The volatile fluctuations in Bitcoin‘s value are causing unease among novice investors, increasing the sense of unpredictability surrounding it.

In other words, although things may seem finished with this asset’s upward trend, there’s a strong possibility that it will experience another surge in value quite soon.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

From my perspective as a researcher, I’ve noticed that on a daily basis, the cryptocurrency has been holding steady just under the significant $100K threshold, having briefly surpassed it twice before. Currently, a substantial falling wedge pattern seems to be emerging, potentially trapping the market within its confines.

If the price is able to break the pattern to the upside with momentum, an aggressive rally will likely occur in the coming months, which could even see BTC touch the $120K mark.

The 4-Hour Chart

On the 4-hour chart, Bitcoin appears more intriguing, as it’s exhibiting initial signals suggesting a fresh bullish trend could be starting.

The market has hunted the stop losses of many traders when it briefly dropped below the $90K area and has rapidly rebounded. This is a typical reversal pattern, with the price also breaking the recent high and creating a higher one. As a result, a rally at least toward the $100K level could be expected soon.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

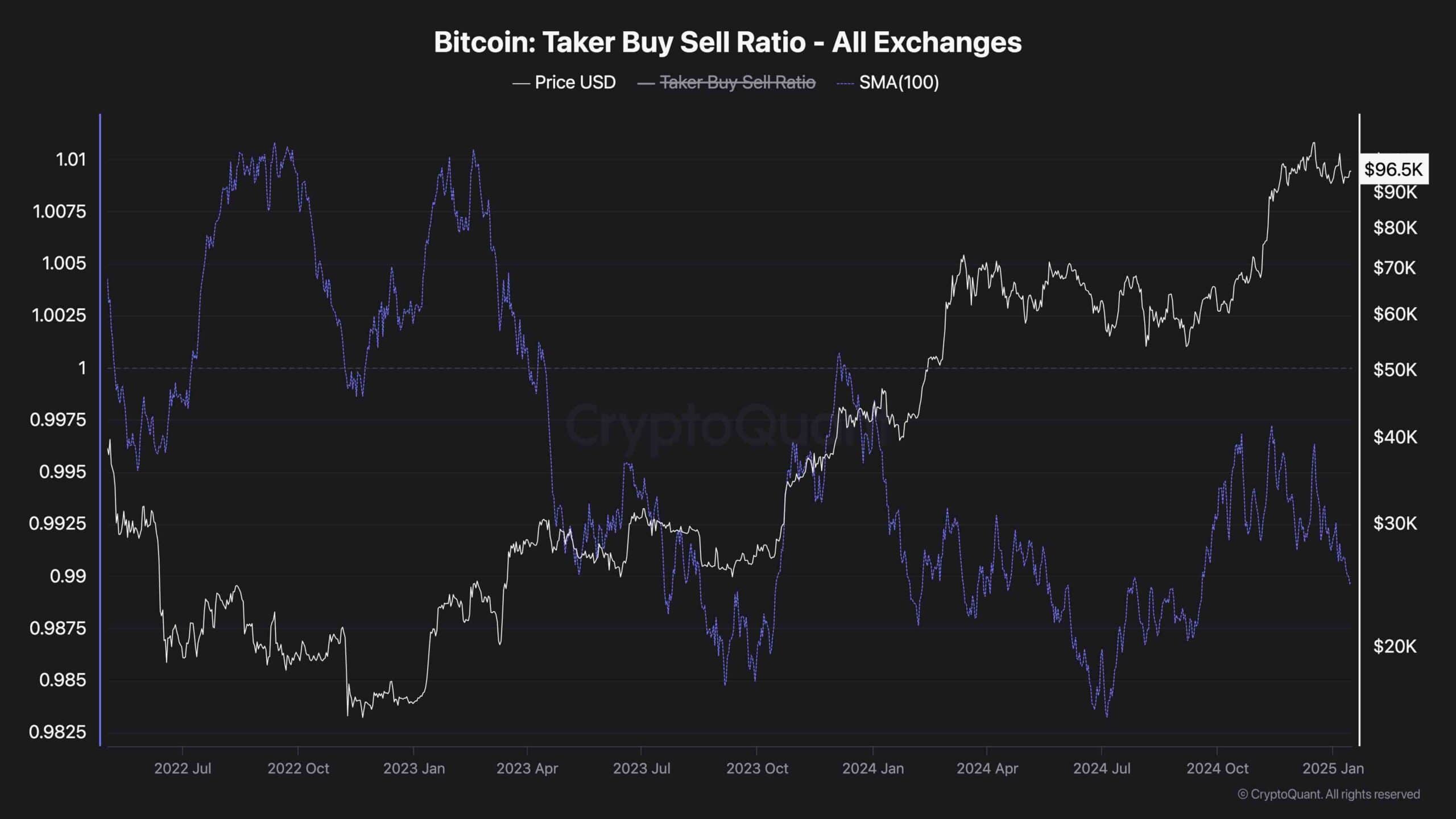

Bitcoin Taker Buy Sell Ratio

As Bitcoin shows signs of price consolidation, investors ponder why the market isn’t extending its upward momentum further. Examining the statistics from the futures market provides a likely explanation.

This graph displays the Bitcoin taker buy-sell ratio, which indicates whether traders are buying or selling more actively in the futures market using immediate orders. Orders considered aggressive are those executed instantly.

As the chart shows, the 100-day moving average of this metric has recently experienced a downturn after months of trending higher. This means that the sellers are once again the dominant force in the futures market and have likely caused the current halt in Bitcoin’s bullish run.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Skull and Bones: Players Demand Nerf for the Overpowered Garuda Ship

- Gaming News: Rocksteady Faces Layoffs After Suicide Squad Game Backlash

- Mastering the Tram Station: Your Guide to Making Foolproof Jumps in Abiotic Factor

- League of Legends: The Mythmaker Jhin Skin – A Good Start or a Disappointing Trend?

- SUI PREDICTION. SUI cryptocurrency

- The Hilarious Realities of Sim Racing: A Cautionary Tale

- ‘The Batman 2’ Delayed to 2027, Alejandro G. Iñarritu’s Tom Cruise Movie Gets 2026 Date

- Honkai: Star Rail Matchmaking Shenanigans and Epic Hand-Holding Moments!

- Smite: Is the Current God TTK Too High? The Community Weighs In!

2025-01-15 16:20