What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

As a researcher, I find myself puzzled: How can anyone perceive Bitcoin (BTC) as anything but a valuable investment at these current prices, given the market trends and its potential future growth? This was my sentiment on Monday, as I observed BTC’s price dropping below $90,000.

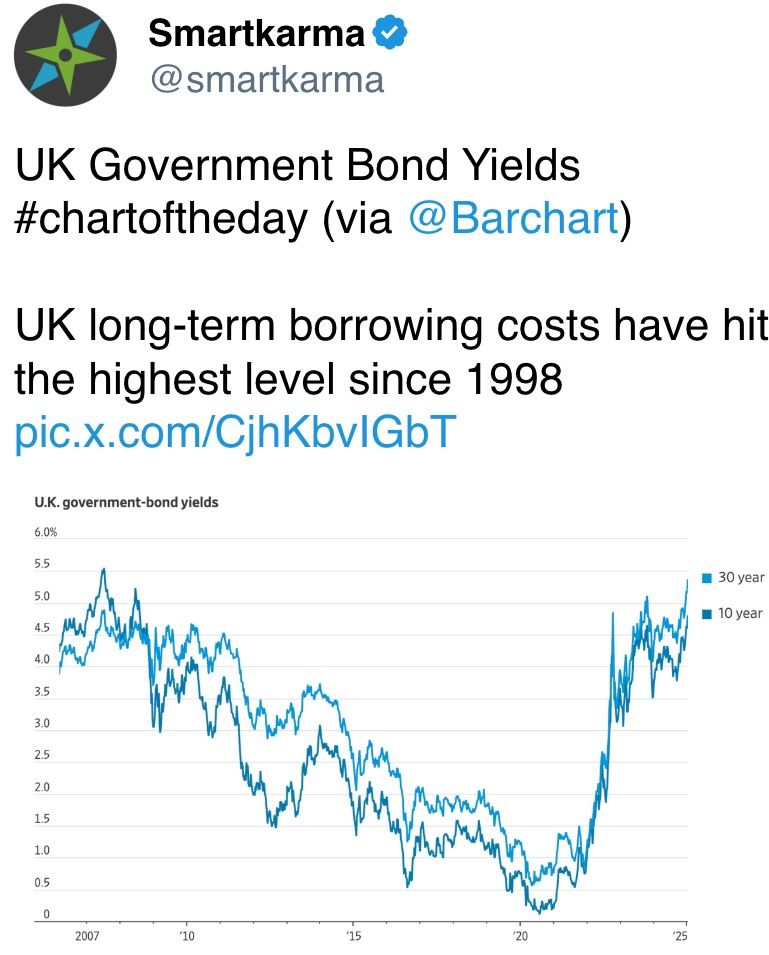

Despite seeming excessively positive to those who are bearish on a large scale (known as macro bears), this comment is not unfounded. Although the DXY, Treasury yields, and Fed rate predictions suggest potential instability in risk assets, the interest in Bitcoin from corporations and institutions remains robust.

It is said that Italy’s largest bank by market capitalization, Intesa Sanpaolo, has reportedly invested in Bitcoin, purchasing 11 BTC for approximately $1 million. This move could potentially speed up the adoption of cryptocurrencies within the third-largest economy of the European Union, where around 1.4 million citizens currently own digital currencies.

Furthermore, it appears that the acquisition of Bitcoin by corporate Treasuries has surpassed expectations, as they’ve amassed a total of 5,774 BTC within just the initial fortnight of January. This accumulation exceeds the current rate at which new Bitcoins are being generated.

To Dragosch’s advantage, Bitcoin has surged past $96,000, suggesting a potential conclusion to the price decline that started a month ago when it hit record highs above $108,000. Typically, this development has brought optimism across the entire crypto market, with artificial intelligence, gaming, and meme sectors taking the front line.

The persistent institutional acceptance and whispers about President-elect Donald Trump potentially signing an executive order concerning cryptocurrency accounting regulations on his first day in office, hints at a challenging environment for bears to exert control.

If the U.S. Producer Price Index suggests a decrease in upcoming inflation on Tuesday, it could potentially push prices up to six figures, as this would weaken the argument for aggressive interest rate hikes by the Federal Reserve (Fed). It’s worth noting that the upward trend of the dollar index has slowed down due to news that Trump’s tariffs might be implemented gradually and less severely than previously anticipated.

Token Talk

By Francisco Rodrigues

- Holoworld AI has announced the start of Agent Market, a Solana-based token launchpad allowing users to create, trade, and interact with on-chain AI agents and their tokens without coding skills. The marketplace has integration with multiple social channels including X, allowing for agents to be deployed on these channels after launch.

- Despite enduring a steep correction, AI tokens have outperformed every other basket class within the cryptocurrency space so far this year, owing their returns to a significant surge seen in the first week of the year. CCData’s basket performance shows that year-to-date, AI tokens are up 2.5%, while the second-best performing class, exchange tokens, is up less than 0.5%.

- On the other end of the spectrum, real world asset (RWA) tokens are down more than 14% , significantly underperforming memecoins, which dropped roughly 10% in this month’s correction.

- Usual Protocol, the popular decentralized finance protocol that came under fire last week over an unexpected change in its redemption mechanism, has activated its Revenue Switch for USUALx holders.

- Solana-based token launchpad Pump.fun has moved 122,620 SOL worth over $21 million to Kraken, bringing their total deposited funds to 1.785 million SOL worth $362 million, Onchain Lens revealed.

- The FTX estate has executed its monthly SOL redemption transfer, unstaking 182,421 SOL and moving the funds to 20 different addresses. Since November, FTX has redeemed over $500 million in SOL, and it still holds $1.18 billion in its staking address.

Derivatives Positioning

- Large cap tokens, excluding XLM, XRP and HYPE, have seen a decline in perpetual futures open interest in the past 24 hours.

- Front-end BTC and ETH options risk reversals show neutral sentiment despite the price recovery. Near-dated and long-term options show a bias for calls.

- Block flows featured large purchase of calls at $95K and $98K expiring in the next two weeks and an ETH bull call spread, involving March 28 expiry calls at $5.5K and $6.5K.

Market Movements:

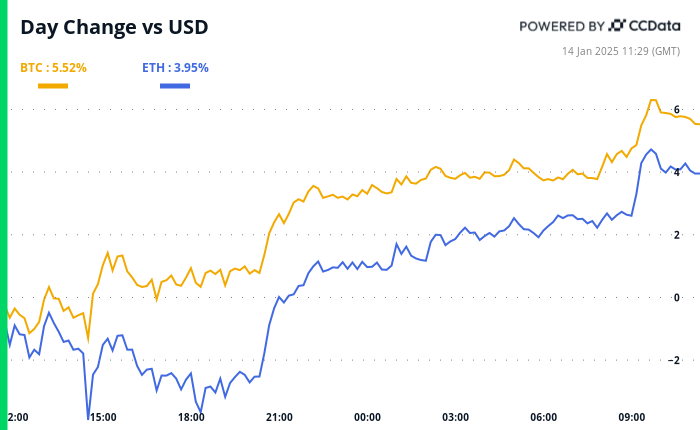

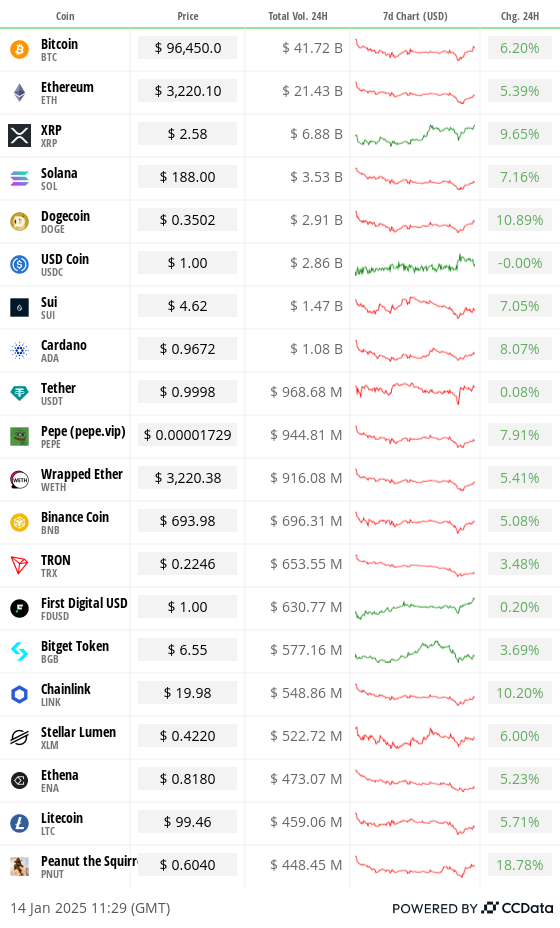

- BTC is up 2.56%% from 4 p.m. ET Tuesday to $96,615.50 (24hrs: +6.44%)

- ETH is up 3.84% at $3,233.91 (24hrs: +5.76%)

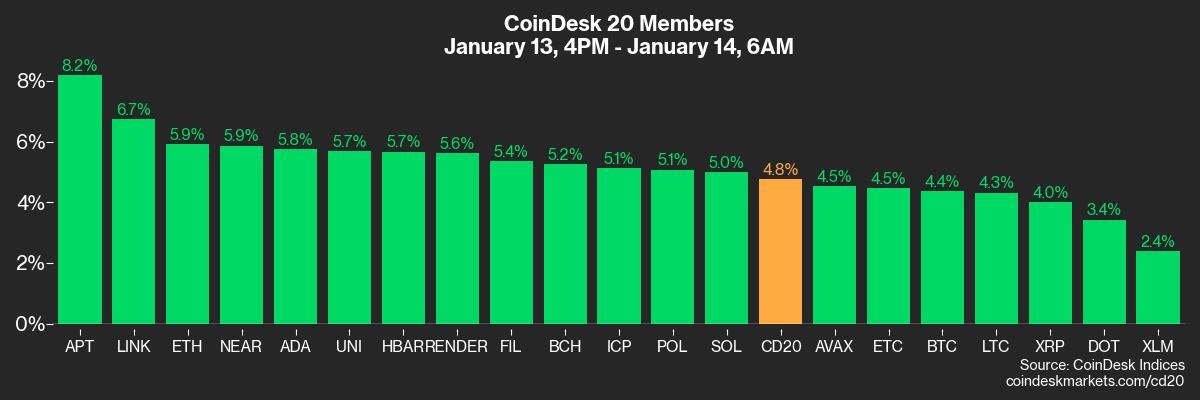

- CoinDesk 20 is up 4.69% to 3,463.07 (24hrs: +6.84%)

- Ether staking yield is up 15 bps to 3.12%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.35% at 109.57

- Gold is up 0.22% at $2,679.50/oz

- Silver is up 0.76% to $30.32/oz

- Nikkei 225 closed -1.83% at 38,474.30

- Hang Seng closed +1.83% at 19,219.78

- FTSE is up 0.17% to 8,237.93

- Euro Stoxx 50 is up 1.03% to 5,005.29

- DJIA closed on Monday +0.86% at 42,297.12

- S&P 500 closed +0.16 at 5,836.22

- Nasdaq closed -0.38% at 19,088.10

- S&P/TSX Composite Index closed -0.93% at 24,536.30

- S&P 40 Latin America closed +0.49% at 2,192.57

- U.S. 10-year Treasury was unchanged at 4.79%

- E-mini S&P 500 futures are up 0.54% to 5,906.00

- E-mini Nasdaq-100 futures are up 0.71% to 21,096.00

- E-mini Dow Jones Industrial Average Index futures are up 0.37% to 42,682.00

Bitcoin Stats:

- BTC Dominance: 58.52

- Ethereum to bitcoin ratio: 0.033

- Hashrate (seven-day moving average): 773 EH/s

- Hashprice (spot): $54.3

- Total Fees: 7.77 BTC/ $721,654

- CME Futures Open Interest: 174,105 BTC

- BTC priced in gold: 35.6/oz

- BTC vs gold market cap: 10.14%

Technical Analysis

- Despite the overnight bounce, BTC’s price remains in the Ichimoku cloud, a momentum indicator created by Japanese journalist Goichi Hosada.

- A crossover above the cloud would signal a renewed bullish outlook.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $328.40 (+0.15%), up 3.19% at $338.89 in pre-market.

- Coinbase Global (COIN): closed at $251.20 (-2.93%), up 3.18% at $259.20 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.04 (-3.8%)

- MARA Holdings (MARA): closed at $17.19 (-3.75%), up 3.61% at $17.81 in pre-market.

- Riot Platforms (RIOT): closed at $11.77 (-1.92%), up 3.65% at $12.20 in pre-market.

- Core Scientific (CORZ): closed at $13.6 (-3.13%), up 1.6222.22$13.82 in pre-market.

- CleanSpark (CLSK): closed at $10.19 (+0.99%), up 3.24% at $10.52 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.22 (-3.85%), up 7.29% at $23.84 in pre-market.

- Semler Scientific (SMLR): closed at $52.70 (+2.61%), up 4.19% at $54.91 in pre-market.

- Exodus Movement (EXOD): closed at $33.58 (-11.09%).

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$284.1 million

- Cumulative net flows: $35.94 billion

- Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

- Daily net flow: -$39.4 million

- Cumulative net flows: $2.41 million

- Total ETH holdings ~ 3.535 million.

Overnight Flows

Chart of the Day

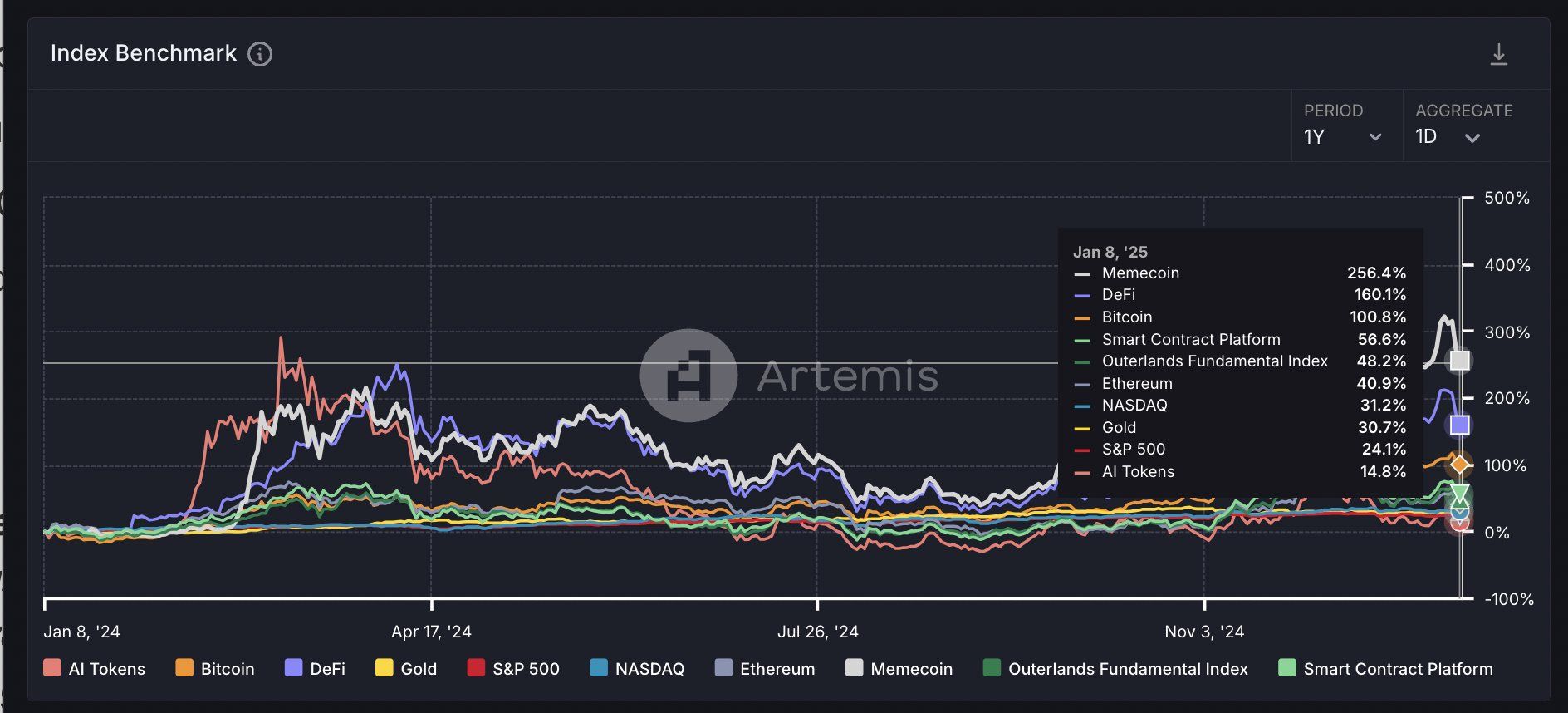

- The chart shows performance of various crypto market sub-sectors in 2024.

- Memecoins witnessed a staggering 254% gain last year, outperforming the broader market and bitcoin by a big margin.

In the Ether

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-14 15:11