What to know:

- KULR Technologies has now purchased 430 BTC, which has increased the share price by 847%.

- Multiple public companies have announced a bitcoin treasury strategy with no acquisition yet.

With the growing enthusiasm for digital assets, it seems that businesses are increasingly adopting Bitcoin, as evidenced by publicly traded companies imitating MicroStrategy’s move by incorporating Bitcoin into their financial holdings.

The journey began when MicroStrategy (MSTR) decided to invest in Bitcoin as a treasury asset back in 2020. Since then, the company’s share price has skyrocketed by approximately 2,500%. Throughout the years, it has expanded its Bitcoin holdings using cash reserves, at-the-market equity offerings, convertible debt, and more recently, preferred stock offerings.

2024 marked the trend of numerous businesses adopting a bitcoin treasury approach, with companies like Metaplanet (3350), Semler Scientific (SMLR), MARA Holdings (MARA) and various other publicly traded mining corporations following this strategy and experiencing significant success.

Now more firms are joining the party.

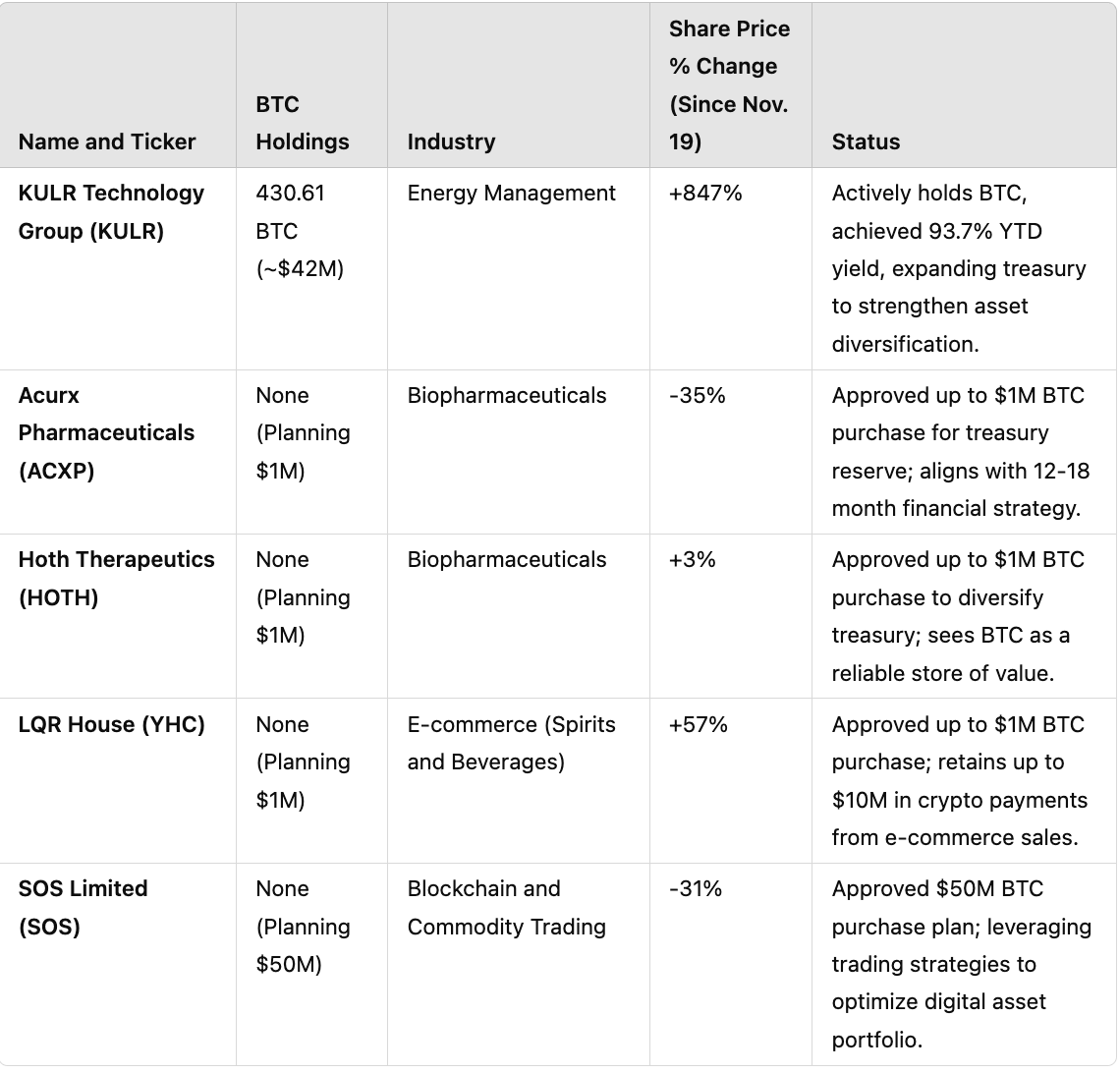

On Monday, KULR Technology Group (KULR), a company that trades on the NYSE, disclosed it had bought $21 million worth of bitcoins. This acquisition brings their total bitcoin holdings to 430 units, with an average cost of approximately $98,393 per token.

KULR utilized an ATM equity program and any excess funds to finance its acquisition. Similar to other trailblazers, they have implemented a Bitcoin yield plan, generating a return of 93.7% from December 2024 to January 2025. Since November 19th, KULR’s stock price has soared by an astonishing 847%.

It appears that as of January 7th, some publicly-traded companies are hinting at adopting a bitcoin storage approach in their treasury reserves, however, they haven’t actually purchased any bitcoin yet.

Initially, we have Acurx Pharmaceuticals (ACXP), a company listed on the Nasdaq, whose board decided to invest in bitcoin, with a maximum amount of $1 million, as of November 20th. Despite a 35% decrease in its share price since November 19th, it has still managed to increase by 30% this year.

Just like Hoth Therapeutics (HOTH), listed on the Nasdaq, made a decision to invest $1 million in Bitcoin in November, but no acquisition has been completed so far. Yet, the stock price has risen by 2% since November 19th.

In a recent announcement on November 19th, LQR House (YHC), a company listed on Nasdaq, revealed that they have adopted a $1 million bitcoin treasury strategy and started accepting cryptocurrency payments. They also disclosed a policy to hold up to $10 million of these crypto payments in bitcoin. Since November 19th, the stock price has risen by 56%.

On November 27th, the publicly traded company SOS Limited (SOS) authorized a $50 million investment in Bitcoin. This decision was made when one Bitcoin was valued at approximately $93,000. However, it’s worth noting that the share price has declined by around 30% since November 19th.

As a crypto investor, I’ve noticed that while many companies in the second wave have experienced growth, KULR has witnessed a significant surge in its share price. Yet, it’s important to highlight LQR House as an exceptional case, given its astounding 57% increase in share price.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- New Mass Effect Jack And Legion Collectibles Are On The Way From Dark Horse

- Record Breaking Bitcoin Surge: Options Frenzy Fuels 6-Month Volatility High

- „I want to give the developer €30 because it damn slaps.” Baldur’s Gate 3 creator hopes Steam adds tipping feature for beloved devs

2025-01-07 15:01