What to know:

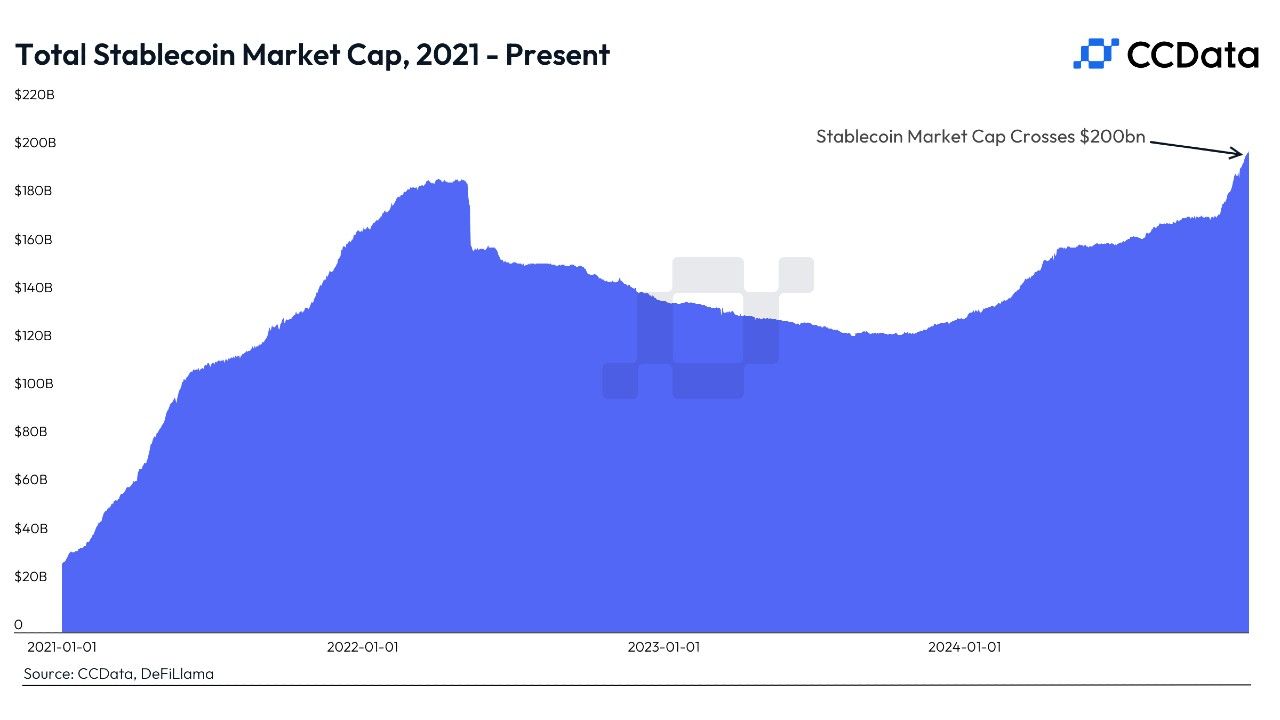

- The total market value of stablecoins crossed the $200 billion mark for the first time ever, CCData and DefiLlama show.

- The expansion was driven by capital inflows to trade crypto and increasing use for non-crypto utilities like payments, while a range of novel yield-generating products also fueled growth.

- Stablecoins could double in market size to $400 billion next year, with the U.S. Congress passing legislation being a key catalyst, asset manager Bitwise said.

As a seasoned researcher with years of experience in the ever-evolving world of digital assets, I must say that the recent growth of stablecoins has left me quite intrigued and optimistic about the future of this burgeoning market. The swift surge past the $200 billion mark is not just a testament to the increasing demand for liquidity in the crypto space but also a signal of their growing utility in non-crypto areas such as payments, remittances, and savings – particularly in developing countries.

On Wednesday, the bustling market for stablecoins reached a new peak, surpassing $200 billion in total market worth for the very first time. This surge is driven by an increase in demand and expanding use of these digital assets.

Over just the past fortnight, the entire asset category has seen a significant increase in market worth by approximately $10 billion, surpassing the previous high-water mark of $190 billion set during the 2022 bull cycle, as reported by CCData and DefiLlama.

Stablecoins are cryptocurrencies designed to hold a steady price, predominantly pegged to the U.S. dollar. They are a key piece of infrastructure for the digital assets space, serving as the main source of liquidity for trading crypto assets on exchanges and move value on blockchain rails.

Demand for stablecoins grew steadily through the past year as crypto markets emerged from a brutal bear market. The growth significantly accelerated following Donald Trump’s election victory last month, adding $30 billion supply as investors poured funds into cryptocurrencies in a frenzy.

The widely used stablecoin, Tether’s USDT, reached a new high of $139 billion in circulation, marking a 12% increase over the past month, according to DefiLlama data. This week, USDT was acknowledged as an acceptable virtual asset by the Abu Dhabi Global Market (ADGM). The issuer intends to broaden its services throughout the Middle East region.

During the same timeframe, the market value of USDC, Circle’s second-largest digital currency asset, increased by approximately 9%, reaching nearly $41 billion. Notably, Circle has recently formed a partnership with Binance, the world’s leading crypto exchange in terms of trading volume, to boost the global adoption of USDC.

It’s not just the booming crypto market that drives growth, though.

There’s been a rise in the utilization of stablecoins for making payments, remittances, and savings, particularly in rapidly depreciating developing countries with unstable financial systems. A clue that stablecoins are being adopted for non-cryptocurrency purposes is the swift increase in stablecoin transactions on transfer applications, such as peer-to-peer payment platforms, as highlighted by Nik Milanovic, a partner at Fintech Fund, in a recent post.

Investment products that are tokenized and maintain consistent prices while providing returns for investors are currently popular. Ethena’s USDe token, which accumulates yield by shorting bitcoin and ether perpetuals using the funding rate, saw a spike above $5 billion, marking an increase of 90% within a month according to DefiLlama statistics. Meanwhile, the stablecoin offered by the emerging decentralized finance (DeFi) platform Usual soared to $700 million in value, more than doubling during the same time frame.

Market cap could double in 2025

It’s expected that growth will carry over into next year, as digital asset manager Bitwise anticipates the market value of stablecoins reaching an impressive $400 billion by 2025. A recent report suggests one significant factor could be the U.S. Congress finally passing legislation on stablecoins, which would establish guidelines for businesses and institutions to issue and engage with these tokens.

As a researcher delving into this field, unraveling the mysteries surrounding who governs these entities and what are the appropriate reserve requirements would undoubtedly ignite an unprecedented surge of interest among issuers, consumers, and businesses alike. Consequently, it’s reasonable to anticipate that established financial powerhouses such as J.P. Morgan and others might choose to venture into this space when the time comes.

Another significant factor fueling growth is the integration of stablecoins into various popular fintech apps, similar to PayPal’s approach with its PYUSD stablecoin. Additionally, the expanding influence of stablecoins in international transactions and money transfers, as detailed in the report.

Apart from Bitwise, both Standard Chartered and Zodia Markets have also expressed optimistic predictions regarding stablecoins. In a report published last month, they suggested that the market share for stablecoins could potentially increase to as much as 10% of the U.S. money supply and foreign exchange transactions, which is significantly higher than their current level of about 1%.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-11 22:05