Markets

What to know, old bean:

- The Strategy (MSTR) crew reported a jaunty $3.9 billion fair value appreciation on its bitcoin holdings in the third quarter-capital gains, with a smile and a wink. 💷😉

- For the first time since April, the 640,000-coin stack did not receive a new topping-up last week. Dash it all, they were on a self-denying spree.

- Shares were ahead 2.5% in premarket trading, as if the market had found a fresh umbrella stand at the exchange. 🕶️

With the third quarter now fully in the books, the original bitcoin treasury outfit Strategy (MSTR) announced a $3.9 billion gain on its mammoth BTC holdings for the quarter-capital numbers, but with a heart of gold. 😄

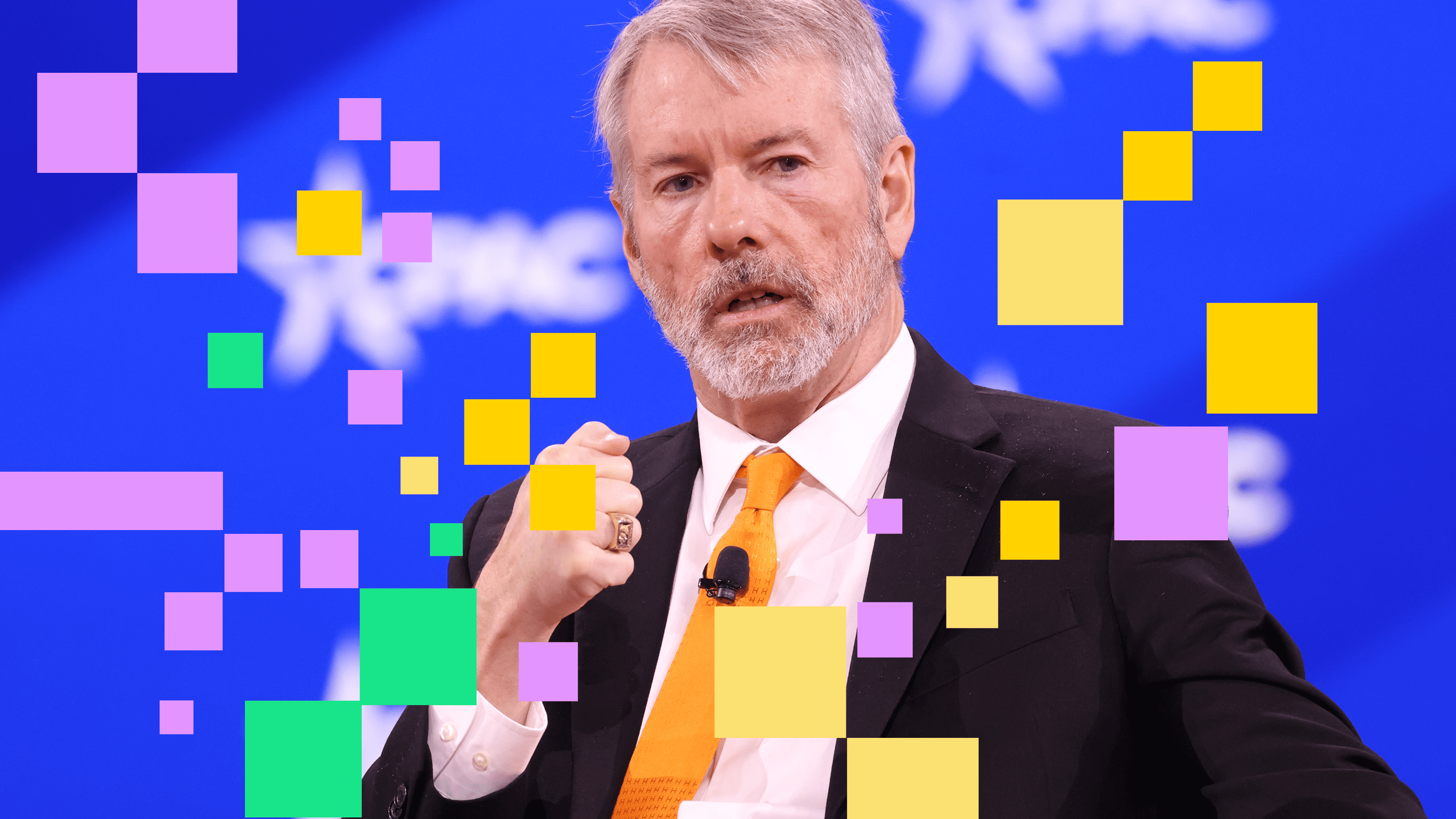

Alongside, the company confirmed what had been teased by its Executive Chairman Michael Saylor over the weekend-that it did not add to its 640,000-coin stack last week-the first time since April that it refrained from topping up.

Strategy’s average purchase price across its bitcoin holdings is $73,983 per coin. With bitcoin’s current price around $124,000 those holdings are now valued around $78.7 billion, representing roughly $31.4 billion in unrealized gains. 😂💼

Financial Update Highlights

For the quarter ended Sept. 30, the company announced an unrealized gain of $3.89 billion on its digital assets, along with a deferred tax expense of $1.12 billion.

As of Sept. 30, the company’s digital asset carrying value stood at $73.21 billion, with a related deferred tax liability of $7.43 billion.

MSTR shares rose 2.5% in premarket trading alongside bitcoin’s weekend gains to the current $124,500. 🚀

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- YouTuber streams himself 24/7 in total isolation for an entire year

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- What time is It: Welcome to Derry Episode 8 out?

- PUBG Creator Says He Is “Really heartened” About The Backlash To AI In Gaming

- Now you can get Bobcat blueprint in ARC Raiders easily. Here’s what you have to do

- These are the last weeks to watch Crunchyroll for free. The platform is ending its ad-supported streaming service

- Jane Austen Would Say: Bitcoin’s Turmoil-A Tale of HODL and Hysteria

- Jamie Lee Curtis & Emma Mackey Talk ‘Ella McCay’ in New Featurette

2025-10-06 17:02