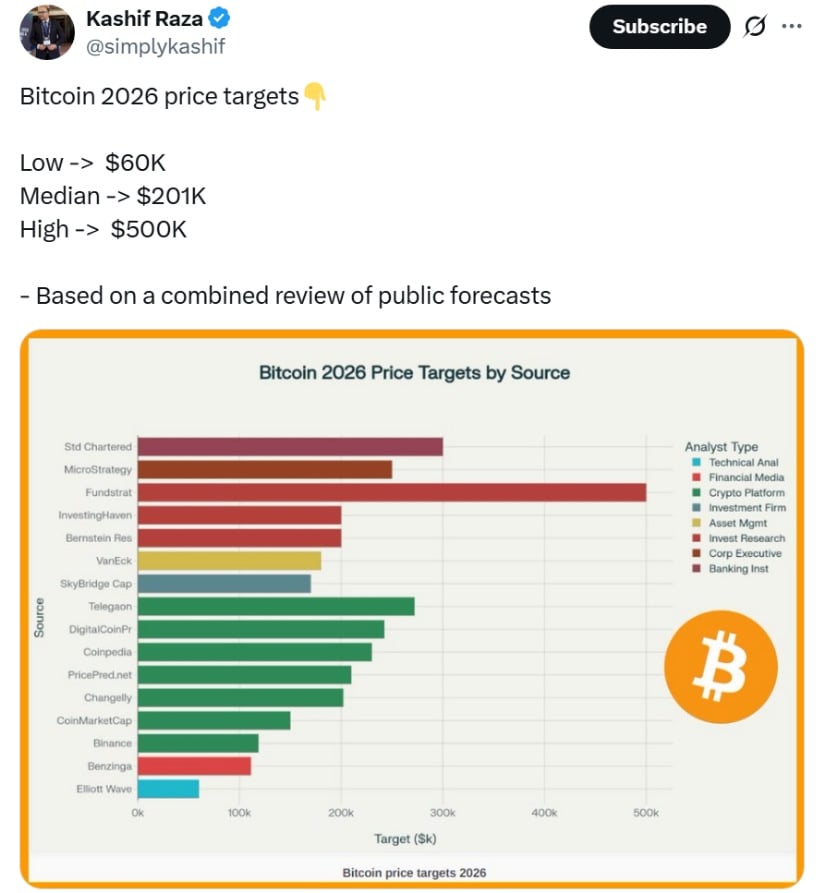

Lo! In the hushed chambers of financial prophecy, a certain Kashif Raza, with the solemnity of a seer, unveils the cryptic forecasts of Bitcoin’s destiny. Behold, the numbers: from a modest $75,000 (a mere whisper of optimism) to a staggering $450,000 (a figure so lofty it might as well be a lunar colony). The median, that fickle darling of averages, rests at a paltry $201K-though one might argue it’s less a target and more a mirage in the desert of speculative fervor. 🧠💸

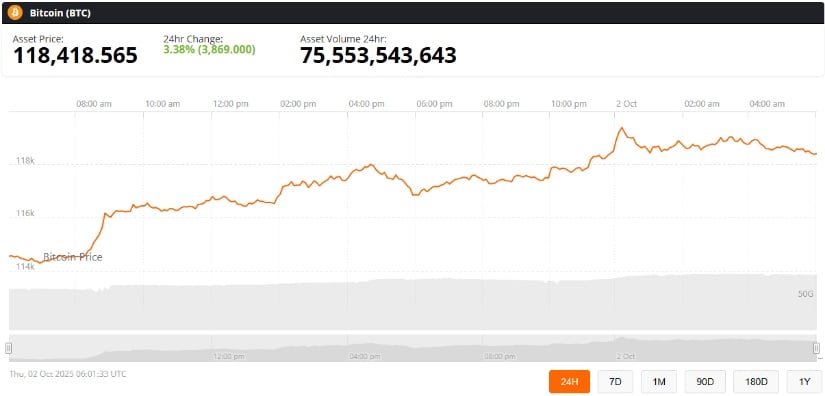

Behold the current state of affairs: Bitcoin hovers near $118,500, a fragile butterfly perched on the edge of a storm. The analysts, like soothsayers in a tavern, promise a 69% ascent-though one wonders if their calculations account for the chaos of human folly. 🌀

Analyst Forecasts Reflect Broad Divergence

What madness is this? A tapestry of predictions, woven with threads of hope, despair, and the occasional wild guess. Some cling to the safety of conservative estimates, while others chase the siren song of institutional flows and macroeconomic fantasies. A true carnival of contradictions! 🎪

Raza, that paragon of clarity, clusters these forecasts into tribes-crypto exchanges, research firms, banks-each with their own peculiar rites and rituals. A Reddit thread, meanwhile, erupts in a tempest of debate, proving that even in the realm of numbers, chaos reigns supreme. 🧨

Why Halving Matters: Historical Lifts, Then Headwinds

Historical Post-Halving Gains

Behold the halvings, those sacred rites of supply reduction! In 2012, Bitcoin soared 8,000%-a feat so audacious it might have made a medieval king weep. In 2016, a more measured ascent, yet still a 30x leap, as if the market had finally remembered how to dance. And in 2020, a 567% surge, fueled by the alchemy of stimulus and optimism. Yet, one must ask: can such magic be repeated? 🧙♂️

The 2024 Halving and Mixed Start

Alas, the 2024 halving began with a whimper, not a bang. Some called it the “worst-ever” post-halving stretch-a period of decline and ETF exodus. Yet, like a phoenix, Bitcoin rose again, climbing 86% to touch $119,000. A resurrection, perhaps, but one that leaves us wondering: will the next act be triumph or tragedy? 🕯️

Market Momentum: Uptober and Macro Tailwinds

Strong Q4 Start

October 2025 arrives with a flourish, as Bitcoin breaches $118,000. This, they call “Uptober,” a season of crypto revelry. Yet what drives this rally? A weak dollar, ETF hunger, and the vague promise of seasonal luck. One might say it’s less a strategy and more a gamble with fate. 🎲

On-Chain Signals and Liquidity

Behold the Stablecoin Supply Ratio, now flashing “buy”-a signal as cryptic as a riddle. Meanwhile, long-term holders hoard BTC like ancient treasures, their accumulation addresses brimming with anticipation. Yet, one must question: are these signs of strength, or merely the whispers of a hopeful few? 🧐

Risks & Caveats: No Guarantees in Crypto

Let us not be deceived! The path ahead is fraught with peril. Regulatory storms loom, macroeconomic tides shift, and the very nature of Bitcoin may render past patterns obsolete. A 201K target is but a dream, and dreams, as we know, are fickle. 🌫️

Looking Ahead: $201K as a Symbolic Benchmark

The $201K target, that elusive beacon, is less a prediction and more a tale spun from hope, models, and the occasional leap of faith. Whether it is reached or not, the journey will test the mettle of all who dare to wager on the future. And so, the dance continues-between ambition and caution, between gold and folly. 🕺

Read More

- Tom Cruise? Harrison Ford? People Are Arguing About Which Actor Had The Best 7-Year Run, And I Can’t Decide Who’s Right

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- What If Karlach Had a Miss Piggy Meltdown?

- Fate of ‘The Pitt’ Revealed Quickly Following Season 2 Premiere

- Yakuza Kiwami 2 Nintendo Switch 2 review

- Gold Rate Forecast

- Mario Tennis Fever Release Date, Gameplay, Story

- This Minthara Cosplay Is So Accurate It’s Unreal

- The Beekeeper 2 Release Window & First Look Revealed

- Burger King launches new fan made Ultimate Steakhouse Whopper

2025-10-02 15:32