What to know:

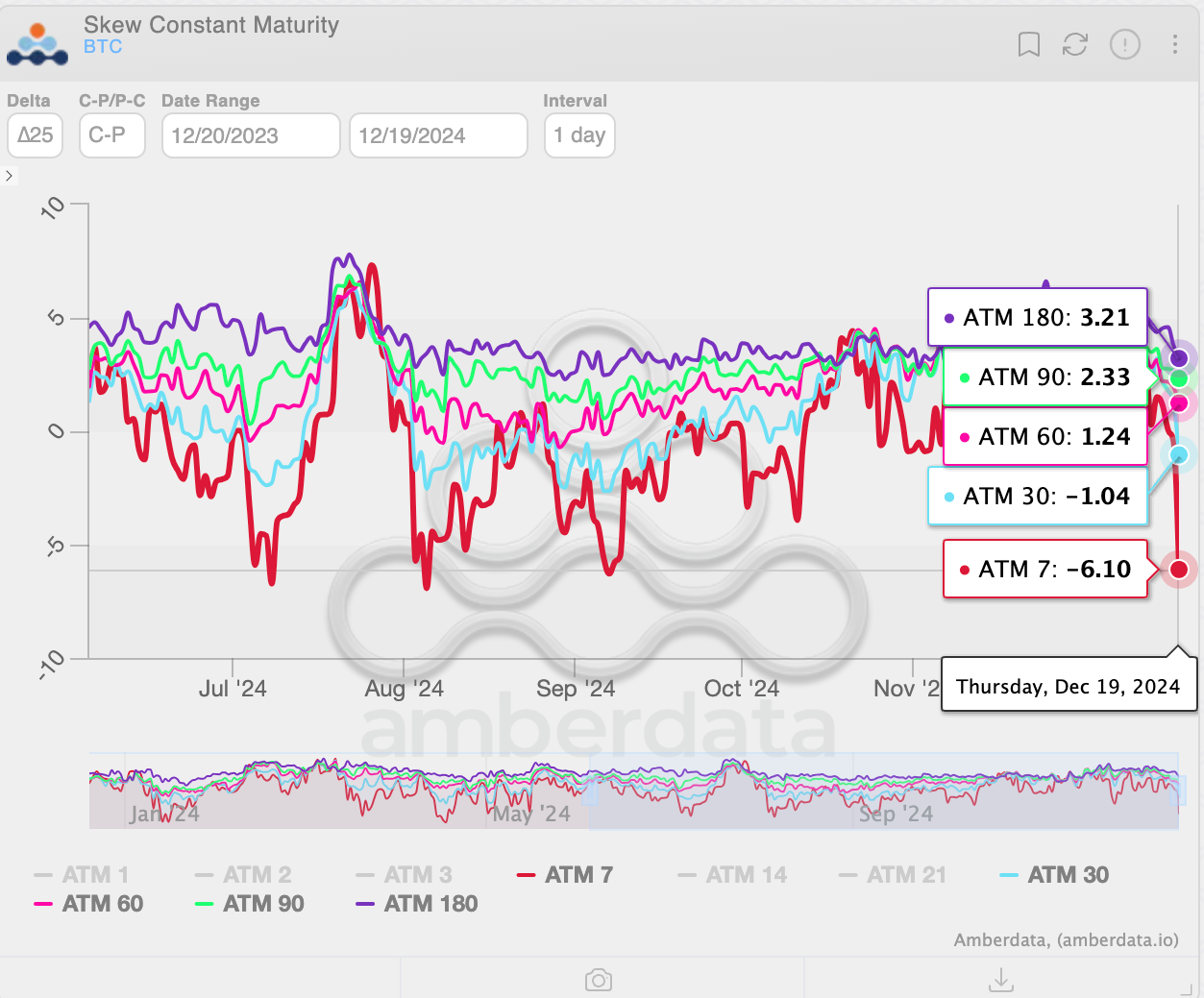

- BTC‘s seven-day puts trade at the highest volatility premium since September.

- The call skew in longer duration options continues to weaken.

- The Fed pencilled in just two rate cuts for 2024 versus four projected in September.

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies and financial markets, I find myself constantly intrigued by the ever-changing dynamics that govern these spaces. The recent developments surrounding Bitcoin and the Federal Reserve are no exception.

In simpler terms, the apprehensions crypto traders had regarding a more aggressive Fed policy became reality on Wednesday when Chair Jerome Powell reduced interest rates but showed hesitation about how quickly or extensively further cuts might occur. This uncertainty has since caused a negative shift in sentiment among traders.

Bitcoin’s seven-day call-put skew indicates that Deribit-listed put options with a one-week expiration date have the highest implied volatility premium compared to call options since September, based on data from Amberdata. This means that put options, which provide downside protection, are currently the most costly in relation to call options for the past three months.

It shows traders rushing to protect their optimistic positions from further declines due to a possible prolongation of the price drop starting on Wednesday, caused by a more aggressive stance from the Federal Reserve.

The pessimistic mood is clearly shown through the negative one-month skew, indicating a preference for purchasing ‘puts’ over ‘calls’ in options spanning from two to six months. At the moment of reporting, these ‘calls’ were trading at a premium of 3 volumens compared to ‘puts’, which is less than the 4-5 volumens premium seen earlier this month.

On this past Wednesday, the Federal Reserve reduced the key interest rate by a quarter of a percent, bringing it within the 4.25% – 4.5% range. This represents a decrease of 100 basis points compared to its level in September when they started the easing cycle.

After the interest rate reduction, Bitcoin’s value dropped due to Federal Reserve Chair Jerome Powell characterizing it as a near decision and urging caution about further actions as rates draw closer to a neutral level.

Powell further stated that the Federal Reserve has no plans to be involved in any government initiative to establish a strategic Bitcoin reserve. Moreover, he emphasized that Fed board members have no intention of advocating for amendments to existing Federal Reserve laws related to this matter. This statement follows President-elect Trump’s suggestion that his administration might consider creating such a Bitcoin reserve, similar to the national oil reserves.

In simpler terms, the dot plot, a graph showing predictions for future federal funds rates by anonymous committee members, suggests that there may only be two interest rate reductions in 2025 instead of the previously anticipated three, and this is fewer than the four cuts predicted in September.

The dot plot significantly outperformed the markets, leading to a decline in risky assets. Despite the Dow Jones index losing 2.5% or approximately 1,000 points, Bitcoin dropped from around $105,000 to below $99,000 as shown by TradingView and CoinDesk data sources.

As of this writing, BTC is trading at around $101,200, aiming to recover from overnight losses.

Currently, the dollar index maintains its previous day’s increase, hovering close to a level of 108 – a peak not seen since October 2022. This prolonged robustness in the US dollar might exacerbate troubles for risky assets.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-19 10:16