As a seasoned crypto investor who has weathered countless market storms and seen the sunshine of countless bull runs, I can’t help but feel a sense of deja vu when I see the current market turmoil. The past seven days have been a rollercoaster ride, reminding us once again that cryptocurrencies are not for the faint-hearted or the risk-averse. The total capitalization plummeting by over $300 billion and Bitcoin‘s price swinging like a pendulum is all too familiar.

In the world of cryptocurrencies, things aren’t always sunshine and lollipops, and despite the recent period seeming otherwise, the last week served as a sobering reminder. The total market value plummeted by over $300 billion, with Bitcoin’s price experiencing a wild ride similar to that of most other altcoins.

To begin the week, things unfolded much like we’ve grown accustomed – mostly upward trends. Bitcoin reached an unprecedented peak of $108,000 in value, sparking market anticipation regarding the outcome of the US Federal Reserve meeting. Generally speaking, people were hoping for another rate cut, a move that is typically seen as beneficial for risk-on assets. Unfortunately, if such a reduction was indeed to occur this time, it has yet to be announced.

At the gathering, Chairman Jerome Powell hinted at potentially lessening the pace of interest rate reductions due to an observed rise in national inflation. This suggestion sparked a broad sell-off throughout the cryptocurrency market and traditional finance (TradFi) as well, with most indices experiencing significant declines.

Powell discussed the potential for Bitcoin to serve as a national reserve asset, stating that the Federal Reserve is legally barred from possessing it. This could potentially hinder Trump’s strategies, and it seems that investors are displeased as the cryptocurrency has dropped below $100K, falling to approximately $92,000 today.

The sell-off also triggered over $1.3 billion worth of liquidated positions across the cryptocurrency market on Friday alone.

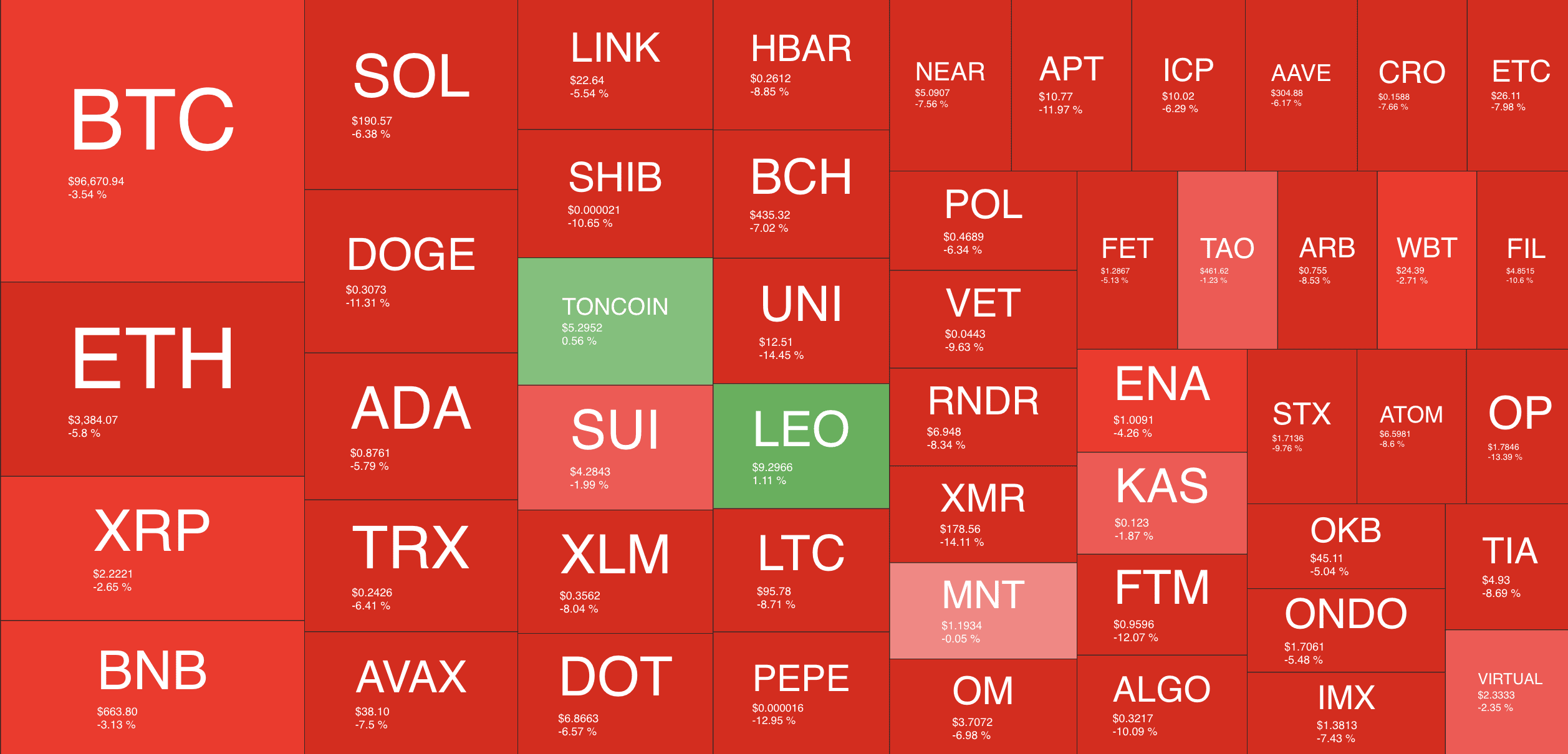

Most altcoins are currently experiencing a decline in value. For instance, Ethereum is dropping by nearly 15%, XRP by about 10%, Binance Coin (BNB) by 8%, Solana by 15%, Dogecoin (DOGE) by 25%, and many others following suit.

Typically, many folks within our community are questioning if the bull market has come to an end. However, in situations such as these, it’s crucial to step back and maintain a broad perspective, focusing on the long-term view instead.

Without a doubt, the upcoming weeks promise an intriguing journey, so we’ll just have to wait and see what unfolds!

Market Data

Market Cap: $3.45T | 24H Vol: $482B | BTC Dominance: 55.3%

BTC: $96,552 (-4.5%) | ETH: $3,370 ( -15% ) | XRP: $2.21 (-10%)

This Week’s Headlines You Can’t Miss

Today isn’t an ordinary Monday for MicroStrategy Inc., a business intelligence corporation founded by Michael Saylor. As usual on such days, the company has made a significant Bitcoin purchase – this week they allocated $1.5 billion to acquire 15,350 Bitcoins at an average price of approximately $100,000 per coin.

On December 17th, Ripple made waves in the crypto world by officially launching their new stablecoin, RLUSD. Despite ongoing legal disputes with U.S. securities regulators, this move sparked optimism and positively influenced the price of XRP.

A significant proportion of Ethereum’s total supply is currently being held by large whale investors. Recent on-chain data shows that these whales, who own at least 100,000 ETH each, now account for more than half (57.35%) of the entire Ethereum supply, reaching a new record high.

In a remarkable achievement, BlackRock’s Bitcoin Investment Trust (IBIT) surpassed the 20-year accumulated asset management milestone of its Gold ETF in under a year, demonstrating an unprecedented growth spurt. As of December 19, the trust boasts an impressive Assets Under Management (AUM) figure close to $60 billion, significantly outperforming its largest gold-based ETF.

Even with the Federal Reserve’s anticipated rate cut at year-end 2024, as expected, a statement from Jerome Powell hinting at potential rate increase in 2025 sent shockwaves through the crypto market, causing it to plummet. Initially, Bitcoin dipped towards $100,000 but soon fell below that level and dropped to $92,100, sparking debate among investors about whether the bullish trend for BTC has come to an end.

As a crypto investor, I witnessed firsthand the impact of the Fed Effect when the comments from Chairman Powell sent shivers down the spines of US investors, causing them to offload their Bitcoin positions, particularly those tied to spot Bitcoin ETFs. The following day after the FOMC meeting (December 19), these financial vehicles experienced their most significant net outflow in a single day, with approximately $700 million being withdrawn.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-20 18:30