As an analyst with over two decades of experience in the financial markets, I have witnessed countless bull and bear runs, and the current journey of Bitcoin is no exception. While it’s always exciting to see such meteoric rises, my personal experience has taught me to remain cautious during these moments. The latest rejection of Bitcoin at the brink of the six-digit territory is a testament to the volatile nature of this asset class.

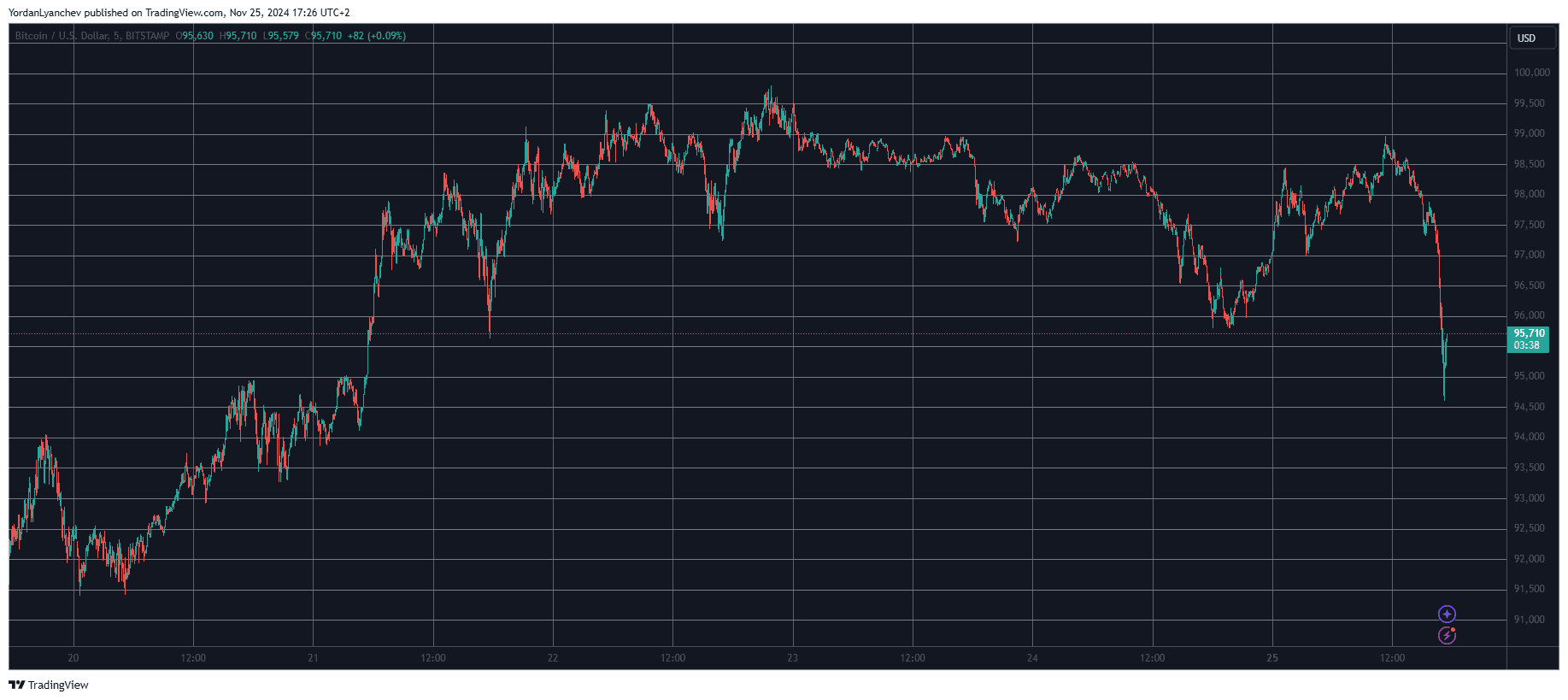

Since discussions about the significant six-digit mark began in 2021, Bitcoin almost reached it last Friday, but as happened three years prior, it fell short and experienced brief dips several times.

In my recent study, I experienced yet another instance where market control shifted towards the bears, causing a steep decline that led Bitcoin’s price to dip below $95,000.

Since Donald Trump’s election victory around three weeks back, the main cryptocurrency has experienced a remarkable surge, gaining more than $30,000 in value since then and reaching its newest record high last Friday. At that moment, the asset hit its highest point ever on many trading platforms, topping out at slightly over $99,800.

Nevertheless, it didn’t manage to breach the six-digit mark and instead reversed over the weekend. The price of BTC surged to $99,000 on Monday, only to dip down again later.

This recent refusal was exceptionally harsh, causing the cryptocurrency to plummet by more than $4,000. Just moments ago, the value hit a low for the day of around $94,550 on Bitstamp, but it has since regained some footing and is now hovering near $96,000.

At an apparently unanticipated time, MicroStrategy, the global leader in corporate Bitcoin holdings, just declared another significant Bitcoin acquisition worth more than $5 billion today.

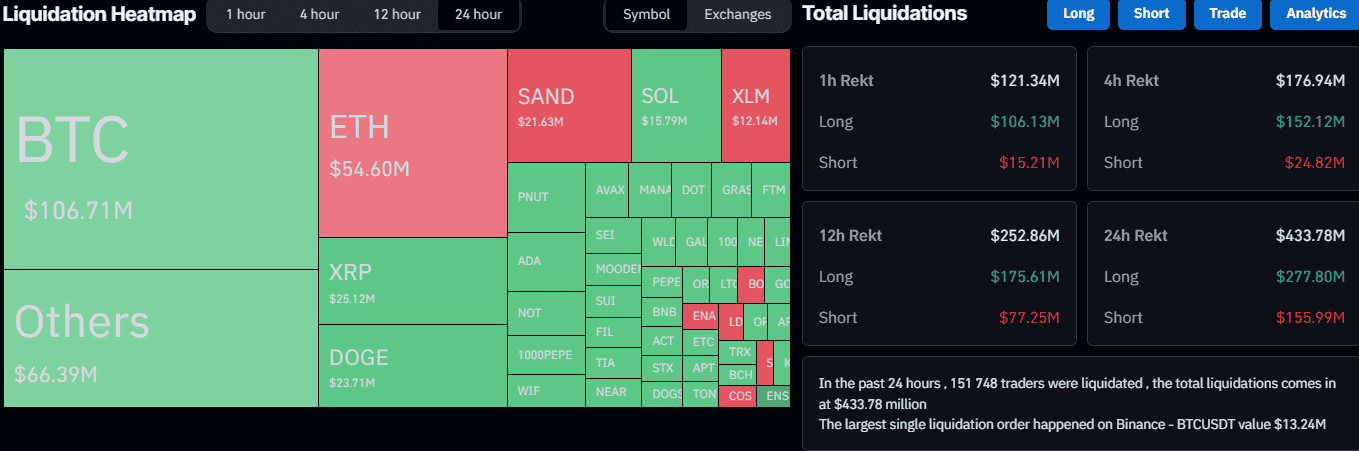

In the last hour or so, several alternative cryptocurrencies such as Ethereum, Solana, Binance Coin, Ripple, and Dogecoin have seen a decrease of around 2-3% each.

The data from CoinGlass indicates that the combined worth of closed positions during this period of market turbulence has reached an astounding $430 million on a daily basis, and an additional $120 million in just the last hour. Bitcoin contributes significantly to this figure, with approximately $106 million in long positions over the past 24 hours.

Read More

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- Excitement Brews in the Last Epoch Community: What Players Are Looking Forward To

- The Renegades Who Made A Woman Under the Influence

- RIF PREDICTION. RIF cryptocurrency

- Smite 2: Should Crowd Control for Damage Dealers Be Reduced?

- Is This Promotional Stand from Suicide Squad Worth Keeping? Reddit Weighs In!

- Epic Showdown: Persona vs Capcom – Fan Art Brings the Characters to Life

- Persona Music Showdown: Mass Destruction vs. Take Over – The Great Debate!

- “Irritating” Pokemon TCG Pocket mechanic is turning players off the game

2024-11-25 18:36