As a seasoned analyst with over two decades of experience in both traditional finance and the crypto industry, I’ve seen my fair share of market trends come and go. In this analysis, it’s clear that we’re moving beyond the hype of Web3 and into a more mature phase where data-driven insights are essential for success.

the caliber of user interaction and the chance for natural, rapid expansion. As we progress past the excitement phase, it’s no longer optional to have dependable, data-driven indicators of success – they’re indispensable now.

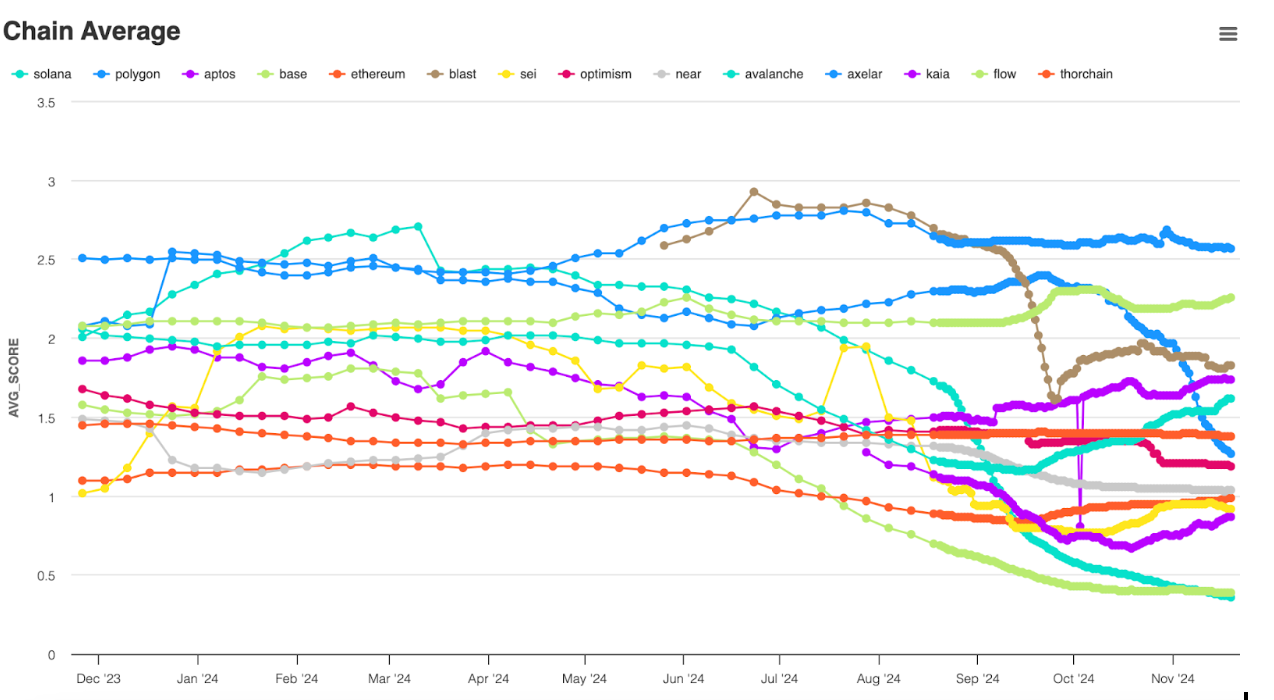

Great news! The necessary tools to navigate through the clutter have been developed already. By merging various on-chain metrics into a single “vitality index,” we can evaluate which blockchains are genuinely prospering and likely to sustain long-term progress. As 2024 winds down, let’s delve into the insights these indicators offer about today’s top chains and what we might anticipate in 2025.

Assessing user quality using aggregated, not isolated, data

To establish a lasting on-chain environment, it’s inappropriate to prioritize optimization of any singular user activity. Instead, we need a method for evaluating not just the actions users perform, but also the significance behind them. A potential strategy to accomplish this is by grouping user behaviors into five fundamental categories:

- Transaction Activity, ranging from spot trades to smart contract interactions.

- Token Accumulation in the medium-to-long-term, and other “investment” behaviors.

- DeFi Engagement for activities like staking, lending and liquidity provision.

- NFT Activity such as minting, trading and utility-driven interactions.

- Governance Participation to quantify DAO or protocol governance contributions.

It’s essential to understand that these metrics aren’t all of equal importance. A more effective method is to assign significance to each one by integrating them with a Bayesian model. This will result in a single comprehensive “score.” Unlike conventional scoring methods that depend on fixed limits or simple averages, this allows us to factor in our prior assumptions (what we think an average wallet should have) and current data (the actual on-chain activity). These scores, which adapt to new information and consider multiple variables, are more difficult to manipulate, making them more reliable sources of valuable insights.

What the data tells us about 2024

The method offered offers a new viewpoint on every chain’s user interactions until 2024. Let’s delve into some of the intriguing discoveries that might catch you off guard.

Between February and mid-March, Solana saw a significant influx of high-caliber users. However, the quality of engagement has decreased since then. Interestingly, this drop in engagement occurred around the same time as SOL‘s first price and trading volume surge in 2024, and it has persisted during the recent memecoin craze. Repeated actions on the Bayesian model show diminishing returns, implying that multiple token swaps lead to smaller score enhancements compared to engagement across various activities, for any specific wallet. This pattern indicates that many Solana users are currently involved in a limited variety of on-chain activities that aren’t fostering Solana’s multi-industry expansion.

For those backing Ethereum (represented by the bottom orange line starting slightly above 1) who anticipated that ETH ETFs in 2021 would significantly boost its growth, the data presents a contrasting image. The relatively low and consistent user rating for Ethereum throughout the first half of 2024 indicates that this year’s positive trends did not lead to increased involvement across the broader ecosystem, as demonstrated by decreased DeFi activity and reduced participation in protocol governance.

As a crypto investor, I found it noteworthy to mention that Axelar (the dark blue line starting at 2.5) stood out for having the most active users across a wide spectrum of on-chain activities when compared to its total user base, according to the data. Although Axelar is significantly smaller in terms of TVL than the established chains grabbing today’s spotlight, this could be an enticing sign that deserves further investigation – a detail I would have overlooked if I were only focusing on market cap or trading volume.

The takeaway here isn’t that Solana is doomed and Axelar will inevitably become the world’s biggest chain. There is limited value in comparing these types of scores across chains, since each score is proportional to the user quality of its corresponding chain. In other words, a Solana user with a score of “4” may be very different from a “4” on Axelar, given the differences in each chain’s baseline activity. As such, these scores are most useful when tracking changes in the quality of a chain’s overall user activity over time, not cross-chain comparisons.

Predictions for 2025

With that said, what does each chain’s user quality track record tell us about next year?

Initially, it’s evident that Solana is encountering both challenges and prospects as we approach 2025. The course it takes hinges on its success in keeping its vast casual user base and broadening the types of on-chain activities they engage in. If it fails to do this, there could be a major dip when memecoins lose popularity – though early data from 2024 indicates that Solana has a substantial number of high-quality users who will remain committed regardless of short-term fluctuations.

2024 showcased that Axelar could draw a focused group of users involved in varied, continuous blockchain transactions, rather than short-term, speculative spikes. From now on, it’s about expanding Axelar’s ecosystem without compromising the caliber of its user base. This might entail focusing on significant collaborations to reach new markets, while also establishing more intuitive entry points for beginners across its decentralized application (dApp) environment.

The move towards Ethereum’s L2 (Layer 2) ecosystem due to its speed and affordability has resulted in a significant shift of active users away from the mainnet. Consequently, we might observe the core functions of the mainnet, such as protocol staking and governance, becoming more concentrated. These activities are essential for the broader Ethereum Virtual Machine (EVM) ecosystem, but this trend could potentially be disadvantaged by evaluation methods that favor diverse on-chain interaction.

This dynamic underscores a challenge for scoring systems: prioritizing wide-ranging user activity can present an incomplete picture when applied to task-specific networks (or general purpose chains that are evolving into something more specialized). As a result, it’s important to clearly define what success means for whatever chain is being evaluated and use a scoring system that captures the corresponding user actions.

A better way to define, and drive, on-chain growth

It appears that for far too long, Web3 has been focusing on measuring the wrong aspects, neglecting to consider data holistically. By the year 2025, the ones who emerge victorious will be those adept at discovering comprehensive methods to assess and respond to factors of utmost importance: user quality.

By adopting updated evaluation techniques within their interfaces, on-chain intelligence platforms offer investors and industry watchers more impactful information. Concurrently, Web3 developers can leverage these scores to pinpoint key focus areas, stimulate user interaction, and foster value generation. Over time, this will guide the sector towards strategic decisions based on facts rather than hype, maximizing the true potential of Web3 from 2025 and beyond.

The opinions shared in this article belong solely to the author; they may not align with the perspectives of CoinDesk, Inc., its proprietors, or its associated entities.

Read More

- SUI PREDICTION. SUI cryptocurrency

- Skull and Bones: Players Demand Nerf for the Overpowered Garuda Ship

- Navigating Last Epoch: Tips for New ARPG Players

- ‘The Batman 2’ Delayed to 2027, Alejandro G. Iñarritu’s Tom Cruise Movie Gets 2026 Date

- Why Sona is the Most Misunderstood Champion in League of Legends

- Gaming News: Rocksteady Faces Layoffs After Suicide Squad Game Backlash

- RIF PREDICTION. RIF cryptocurrency

- House Of The Dead 2: Remake Gets Gruesome Trailer And Release Window

- Honkai: Star Rail Matchmaking Shenanigans and Epic Hand-Holding Moments!

- League of Legends: The Mythmaker Jhin Skin – A Good Start or a Disappointing Trend?

2024-12-23 21:56