What to know:

- Short duration options show cautious sentiment a day after BTC set new lifetime high.

- Latest flows lean slightly bearish as the Fed is expected to deliver a hawkish hike.

As a seasoned crypto investor with a decade of experience under my belt, I must say that the latest trends in the options market are making me pause and reconsider my strategies. While Bitcoin’s relentless climb to new highs is nothing short of exhilarating, the cautious sentiment reflected in the options market is a stark reminder that the crypto market can be as unpredictable as a rollercoaster ride at an amusement park.

As Bitcoin (BTC) consistently sets fresh record peaks, recent trends in the options market suggest that traders are not jumping into the upward momentum with the same fervor they once did.

As a researcher, I observed on Monday that the value of Bitcoin (BTC) soared past $107,000, surpassing its previous high recorded on Dec. 5 and propelling the total post-U.S.-election increase to exceed 50%. According to CoinDesk data, this significant growth is a testament to the ongoing interest and potential of cryptocurrencies in the global market.

The rally is in response to President-elect Donald Trump’s promise to establish a strategic Bitcoin reserve, much like the U.S.’s oil reserves. Experts predict that this upward trend will persist into the next year, with Bitcoin prices potentially reaching between $150,000 and $200,000 by the end of the following year.

As a crypto investor, I’ve noticed that the prices of options trading on Deribit seem to suggest a shift in trader behavior. It appears that they’re not aggressively pursuing the market surge as enthusiastically as before, which might hint at a more cautious perspective for the near future.

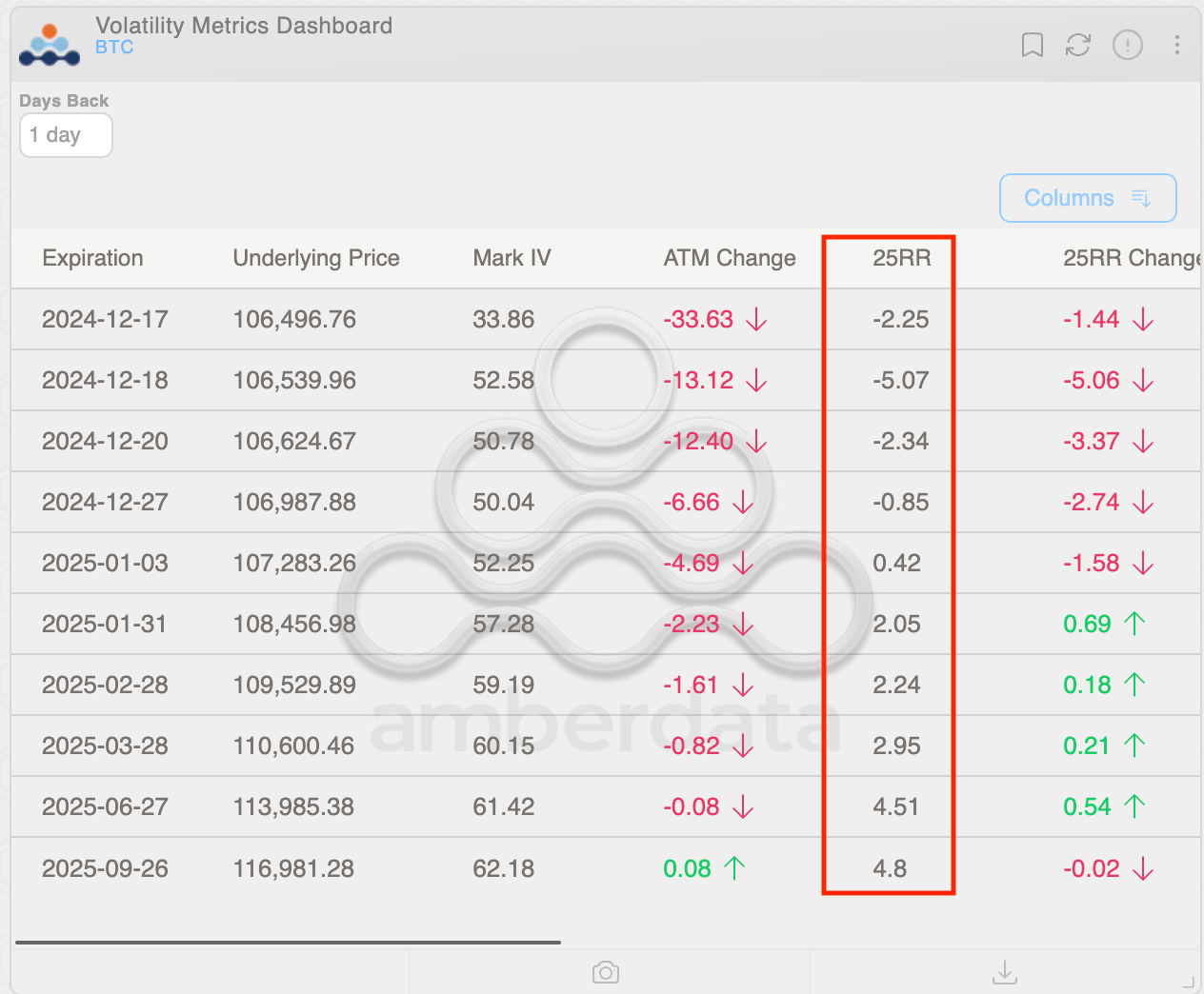

Currently, the risk reversal for options ending this Friday shows a negative value, signifying that put options, offering protection against price falls, are slightly more valuable compared to call options. On December 27th, puts are being traded at a small surplus over calls. Additionally, the risk reversals stretching to March’s expiration date suggest a preference for call options by less than three volatility points.

Over the last few weeks, I’ve noticed an interesting pattern in the crypto market. Instead of the usual cautious approach, traders have been actively pursuing new price highs, pushing both short-term and long-term expectations significantly beyond four or five volatility points. Remarkably, when it comes to short-term risk reversals, the call bias has often been stronger than that of their longer-term counterparts.

The most recent trades observed on Deribit, monitored by Amberdata, indicate a predominantly bearish sentiment. Notably, the largest trade today involves a short position in the December 27th expiration call option with a strike price of $108,000. This is followed by long positions in the puts (selling protection) for the same expiration date, with one at the $100,000 strike price and another for January 3rd. In simpler terms, this trader appears to be betting that the price will decrease before December 27th and either remain stable or slightly increase by January 3rd.

It’s possible that the hesitant attitude stems from anticipation that on Wednesday, the Federal Reserve might indicate fewer or slower rate increases for 2025, coupled with a predicted 25 basis points reduction in rates. This scenario could lead to an increase in bond yields, fortifying the dollar and potentially diminishing the appeal of riskier investments. It may be that experienced Bitcoin traders are preparing for a market correction.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-17 10:08