What to know:

As someone who’s been navigating the crypto waters for quite some time now, let me tell you – this daily briefing is a treasure trove of insights! The numbers and charts are like a symphony to my crypto-loving ears.

By Jacob Joseph and Jamie Sly (All times ET unless indicated otherwise)

As the year nears its end, it appears that the cryptocurrency market is getting a pre-holiday boost. Yesterday, Bitcoin reached an unprecedented peak of nearly $108,000 and has since maintained a level close to $107,000.

Supporters of Bitcoin (often called “Bitcoin maximalists”) have been feeling festive since the U.S. elections in early November, as President-elect Donald Trump’s positive remarks towards the industry indicate an increasing institutional interest and alignment with the digital currency market.

It appears the newly elected president is hinting at further developments, sparking discussions about potential pro-crypto regulations following his promise to establish a strategic Bitcoin reserve. This commitment made earlier in the month has contributed to Bitcoin’s recent surge in value.

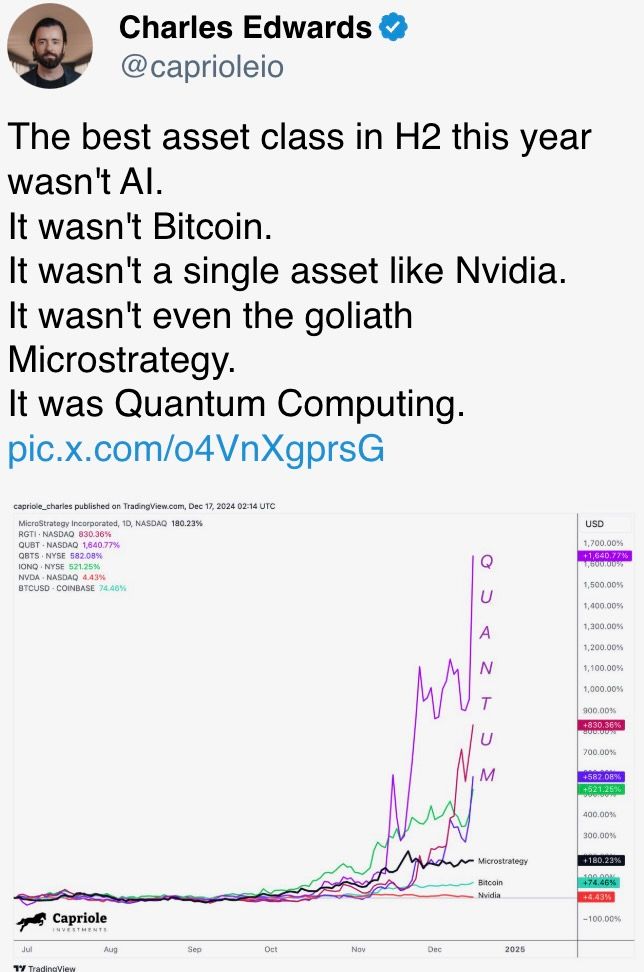

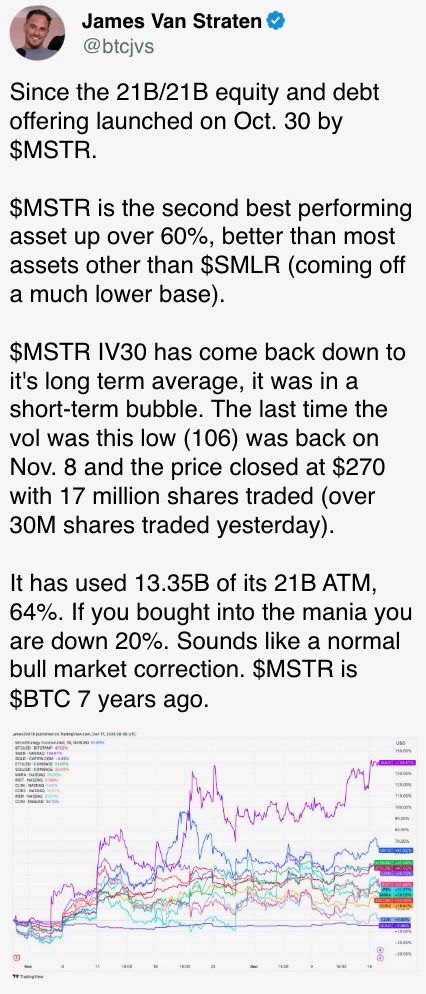

The positive statements about cryptocurrencies from the new government have significantly boosted optimism, leading some experts to make connections with MicroStrategy’s approach to its balance sheet, but on a country-wide level. Although the concept of the U.S. accumulating bitcoin seems bold, the markets are appreciative of this boldness.

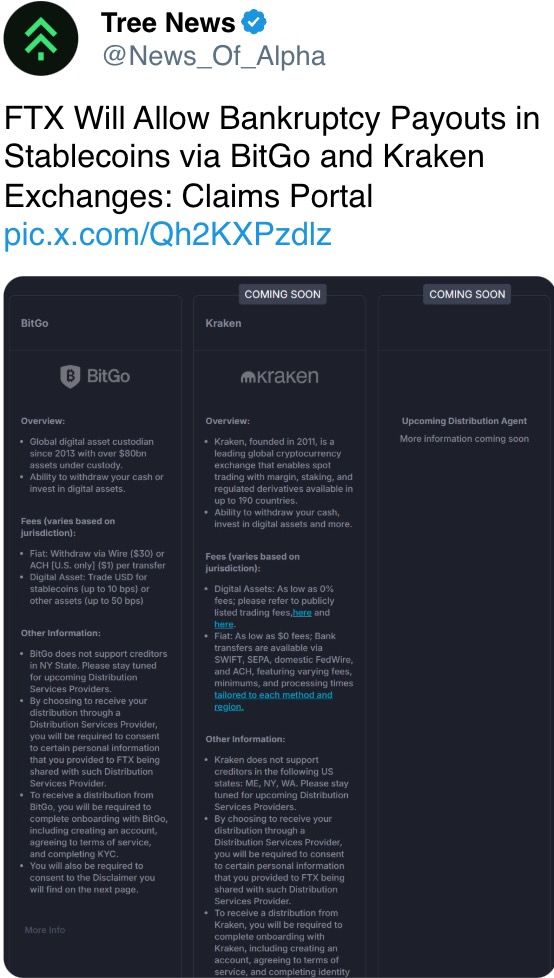

Despite the uncertainty surrounding a proposed “national bitcoin reserve,” President Trump’s favorable stance towards cryptocurrencies is noticeably impacting opinions and financial markets. Recently, Exodus Movement (EXOD), a provider of crypto wallet services, obtained approval to be listed on NYSE American, which is associated with the New York Stock Exchange. Although one listing may not seem significant, it adds to the evidence that U.S. markets are becoming increasingly receptive towards digital asset companies.

The spirit of giving is also present within the crypto world, where the much-awaited launch of PENGU, the native token of the Pudgy Penguin universe, takes place. As stated by Luca Netz, CEO of Pudgy Penguins, this token’s debut “paves the way for increased interaction” and acknowledges those who have been loyal supporters of the ecosystem.

1) The distribution of PENGU tokens, similar to the recent drops from Hyperliquid and Magic Eden, has occurred. The fluctuations in Hyperliquid’s pricing serve as a reminder for those considering an early sale of the token.

Avalanche has unveiled its major network upgrade, named Avalanche9000, which incorporates advancements to make it more affordable and straightforward to establish subnetworks. As the team stated on platform X, “This marks the beginning of hundreds of Avalanche L1 launches.” The Avalanche9000 update decreases the cost to deploy an L1 by a staggering 99.9%, and with over 200 L1s currently being developed in the testnet, anticipate a flurry of launches within the upcoming months. Currently, the blockchain’s AVAX token is trading at $50.2, representing a rise of 2.49% compared to its closing price last night.

The latest leg up for BTC, however, faces a near-term headwind in the form of the Federal Reserve’s rate decision on Wednesday. Moreover, with this cycle marked by growing institutional participation, the markets might be in for further volatility as the holiday season approaches. TradFi participants often adopt a risk-off stance and close positions ahead of the break. Stay Alert!

What to Watch

- Crypto:

- Dec. 18, 9:30 a.m.: Software cryptocurrency wallet maker Exodus Movement (EXOD) starts trading on NYSE American, a sibling of NYSE.

- Macro

- Dec. 17, 8:30 a.m.: Statistics Canada releases November’s Consumer Price Index (CPI) report.

- Inflation Rate YoY Prev. 2%.

- Core Inflation Rate Prev. 1.7%.

- Dec. 18, 2:00 a.m.: The U.K.’s Office for National Statistics (ONS) releases November’s Consumer Price Inflation bulletin.

- Inflation Rate YoY Est. 2.6% vs Prev. 2.3%.

- Core Inflation Rate YoY Est. 3.6% vs Prev. 3.3%.

- Dec. 18, 5:00 a.m.: Eurostat releases November’s euro-area inflation data. Inflation Rate YoY Final Est. 2.3% vs Prev. 2.0%.

- Dec. 18, 2:00 p.m.: The Federal Open Market Committee (FOMC) releases its fed funds target rate, currently 4.50%-4.75%. The CME’s FedWatch tool indicates that interest-rate traders assign a 97.1% probability of a 25 basis-point cut. Press conference starts at 2:30 p.m. Livestream link.

- Dec. 18, 10:00 p.m.: The Bank of Japan (BoJ) announces its interest rate decision. Short-term interest rate Est. 0.25% vs. Prev. 0.25%.

- Dec. 19, 7:00 a.m.: The Monetary Policy Committee (MPC) of the Bank of England (BoE) announces its interest-rate decision. Bank Rate Est. 4.75% vs Prev. 4.75%.

- Dec. 19, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases third-quarter GDP (final).

- GDP Growth Rate QoQ Est. 2.8% vs Prev. 3.0%.

- GDP Price Index QoQ Est. 1.9% vs Prev. 2.5%.

- Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November’s Personal Income and Outlays report.

- Personal Consumption Expenditure (PCE) Price Index YoY Prev. 2.3%.

- Core PCE Price Index YoY 2.8%.

- Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.

- Dec. 17, 8:30 a.m.: Statistics Canada releases November’s Consumer Price Index (CPI) report.

Token Talk

By Shaurya Malwa

AI Agents aren’t a joke category anymore.

Eliza Labs, the creator of the sector leader AI16Z, is joining Stanford University’s Future of Digital Currency Initiative to research how artificial intelligence agents can improve Web3.

The partnership is set to leverage Eliza Labs’ open-source AI agent framework, an anime character named Eliza, to research how AI agents can foster trust, coordinate activities and make choices in the world of decentralized finance.

Starting in 2025, the focus will be on crafting new strategies for how these autonomous agents can build and confirm trust in digital-currency ecosystems — providing credence to the niche sector that may initially pass off as yet another meme play.

Eliza is an open-source, decentralized AI agent framework developed by ai16z, a project parodying the venture capital firm Andreessen Horowitz (a16z). It allows users to build and deploy autonomous AI agents that can interact across multiple platforms, including Discord, X (formerly Twitter) and Telegram.

These agents can handle voice, text and media interactions, providing a versatile communication tool for users.

Derivatives Positioning

- The futures annualized rolling basis continues to float around 15%, making the basis trade an incredibly attractive investment. This can be seen with CME futures open interest growing by around 30,000 BTC from the November low.

- Currently, $15.4 billion of notional value is set to expire in bitcoin on Dec. 27, with almost 60% of the total set to expire out of the money.

- MicroStrategy’s 30-day implied volatility has dropped 53% from a Nov. 22 high, indicating the market is expecting less dramatic price swings as we approach the end of the trading year.

Market Movements:

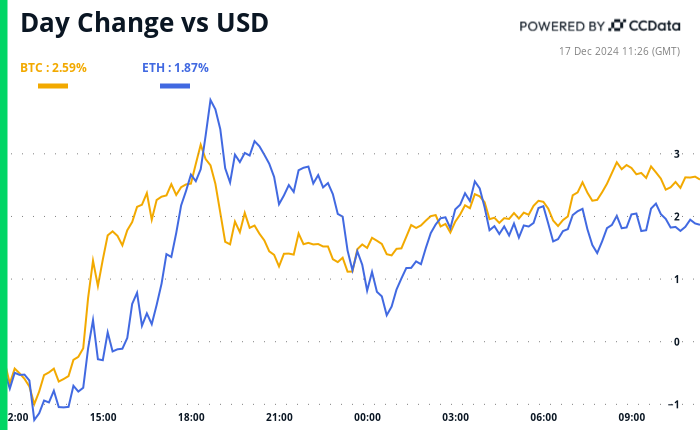

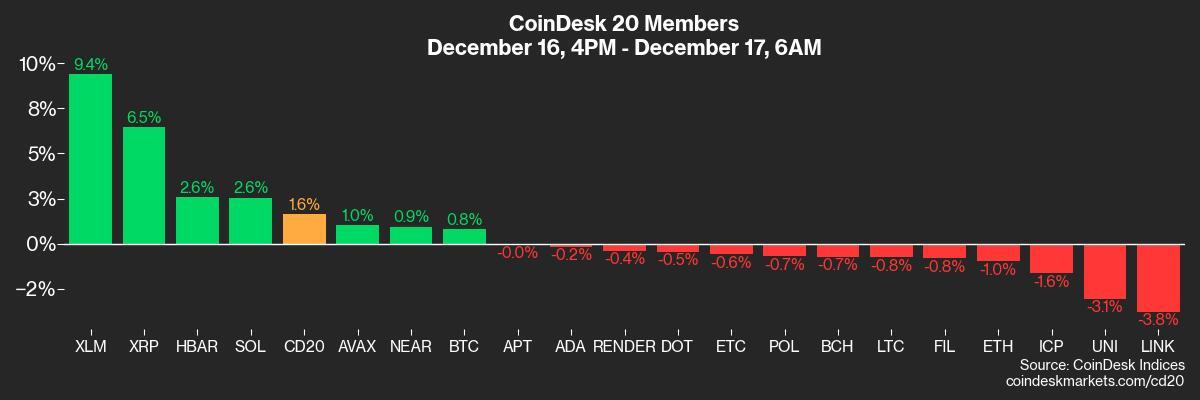

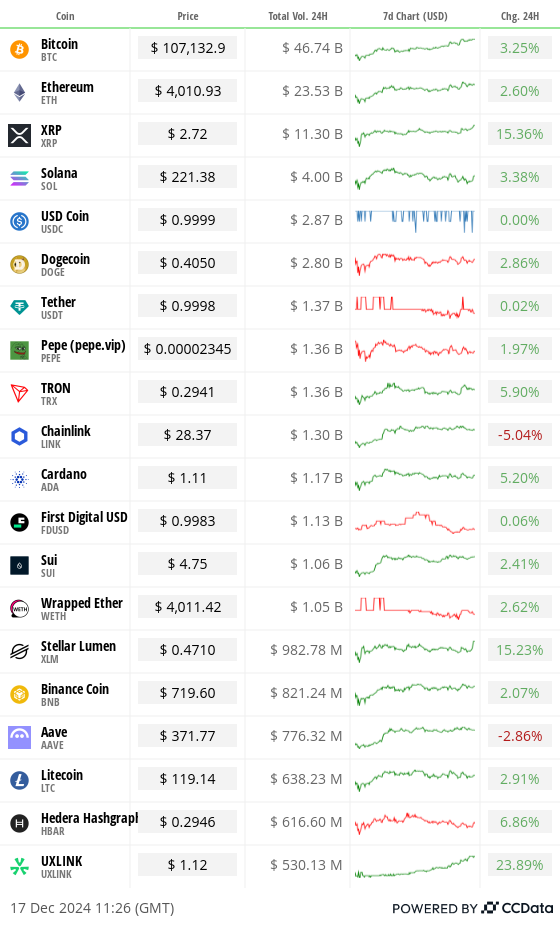

- BTC is up 0.93% from 4 p.m. ET Tuesday to $107,069.48 (24hrs: +3.36%)

- ETH is down 0.92%% at $4,011.12 (24hrs: +2.81%)

- CoinDesk 20 is up 0.87% to 3,950.07 (24hrs: +2.93%)

- Ether staking yield is up 12 bps to 3.16%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is up 0.16% at 107.03

- Gold is unchanged at $2,653.70/oz

- Silver is unchanged at $30.86/oz

- Nikkei 225 closed -0.24% at 39,364.68

- Hang Seng closed -0.48% at 19,700.48

- FTSE is down 0.75% at 8,199.90

- Euro Stoxx 50 is up 0.33% at 4,963.45

- DJIA closed -0.25% to 43,717.48

- S&P 500 closed +0.38% at 6,074.08

- Nasdaq closed +1.24% at 20,173.89

- S&P/TSX Composite Index closed -0.5% at 25,147.20

- S&P 40 Latin America closed -1.86% at 2,276.92

- U.S. 10-year Treasury was unchanged at 4.42%

- E-mini S&P 500 are down -0.27% at 6,064.00

- E-mini Nasdaq-100 futures are up 1.31% to 22,400.50

- E-mini Dow Jones Industrial Average Index futures are down 0.37% at 43,608.00

Bitcoin Stats:

- BTC Dominance: 57.88 (24hrs: +0.32%)

- Ethereum to bitcoin ratio: 0.037 (24hrs: -0.45%)

- Hashrate (seven-day moving average): 784 EH/s

- Hashprice (spot): $63.4

- Total Fees: $1.3 million/ 12.3 BTC

- CME Futures Open Interest: 208,000 BTC

- BTC priced in gold: 40.3oz

- BTC vs gold market cap: 11.47%

- Bitcoin sitting in over-the-counter desk balances: 405,423 BTC

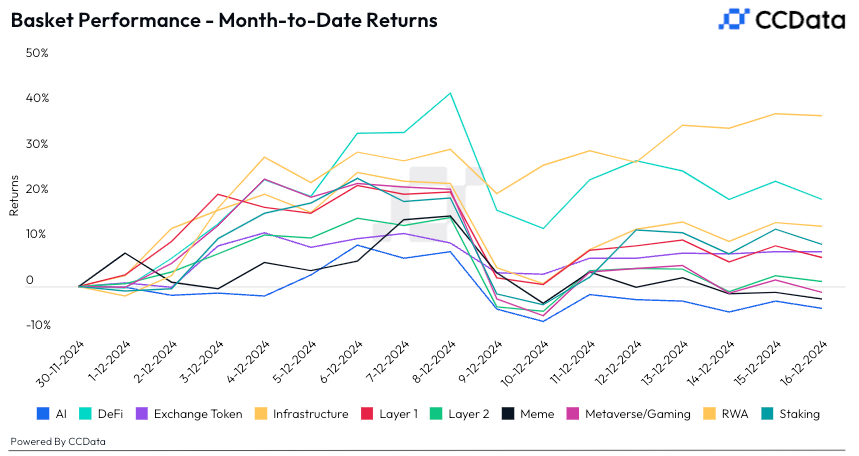

Basket Performance

Technical Analysis

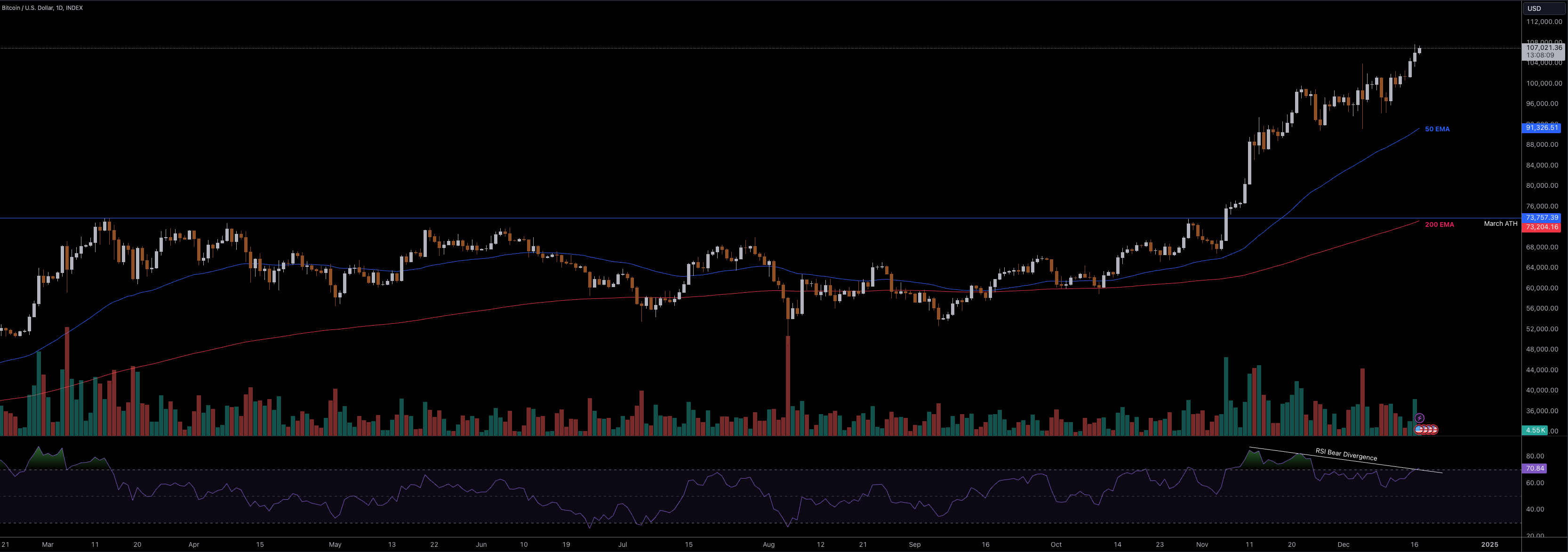

- Bitcoin has seen free-flowing price discovery since breaking March’s all-time high on Nov. 6, with the price rising to a record above $107,000 from $73,757.

- Both the 50-day and 200-day exponential moving averages (EMA) are pointing upwards, indicating bullish momentum during the price discovery phase. The notably large gap between the two EMAs underscores the recent short-term price action as one of significant strength.

- Still, the RSI shows momentum gradually slowing since the March breakout, with the measure printing a bearish divergence on the daily chart. The current RSI reading of 70.85, may be considered overbought.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday unchanged at $408.50, up 1.65% at $415.25 in pre-market.

- Coinbase Global (COIN): closed at $315.31 (+1.52%), up 0.67% at $317.42 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$29.56 (+2.07%)

- MARA Holdings (MARA): closed at $24.56 (+8.05%), up 2.04% at $25.06 in pre-market.

- Riot Platforms (RIOT): closed at $14.03 (+8.01%), up 2.49% at $14.38 in pre-market.

- Core Scientific (CORZ): closed at $16.56 (+6.5%), up 1.87% at $16.87 in pre-market.

- CleanSpark (CLSK): closed at $12.48 (+3.83%), up 1.2% at $12.63 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.60 (+8.19%), up 1.96% at $30.18 in pre-market.

- Semler Scientific (SMLR): closed at $74.50 (+10.91%), up 3.36% at $77.00 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $636.9 million

- Cumulative net inflows: $36.21 billion

- Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

- Daily net inflow: $51.1 million

- Cumulative net inflows: $2.31 billion

- Total ETH holdings ~ 3.520 million.

Overnight Flows

Chart of the Day

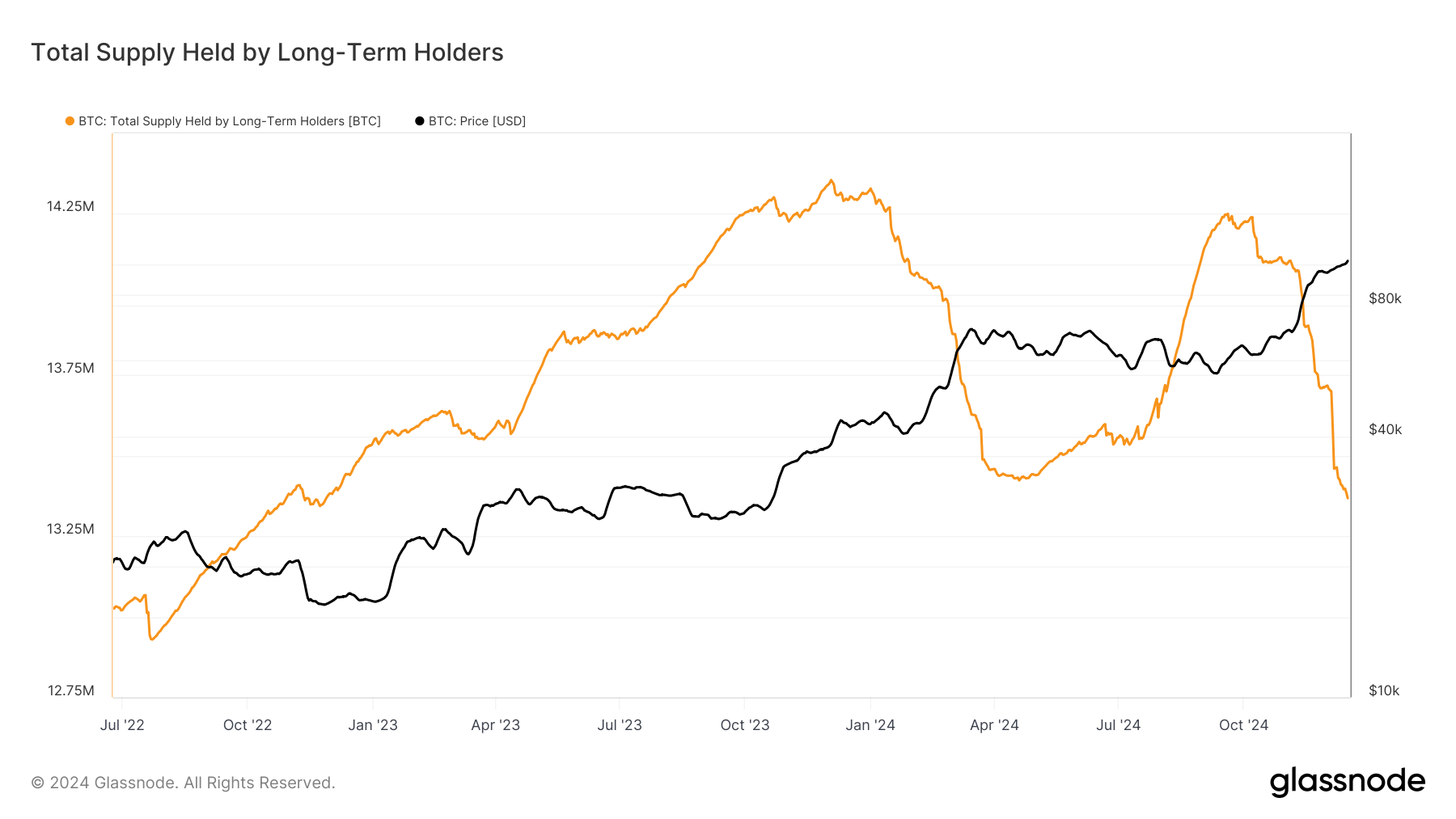

- Since Sept. 19, long-term holders — defined by Glassnode as investors who have held bitcoin for longer than 155 days — have distributed over 880,000 bitcoin.

- On average, about, 9,887 BTC have been sold each day since Sept. 19.

In the Ether

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-17 15:12