What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

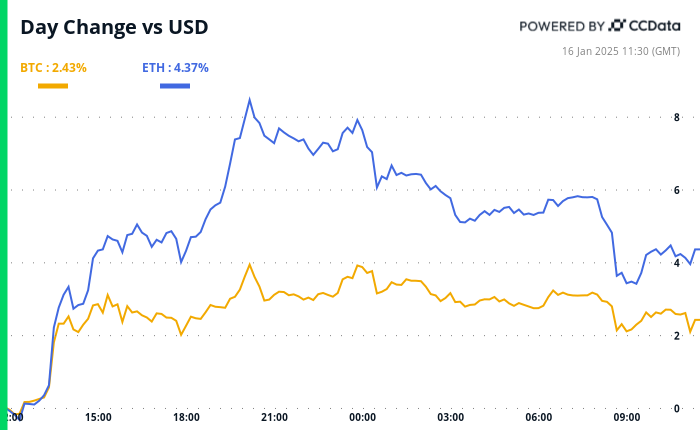

Cryptocurrencies have seen a surge in value over the past day due to the lower-than-expected U.S. core inflation rate reported on Wednesday, which eased fears about aggressive Federal Reserve actions. However, this upward trend seems to be losing steam now.

After the release of inflation data, crypto traders are shifting their attention towards President-elect Donald Trump’s inauguration on January 20th, eagerly awaiting any pro-crypto actions that might occur on his first day in office. Some analysts predict bitcoin could reach new record highs by then, while others foresee significant price fluctuations of at least 10% for XRP, SOL, ETH, and BTC.

For the first time on Polymarket, it’s predicted that there’s a 50% chance that the U.S. will include Bitcoin as part of its strategic reserves.

In simple terms, a firm called Bitwise, located in San Francisco and specializing in managing cryptocurrency assets, revealed on X that they had shared data regarding Bitcoin Exchange-Traded Funds (ETFs) with a foreign government. This act lends credence to the story suggesting widespread adoption of Bitcoin by sovereign nations.

There’s buzz in the air that crypto policy might be reignited by commissioners Hester Peirce and Mark Uyeda as soon as the coming week.

Remember to pay close attention to Scott Bessent’s confirmation hearing before the Senate Finance Committee, starting at 10:30 a.m. in Washington. This crucial event has the potential to significantly impact the market. During this hearing, Bessent may be questioned on diverse topics such as monetary policy for the dollar, tariffs, and the long-term financial stability of our economy.

In his recent statements, Bessent expressed a desire for the 2017 tax reductions to be made permanent and to maintain the dollar as a leading global reserve currency. Furthermore, he considered tariffs as an effective tool in negotiations.

As per ING, the U.S. dollar might strengthen if Bessent emphasizes tariffs as a significant factor contributing to inflation. This could lead to an increase in the currency and Treasury yields, which may dampen Bitcoin’s growth and potentially introduce volatility across all risk assets. Stay vigilant!

Token Talk

By Oliver Knight

- Cryptocurrency exchange Kraken has experienced a spike in ether (ETH) inflows after a whale deposited $67 million worth of the token on Thursday.

- The wallet in question withdrew a total of 217,513 ETH ($350 million) from Kraken and Coinbase over a 10-day period in 2022 at an average price of $1,611. With ether currently trading at $3,330, the trader has made a total profit of $354 million, Lookonchain reports.

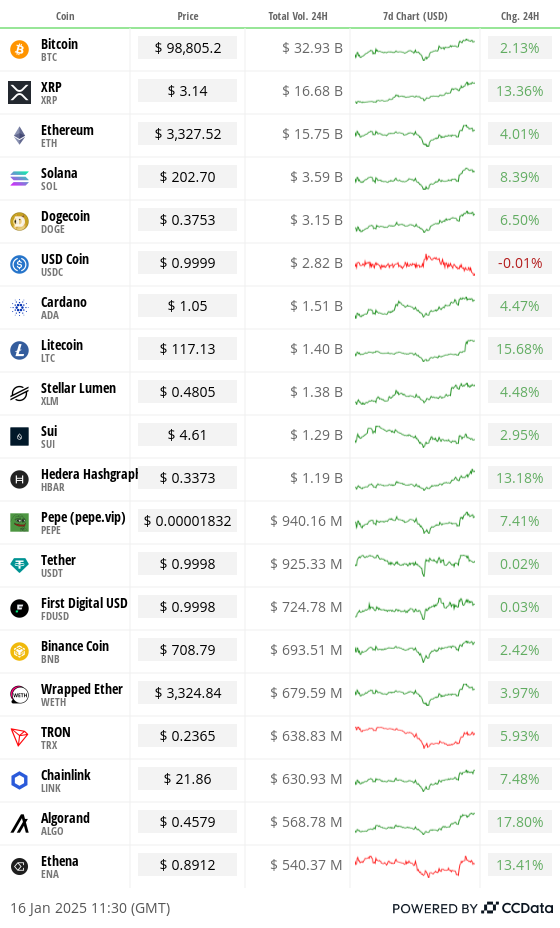

- Coinbase’s (COIN) derivatives exchange has listed perpetual swap contracts for AERO, BEAM, DRIFT and S. All tokens are up between 4% and 7% respectively.

- Artificial intelligence (AI) agent tokens shrugged off last week’s drop with a significant move to the upside. Virtuals protocol (VIRTUAL) is up 31% in the past 24 hours while AI16Z is up 13%, both outperforming the CoinDesk20 (CD20) index which has risen by 5.7% in 24-hours.

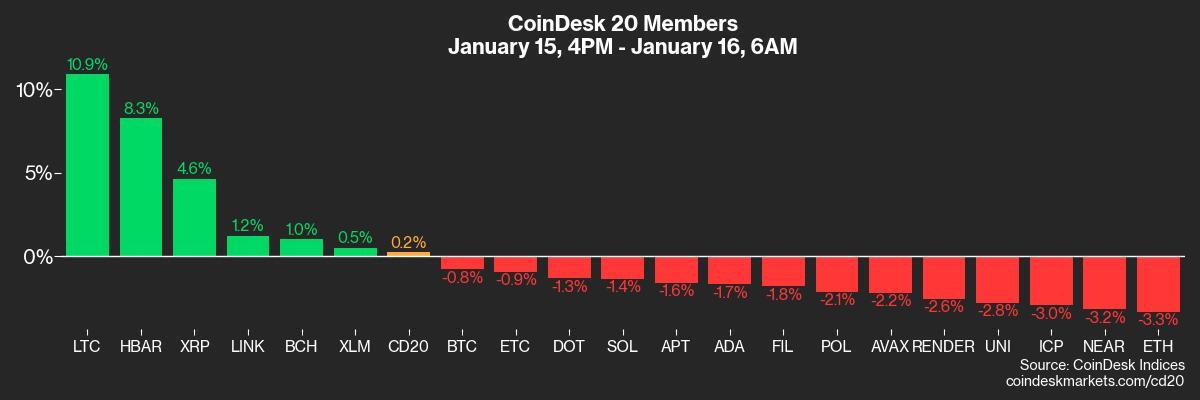

- Litecoin is also one of the day’s top performers after exchange-traded fund (ETF) analyst Eric Balchunas said that the Litecoin S-1 ETF application had received comments back from the SEC, potentially paving the way for a spot LTC ETF.

Derivatives Positioning

- LTC has emerged as the best-performing major coin in the past 24 hours, with prices rising by 16%. The surge is accompanied by a 21% increase in futures open interest and a positive Cumulative Volume Delta (CVD) indicator, suggesting strong net buying pressure.

- HBAR and XRP have seen 10% jumps in open interest with positive CVDs.

- Front-end BTC and ETH options no longer show a bias for puts, realigning with bullish long-term sentiment.

- Key flows on Deribit and Paradigm featured a BTC bull call spread involving $102K and $110K strikes and a bear call spread in ETH, involving the March 28 expiry options at $3.5K and $4.5K strikes.

Market Movements:

- BTC is down 0.47% from 4 p.m. ET Wednesday at $99,217.43 (24hrs: +0.64%)

- ETH is down 2.46% at $3,334.68 (24hrs: +3.22%)

- CoinDesk 20 is up 0.2% at 3,752.68 (24hrs: +5.68%)

- Ether staking yield is down 2 bps at 3.1%

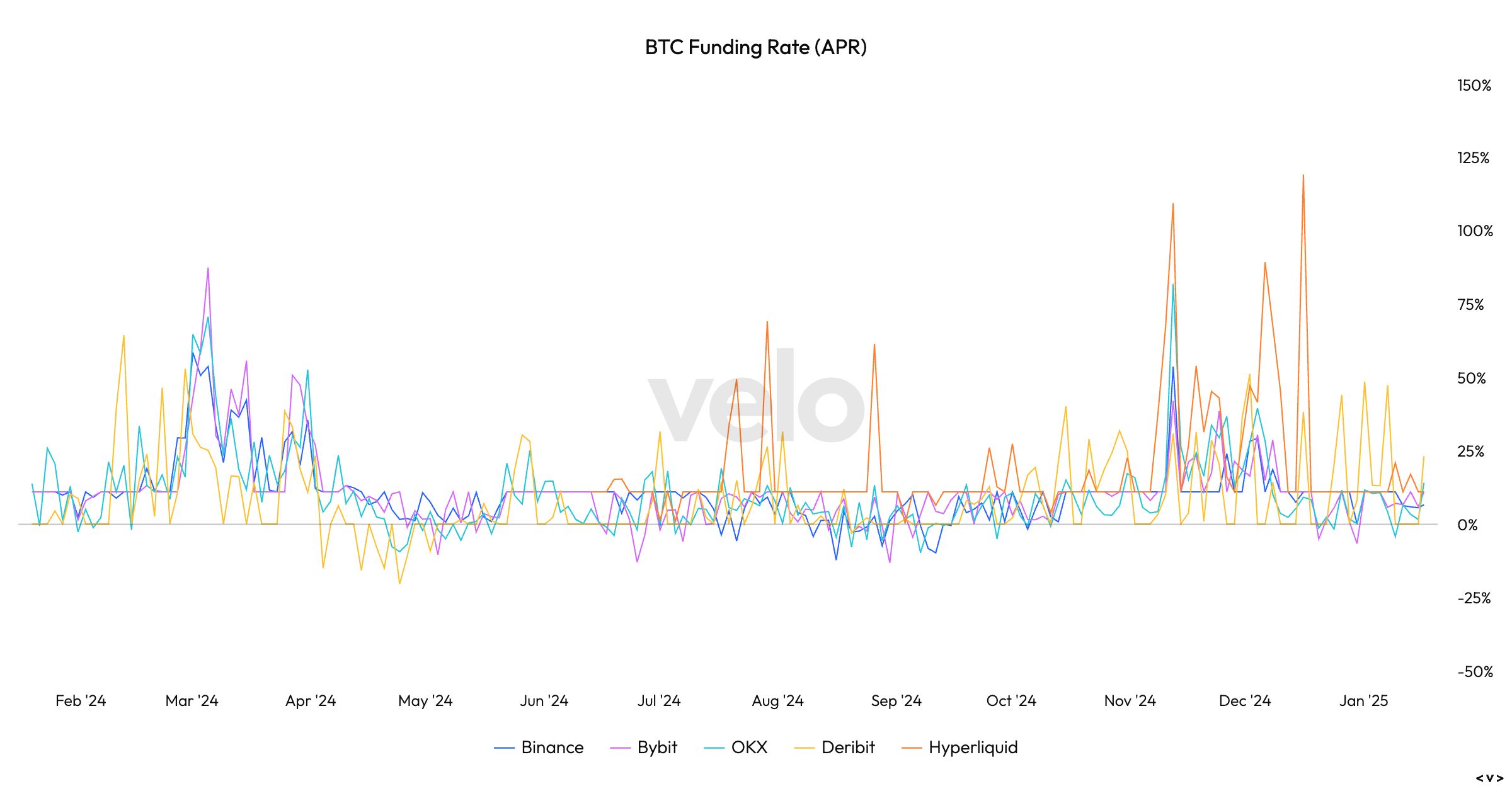

- BTC funding rate is at 0.006% (6.52% annualized) on Binance

- DXY is unchanged at at 109.13

- Gold is up 0.94% at $2,737.90/oz

- Silver is up 1.85% at $31.90/oz

- Nikkei 225 closed +0.33% to 38,572.60

- Hang Seng closed +1.23% at 19,522.89

- FTSE is up 0.82% at 8,369.48

- Euro Stoxx 50 is up 1.24% at 5,094.68

- DJIA closed on Wednesday +1.65% to 43,221.55

- S&P 500 closed +1.84% at 5,949.91

- Nasdaq closed +2.45% at 19,511.23

- S&P/TSX Composite Index closed +0.82% at 24,789.3

- S&P 40 Latin America closed +2.49% at 2,262.81

- U.S. 10-year Treasury is up 1 bp at 4.67%

- E-mini S&P 500 futures are up 0.33% at 6,009.00

- E-mini Nasdaq-100 futures are up 0.48% at 21,504.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 43,501.00

Bitcoin Stats:

- BTC Dominance: 57.66

- Ethereum to bitcoin ratio: 0.033

- Hashrate (seven-day moving average): 801 EH/s

- Hashprice (spot): $56.8

- Total Fees: $739,760/ 7.5 BTC

- CME Futures Open Interest: 178,810 BTC

- BTC priced in gold: 36.5 oz

- BTC vs gold market cap: 10.40%

Technical Analysis

- BTC is probing dual resistance at around $100K, marked by the descending trendline from record highs and the Ichimoku cloud.

- A breakout may motivate momentum traders to join the market, accelerating price gains.

- Crossovers above the cloud are said to represent a bullish shift in momentum.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $360.62 (+5.39%), down 1% at $357 in pre-market.

- Coinbase Global (COIN): closed at $274.93 (+7.66%), down 0.53% at $273.48 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.93 (+5%)

- MARA Holdings (MARA): closed at $18.15 (+4.55%), down 0.55% at $18.05 in pre-market.

- Riot Platforms (RIOT): closed at $13.46 (+%), down 0.52% at $13.39 in pre-market.

- Core Scientific (CORZ): closed at $14.53 (+4.46%), down 0.21% at $14.50 in pre-market.

- CleanSpark (CLSK): closed at $11.2 (+8.21%), down 0.89% at $11.10 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.57 (+6.5%), down 1.14% at $24.29 in pre-market.

- Semler Scientific (SMLR): closed at $56.11 (+2.15%), unchanged in pre-market.

- Exodus Movement (EXOD): closed at $35.36 (+6.92%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: $755.1 million

- Cumulative net flows: $36.48 billion

- Total BTC holdings ~ 1.133 million.

Spot ETH ETFs

- Daily net flow: $59.7 million

- Cumulative net flows: $2.477 billion

- Total ETH holdings ~ 3.550 million.

Overnight Flows

Chart of the Day

- Bitcoin funding rates on major exchanges, excluding Hyperliquid, remain well below early 2024 levels and the highs seen in December, when the BTC price broke above $100,000 for the first time.

- In other words, it’s cheaper to be long right now than last month and a year ago.

In the Ether

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2025-01-16 17:34