What to know:

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself constantly intrigued by the market movements and the insights they provide into the collective sentiment of traders. The current state of BTC and XRP presents an exciting opportunity to delve deeper into the intricacies of their price dynamics.

As an analyst, I’m currently grappling with a common trader’s dilemma: determining crucial resistance levels for Bitcoin (BTC) and Ripple (XRP), prices at which the market might momentarily pause its upward trend. Given that both cryptocurrencies have reached new peaks or not seen such highs in months, this is a question on many traders’ minds right now.

Currently, Bitcoin, the most valued cryptocurrency, is reaching unprecedented levels close to $100,000. This means it’s venturing into uncharted territory. As for XRP, it’s trading at $2.44. The highest price from 2018, around $3.30, serves as the only resistance before we enter a phase of determining new prices, similar to Bitcoin.

An effective method for pinpointing crucial resistance points is by examining the spread of open interest and the total value of active options contracts across different price thresholds.

Currently, on Deribit, the globally recognized top cryptocurrency options trading platform, the call option for Bitcoin with a striking price of $120,000 is drawing the most attention. Data from Deribit Metrics shows that this contract boasts a significant notional open interest of approximately $1.93 billion.

In other words, when a contract with high volume trades (open interest) is struck, it frequently serves as a barrier for price increase. This is because sellers of call options, often large institutions, may sustain substantial losses if the prices go beyond this point. To avoid such losses, they might take actions to prevent the prices from rising above that level. On the flip side, this strike price can also attract activity due to hedging from market makers or entities responsible for maintaining liquidity in the order book.

Prior to and right after the U.S. elections, the $100,000 call option had the highest demand, as measured by notional open interest. Currently, its price is hovering near the seven-digit range.

As we speak, the call option for a strike price of $100,000 remains the second most favored contract, with an outstanding commitment of approximately $1.8 billion. The $110,000 strike call option comes in close behind, boasting an outstanding commitment of around $1.68 billion.

It’s evident that approximately $500 million is tied up in a call option with a strike price of $200,000, which suggests a belief that the bitcoin price will double. The majority of these positions are found in contracts expiring in June 2025 and September 2025. Experts at Standard Chartered predict that the price could reach this level by the end of 2025.

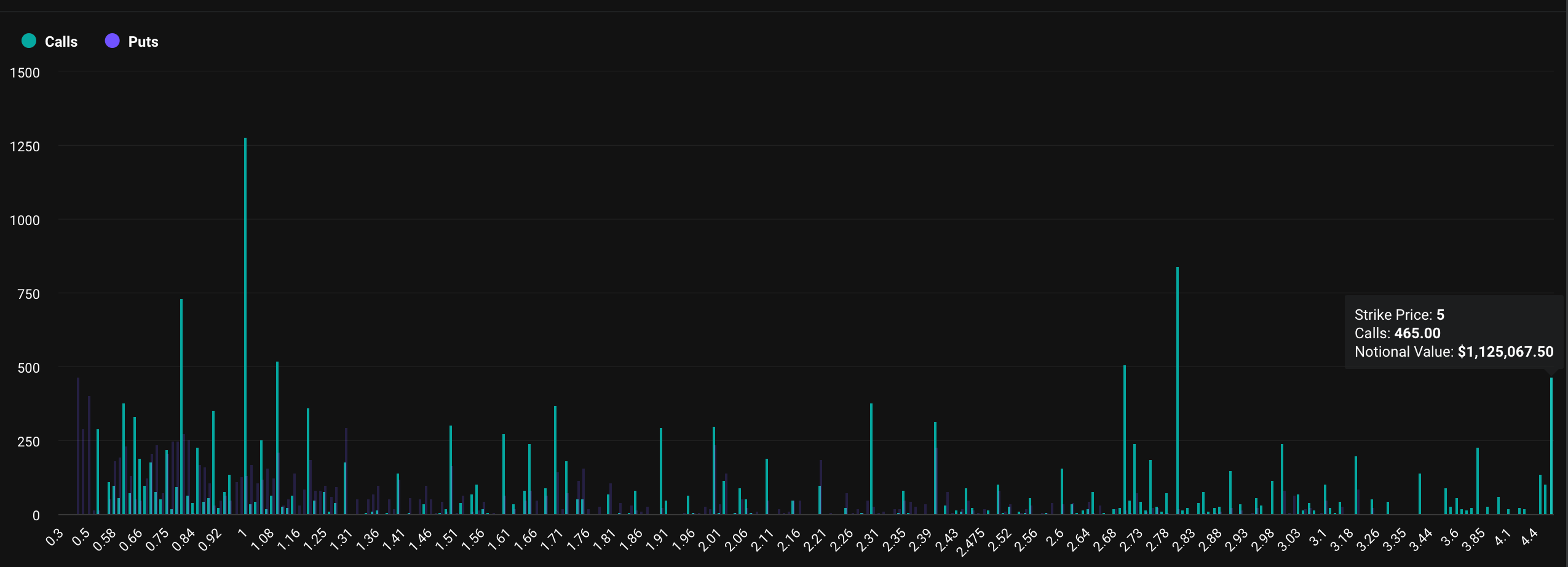

Key levels for XRP

For XRP, it’s the $1 call option that sees the highest activity, boasting more than $3 million in ongoing contracts. This option is significantly profitable, or “in-the-money,” due to the current value of the digital currency hovering around $2.42.

Currently, attention is centered on the $2.8 call option, where traders have secured a total of $2 million in commitments. The next possible goal is set at $5. Notably, this deep out-of-the-money call option is the third most popular among active trades, with an open interest of approximately $1.12 million.

Read More

- “I’m a little irritated by him.” George Clooney criticized Quentin Tarantino after allegedly being insulted by him

- South Korea Delays Corporate Crypto Account Decision Amid Regulatory Overhaul

- What was the biggest anime of 2024? The popularity of some titles and lack of interest in others may surprise you

- Destiny 2: When Subclass Boredom Strikes – A Colorful Cry for Help

- Deep Rock Galactic: The Synergy of Drillers and Scouts – Can They Cover Each Other’s Backs?

- Sonic 3 Just Did An Extremely Rare Thing At The Box Office

- Final Fantasy 1: The MP Mystery Unraveled – Spell Slots Explained

- Influencer dies from cardiac arrest while getting tattoo on hospital operating table

- Smite’s New Gods: Balancing Act or Just a Rush Job?

- Twitch CEO explains why they sometimes get bans wrong

2024-12-09 12:27