What to know:

- The bitcoin price is languishing 13% below its record high, the most since the U.S. election.

- While long-term holders are selling into price strength, there’s not enough demand from short-term investors to meet the supply.

As an analyst with over two decades of experience in the financial markets, I have seen many market cycles and corrections. The current correction in Bitcoin, 13% below its record high, reminds me of the dot-com bubble burst of the early 2000s. However, unlike that period where the fundamentals were not sound, Bitcoin’s underlying technology is robust and has shown resilience over the years.

Currently, Bitcoin (BTC) is being traded approximately 13% lower than its peak value of roughly $108,000, a drop not seen since the U.S. election victory of President-elect Donald Trump in early November.

After that point, the biggest cryptocurrency has gone through multiple phases where it was about 10% short of its all-time high, which some investors refer to as a “correction”.

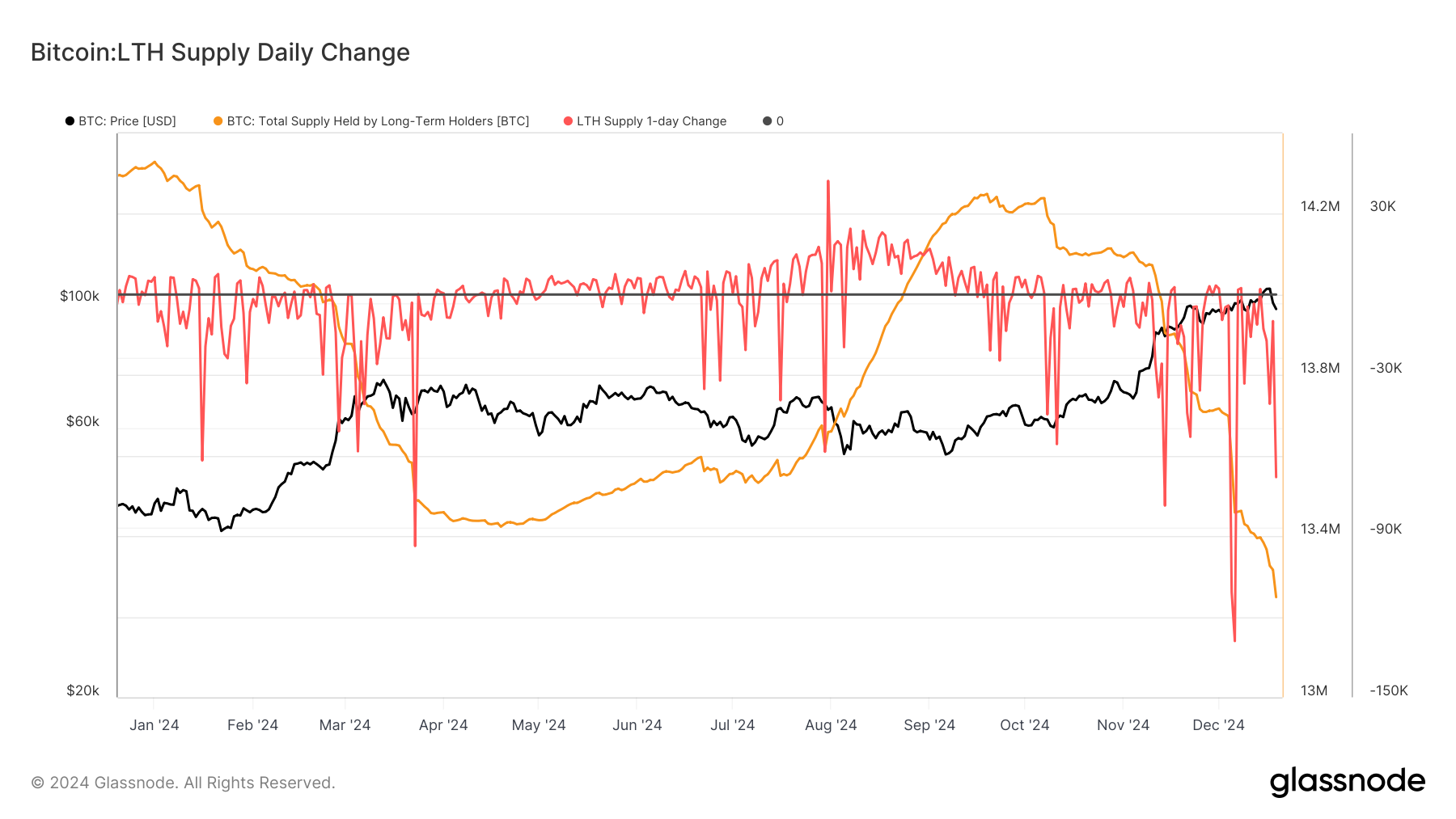

Long-term investors, identified by Glassnode as those holding Bitcoin for more than 155 days, often initiate selling when the market is strong, having previously purchased during periods of low price.

Last week, Large Bitcoin Holders (LTHs) were already transferring a substantial quantity of Bitcoin. Our earlier research at CoinDesk revealed this. Since then, they’ve been selling more quickly and have decreased their overall Bitcoin stash from approximately 14.2 million BTC in mid-September to around 13.2 million currently. On Thursday, they offloaded nearly 70,000 BTC, marking the fourth largest single-day sell-off this year, as per Glassnode data.

From another perspective, for every seller of Bitcoin, there must be a buyer. In this instance, it appears that the short-term holders (STHs) have taken on the role of buyers, amassing roughly 1.3 million Bitcoins during the same timeframe. This figure suggests they obtained coins not only from long-term holders but potentially more as well.

Over the last few days, I’ve noticed a shift in the market storyline. It seems long-term holders (LTHs) are inclined to sell their cryptocurrency assets more than short-term traders are eager to buy. This imbalance has been a significant factor in the recent drop of about $94,500 in the price.

Approximately 19.8 million units of this cryptocurrency are currently in circulation, with an additional 2.8 million kept on exchanges. However, it’s worth noting that the amount on exchanges is decreasing gradually, as around 200,000 bitcoins have been withdrawn from them over the past few months.

These cohorts are key to monitoring bitcoin’s price activity in the next few days.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-20 14:26