 2020-21 bull run due to regulatory challenges, it is currently experiencing its quickest climb in years. Remarkably, we are witnessing unprecedented activity in derivatives associated with this token.

Over the course of this month, the value of the cryptocurrency has significantly increased by 50%, reaching levels not seen for seven years that exceed $3. This surge follows a remarkable rally in the previous quarter which saw an increase of 240%. As reported by CoinDesk, the price has risen by 30% just in the last week. This recent growth has boosted the market capitalization to approximately $176.75 billion, placing it as the third-highest behind tether, a stablecoin.

Currently, XRP is experiencing one of its quickest upward trends since the altcoin surge in January 2018, as indicated by a widely-used market analysis tool known as the Relative Strength Index (RSI). This index fluctuates between 0 and 100, evaluating the pace and direction of price fluctuations over given timeframes, usually 14 days or a year.

12-month Relative Strength Index (RSI) of XRP has spiked to 92, a level not seen since October 2017, suggesting that the power behind its price movement during the last year is the greatest it’s been in seven years.

Inexperienced investors often note that RSI values exceeding 70 signal an overbought market, suggesting it might be due for a break or correction. Yet, it’s important to remember that the Relative Strength Index (RSI) simply gauges the pace of price fluctuations within a particular timeframe, not necessarily predicting an imminent downturn.

In other words, market indicators may show signs of being ‘overbought’ for a prolonged period, while bulls (optimistic traders) can maintain their financial stability longer than bears (pessimistic traders). Following the principle of physics, an object that is in motion tends to keep moving unless something external causes it to stop.

Diego Cardenas, an OTC trader at Abra’s digital asset platform, stated in a note to CoinDesk that crypto is bouncing back from its Monday decline, with Bitcoin approaching the $100k level. The overall market is reviving, and noteworthy coins such as Ripple (XRP) and Stellar Lumens (XLM) are leading the charge. Specifically, XRP has regained its position as the third most valuable cryptocurrency and surpassed BlackRock’s market capitalization.

As a crypto enthusiast, I’ve noticed that this current spike in value is primarily fueled by an increasing number of collaborations, the debut of Ripple’s stablecoin RLUSD, and rumors swirling around a potential XRP exchange-traded fund (ETF). Cardenas emphasized this point.

At present, elements unique to XRP, along with wider trends in the cryptocurrency market, are fueling the continued upward trend.

To illustrate this, consider trading volumes. In just the past 24 hours, the total on the spot market has skyrocketed to over $23 billion, which supports the increase in prices. Moreover, it’s been reported by data sources like Coingecko and Coinglass that derivatives volumes have more than doubled, reaching a staggering $34 billion.

The amount of XRP locked in perpetual futures contracts has reached an all-time high of 2.34 billion XRP. The fees associated with maintaining these leveraged positions, known as funding rates, are currently around 13%. This is significantly lower than the inflated 100% seen in early December, which indicated excessive bullish leverage. In essence, the XRP market is showing signs of improved health and continued growth in prices.

Currently, Bitcoin, the leading cryptocurrency, surpassed $100,000, a development that’s been met with enthusiasm as it coincides with a slowdown in U.S. core inflation. This Bitcoin surge typically encourages higher risk-taking within the broader crypto market.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-16 17:39