As a seasoned researcher with over two decades of experience in financial markets, I’ve seen my fair share of market fluctuations and trends. The recent Bitcoin rally has certainly caught my attention, as it seems to be following a familiar pattern we’ve witnessed in other bull cycles.

TL;DR

- After a correction below $94,500, BTC rebounded to almost $99,000, with certain indicators signaling a further push to the north.

- Some analysts see BTC’s next targets ranging from $101,000 to $275,000, supported by bullish technical patterns and market sentiment.

New BTC Rally Incoming?

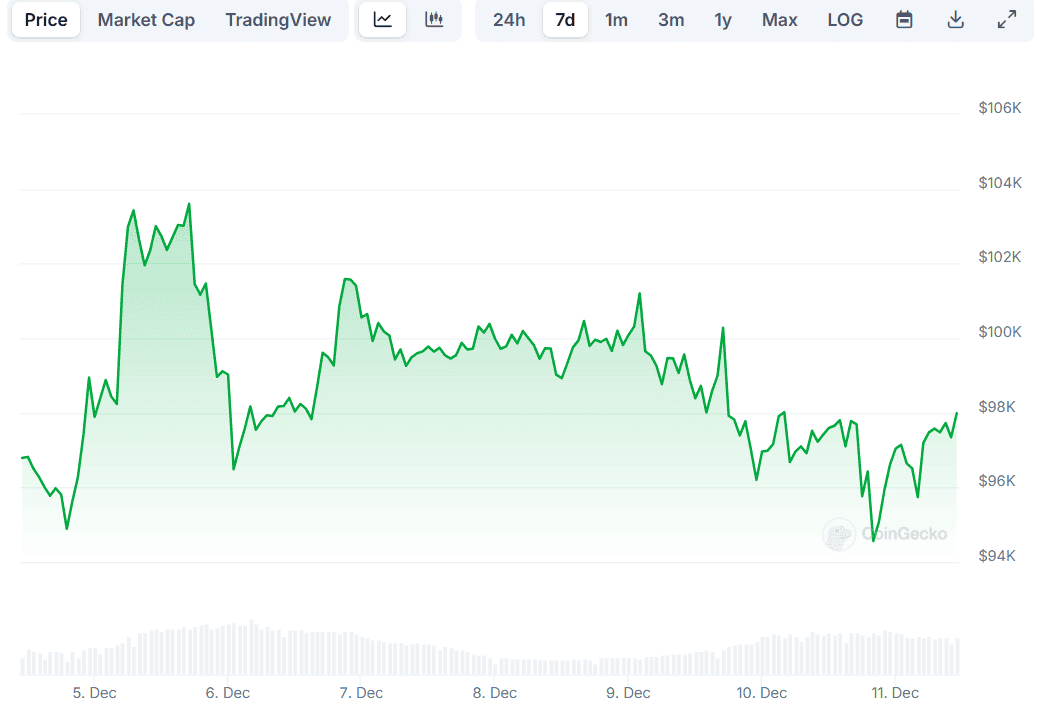

At the beginning of the month, the main cryptocurrency sparked excitement throughout the town when it surpassed the $100,000 psychological barrier for the first time. On December 5th, it reached a new record high of over $103,500, causing a massive buzz within the crypto community. Over the subsequent days, Bitcoin experienced increased volatility, frequently hovering around the $100K mark.

At the start of this current week, a significant correction occurred that pushed the value down below $94,500. However, in the last few hours, Bitcoin has regained some ground and is now being traded at around $98,700, according to CoinGecko’s data.

One important indicator suggests that the leading digital asset might be poised for a much more substantial resurgence in the short term. This is the BTC supply stored at exchanges, which, according to CryptoQuant’s data, has dropped to a level last observed in the summer of 2018.

This advancement could indicate a move away from centralized platforms towards individual wallets, a trend that might be considered positive or bullish because it lessens the immediate urge to sell.

As a researcher delving into the realm of cryptocurrencies, I find it noteworthy to highlight Bitcoin’s Network Value to Metcalfe (NVM) ratio. This metric sheds light on the correlation between the asset’s market capitalization and its adoption or usage. Normally, readings less than 2 imply that Bitcoin might be underestimated in terms of value, potentially hinting at an upward price trend. At present, the NVM stands around 1.5.

How High Can BTC Fly?

Many experts view the current market downturn as a chance for savvy investors to buy at a discount. For example, analyst Ali Martinez anticipates that Bitcoin could surge to around $275,000. He recommends capitalizing on this dip by investing without taking on excessive risk – a strategy known as “buying the dip.” His prediction is based on a “cup and handle” pattern observed in the asset’s price chart.

Consider purchasing when prices drop, but avoid excessive borrowing! Bitcoin (BTC) is projected to hit an astonishing $275,000, given its cup and handle chart pattern!

— Ali (@ali_charts) December 10, 2024

Captain Faibik also contributed to the discussion, but with a slightly more cautious outlook. The user from X platform pointed out that Bitcoin’s recovery could potentially challenge the $101,000 resistance point soon.

“Once the critical resistance is cleared, next target is likely to be $110K,” they assumed.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-12-11 20:18