In a rather audacious September discourse with Bitcoin Magazine, the illustrious Michael Saylor, the executive chairman of MicroStrategy, distilled a half-decade’s worth of corporate folly into a disarmingly simplistic, almost robotic outline of what he eagerly dubs Bitcoin’s “endgame.” With a flourish reminiscent of a conductor orchestrating a grand symphony, he proclaimed his intent to amass a staggering stockpile of this digital artifact, akin to some modern-day Midas, before assembling a new realm of credit markets atop it. Ah, the modern sorcery of finance!

“The endgame,” he declared with a gleam in his eye, “is we accumulate a trillion dollars worth of BTC and then we grow that capital by issuing more credit.” A statement so bold it could almost lead one to ponder whether Saylor had hit upon the philosopher’s stone of finance itself! The man sees it not as mere gambling, but an inevitable stride into the next epoch of corporate dealings, where Bitcoin metamorphoses into “digital energy,” whilst balance sheets evolve into engines whirring and spinning out yields from Bitcoin-backed instruments… finer than grandma’s needlework! 😂

Saylor’s Bitcoin Endgame Plan

The presentation was stripped to its bare essence-elemental, one might say. He artfully interwove Bitcoin into the grand tapestry of humanity’s monumental revolutions-fire, steel, oil, and… electricity, of course! To him, the monetary aura of Bitcoin is nothing less than a means to transport economic “energy” across the vast landscapes of time and space at light speed-move over, Einstein! ⚡

“Bitcoin is hope because Bitcoin represents digital energy,” he exclaimed, as if bestowing a blessing upon the unsuspecting masses. “It’s a way to convey energy… the next paradigm shift!” Here, he confidently posits that the collective incredulity surrounding this shift isn’t a flaw, but rather the very quintessence of opportunity. “I’d wager that around 95% of financial decision-makers still don’t grasp the concept of digital energy,” he quipped, unperturbed by the likely roars of laughter from his skeptics. After all, societal comprehension of revolutionary ideas often lags behind, just as one may find oneself too satiated to finish a delightful cake! 🍰

At the core of his grand strategic play is an uncomplicated balance-sheet identity-scaled, of course! Treat Bitcoin as the monetary bedrock-our “digital gold”-and then transform it into “digital credit” via familiar capital market formats: convertible bonds, preference shares, money-market-like papers… the lot! “If I create a company purchasing Bitcoin and I gather a billion dollars of Bitcoin, then what’s stopping me from issuing digital credit?” he queried as if speaking the hidden wisdom of olden sages. 😂

In Saylor’s grand vision, the equity of a company that executes this cycle with increasing frequency metamorphoses into “digital equity,” deftly engineered to outperform the attractive allure of the original asset through conservative leverage and well-managed duration. “If my goal is to birth a company that performs double the returns on Bitcoin, I take the Bitcoin, issue Bitcoin-backed credit… I carve out the digital equity and the digital equity surpasses the asset at its core.” Quite a delightful thought, wouldn’t you concur?

He insists the true competition isn’t among Bitcoin vaults, but rather the vast, sprawling inventory of 20th-century credit-mortgages, corporate bonds, sovereign debts-often ensnared by low yields and saddled with depreciating collateral. “What they’re truly up against are the archaic instruments of credit that linger in our capital markets,” he proclaimed, sounding quite like a knight declaring war against dragons in a distant land. 🐉

The pitch to savers was a blunt instrument indeed: the “better bank” is simply one that strips away the cumbersome notions of duration while providing a more succulent return compared to the lackluster fiat offerings, all funded by our lofty, over-collateralized Bitcoin. It was a pitch not for the timid, but rather for those adorned with courage and a sense of adventure: “Raise equity, purchase Bitcoin, then sell short-duration, BTC-secured credit that just… strips the duration to one month!” 🔥

The audacious scale he envisages is nothing short of monumental. He carefully detailed jurisdictions where enduring financial repression or melancholic interest rates augment the spread, declaring that mature markets, with their suppressed yields, are optimal breeding grounds for “pure-play digital credit issuers.” Switzerland and Japan serve as his illustrative beacons of hope or perhaps, to some, a strange type of taxation! 🏦

Yet, the objective is far broader-truly global. “What if there’s a hundred trillion dollars of digital credit and… perhaps 200 trillion’s worth of digital capital?” he inquired, as though sketching the grand lines of a utopian blueprint upon invisible canvas. This structure, he maintains, could remain comfortably over-collateralized whilst veering away from the treacheries of fractional banking; a noble ambition for the modern age, indeed.

Bitcoin Treasury Companies Will Be Banks

Saylor was unambiguous in voicing that the corporate world is already gathering speed. He traced the lineage of publicly traded entities hoarding BTC, beginning with a sole firm in 2020-MicroStrategy, of course-to “two or three… then swiftly 10… and then 20… spiraling upwards to around 180.” The trajectory appears as if charted by the very stars themselves, shifting from “100 to a thousand, to 10,000, to 100,000”-his fervor igniting almost existential questions about numbers and their very nature! 📈

He intricately melded this diffusion narrative with a grand thesis-the very essence of Bitcoin woven into the operating systems of iOS, Android, Windows, and all manner of consumer hardware-firmly declaring that it signals the point where-in his mind-“digital energy” has fused seamlessly into the fabric of commerce like a fine silk thread. 🎇

When confronted with the distributional critique-that corporations merely overshadow individuals-Saylor cunningly flipped the script, suggesting that institutional influxes have primarily benefitted early adopters. “When we first waded into these waters, Bitcoin was trading at a mere $9,000 a coin… and now? Oh dear, it’s $115,000,” he remarked, bestowing much of the credit upon the corporate and ETF enthusiasm. “Notably, that translates to 93% of the gains… reaching those cherished individuals who held the Bitcoin prior to the corporate stampede!” Truly a twist of fate befitting Shakespearean comedy! 😂

Despite his martial rhetoric-it’s so easy to brand it a “protocol war”-Saylor’s disciplined approach hinges on skillfully sidestepping the traps that ensnared miners in the preceding cycle. Short and costly liabilities strapped to depreciating hardware proved a fatal misalignment in his view. The treasury archetype he extols prefers mid-to-longer duration capital structures, all anchored to an appreciating base asset. “Invest in mid to long-duration loans for assets appreciating 30 to 60% annually, you’ll likely be on golden shores!” he proposed, dismissing M&A diversification as an overly convoluted endeavor compared to the “perfect partner” of simply acquiring more BTC at “one times revenue.” Oh, the irony! 😅

Saylor also beamed light on the policy and infrastructure landscape, forecasting a gradual legitimization of tokenized assets while reiterating that the “greatest regulatory clarity” continues to rest in Bitcoin’s identity as a digital commodity that comfortably nestles on balance sheets and collateralizes credit. He succinctly summed up the new political atmosphere in Washington as increasingly favorable towards envisaging the U.S. as a “global Bitcoin superpower”-not by nationalizing miners or commandeering equity stakes but by normalizing custody, collateralization, lending, operating-system integration, and, naturally, tax treatment. “The goal is for financial firms in the United States to pioneer this path forward… to embrace digital assets and capital!” he declared, his optimism almost palpable! 🌍

To a community preoccupied with debates over halvings, hash rates, and the minutiae of on-chain workings, Saylor’s endgame, it turns out, lies elsewhere: indexes, coupons, tenors, and yield curves-all re-denominated atop this new monetary foundation. It’s a corporate finance thesis nestled deep at the core of Bitcoin, serving double duty as a challenge to boards and CFOs across every currency regime. “For every business across the globe, it’s always preferable to adopt Bitcoin as their capital asset,” he succinctly proclaimed. The remaining task? Execution at scale. “Let’s amass a trillion dollars worth of collateral growing at 30% annually, while issuing $100 billion in credit, also growing by 20 or 30% a year,” Saylor concluded, perhaps pondering whether he should become a poet instead. “We are crafting a better bank!”

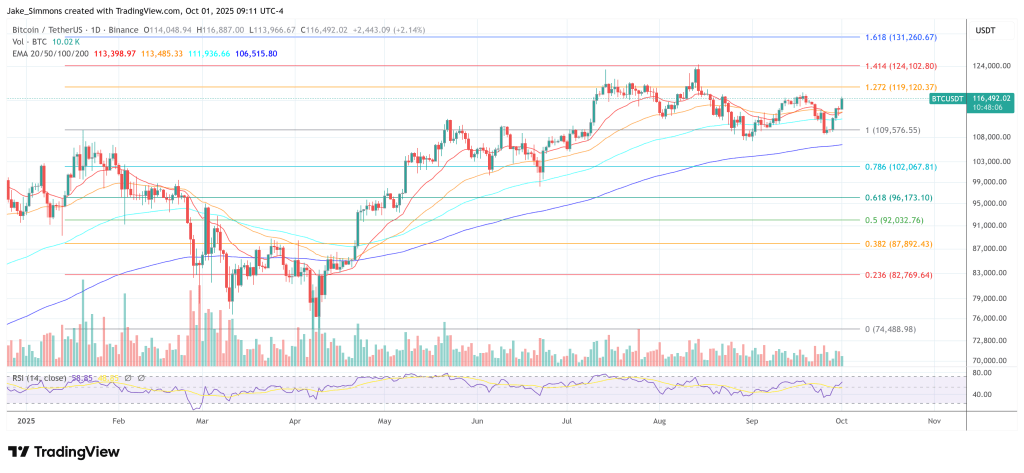

At the last tick of the clock, Bitcoin traded at $116,492.

Read More

- Tom Cruise? Harrison Ford? People Are Arguing About Which Actor Had The Best 7-Year Run, And I Can’t Decide Who’s Right

- How to Complete the Behemoth Guardian Project in Infinity Nikki

- Brent Oil Forecast

- ‘Stranger Things’ Conformity Gate and 9th Episode Fan Theory, Explained

- Fate of ‘The Pitt’ Revealed Quickly Following Season 2 Premiere

- Katanire’s Yae Miko Cosplay: Genshin Impact Masterpiece

- Mario Tennis Fever Release Date, Gameplay, Story

- What If Karlach Had a Miss Piggy Meltdown?

- What time is Idol I Episode 7 & 8 on Netflix? K-drama release schedule

- Burger King launches new fan made Ultimate Steakhouse Whopper

2025-10-02 05:17