Ah, SUI, a cryptocurrency akin to one of those notorious contraptions invented by Sir Harry Flashman Agnew, due to occasionally fizzle out but with the potential for something spectacular. The coin has been plodding along, humbly forming higher lows and maintaining a chivalrous guard around its $3.30 support level, proving that there’s more than one dragon to slay if you’ve got the wherewithal to hold your ground. Looks like this brave little trooper is trying to show us that sometimes even digital money can have moxie.

Keep the SUI Ship Afloat

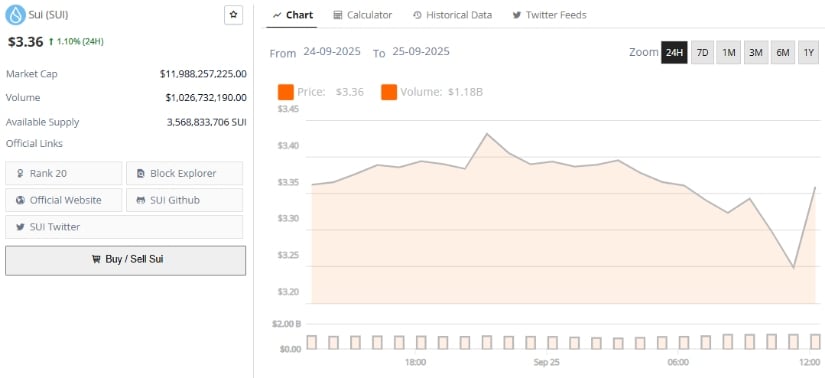

Right now, SUI is hobbling along more or less at $3.53, even after taking a 3.9% dip in the last 24 hours. Still, market sages note that this token has been stubbornly hanging on by its fingernails to the $3.20-$3.30 support zone, a launching pad for previous bullish shenanigans.

The repeated flirtations with the $3.30 support line are a tantalizing hint that optimism isn’t entirely a lost cause, with recent market observations cautiously nodding towards budding confidence in SUI’s value.

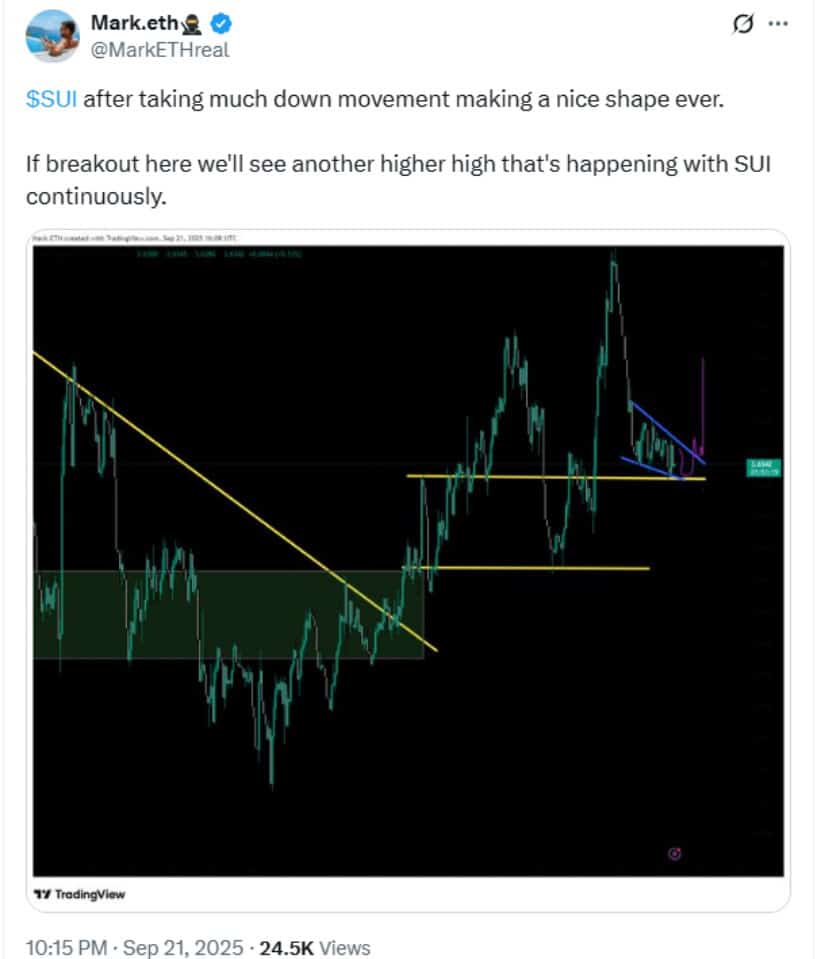

Now, the technical analysis realm is buzzing with talk of an ascending triangle formation as if drawn by a toddler with an astrolabe. You’ve got your horizontal resistance playing hard to get above at $3.90-$4.50, nursing hopes of a romance with a rising lower trendline. Concluding from this dance, higher lows suggest many buyers are accumulating, almost as if gathering for the village Christmas party.

The Technical Crystal Ball: Breakout or Breakdown?

Treating price charts like tea leaves, market soothsayers declare that traders are gearing up for something big. Should this current support hold fast, SUI might wobble its way up to $4.00 first, then scamper hesitantly toward $4.50. Historical patterns suggest these triangle formations might be leading watershed moments, especially when the volumes hold steady as ever, like an overexcited librarian cataloging the end of the world.

For investors bunkering down with caution, the entry zone between $3.20 and $3.30 is ripe for consideration, akin to a forward leap into a rather tepid yet promising bog. If you’re not keen on swimming with the sharks, a prudent stop-loss order just below $3.00 acts like a comfy pair of wellingtons on a rainy day.

The Tangled Web of ETFs and Euphoria

SUI is making itself a busybody, prancing about with its Exchange-Traded Fund (ETF) proposals in 2025 and trotting towards auditions in front of Canary Capital, 21Shares, and Nasdaq. If the stars align and the bureaucratic constellations deem it worthy, the potential for an institutional dash could send SUI soaring to dizzying heights of about $10 within the span of a year. Now, wouldn’t that be a hoot?

Fans of SUI tout this technical enchantment, where gasless transactions and high-speed throughput grant it a pecking order above the likes of Solana. With over 3.5 million active addresses and a thriving bunch of at least 1,400 developers conjuring up new sorceries, the SUI blockchain’s ecosystem is mushrooming like an enthusiastic mycelium network.

However, those pesky regulatory delays are throwing a spanner (or just dampening expectations) in the machinery, much like a gremlin that targets to trip up any attempts at scaling the Crypto Olympus.

Bears, Bulls, and Short-term Guilt

Despite encouraging vibes, SUI hasn’t been spared the occasional bearish swat. Hedge-wary traders have unfurled a carpet of short positions totaling nearly $31 million, an interstellar amount of caution draped across the floor. After a bold 9% plunge, the token retested support at $3.29, drawing attention back to the importance of secure footing.

As per the wizards with their crystal Bollinger Bands and higher trendline papyrus scrolls, SUI can still rally valiantly if its base holds firm. If not, well, getting sent tumbling towards $2.80 is rather unappealing-a frightful potion of about 16% potential loss.

The Big Picnic of the Crypto Market

Current windfalls and woes in the grand cryptocurrency marketplace have spiced up SUI’s fortune. Old companions Bitcoin and Ethereum have contributed to a storm, making it challenging for lesser altcoins. Still, SUI’s robe of accomplishments includes prancing merrily to 1,632 transactions per second and amassing $143 billion in cumulative DEX trading volume. What a show!

Of course, if this ascending triangle formation breaks out positively, analysts whisper how SUI might leap by 27% toward that unforgotten $4.50 mark. Such projections match neatly with both the technical patter and inherent strengths, including budding ETFs, muscle-bound network performance, and an ever-burgeoning developer community.

Deciding Where to Wedge SUI’s Finances

Today, SUI finds itself ambled along the crossroads where short-term caution meets long-term ambition. Astute investors and dealers scrutinize key levels of support and resistance, excited ETF approval signals, and the sweeping mood of the market, all crucial threads in the tapestry of decision-making.

With its fair share of technical prowess, innovative quirks, and a welcoming gathering of contributors, SUI could make for an engaging prize for those squirreling away in the short-game bush or, for a dash of long-term sunshine, general investment under the eldritch Crypto Sun. Staying above $3.30 remains like holding the correct card at a high-stakes party, or, in simpler terms, the prelude to SUI’s next grand breakout act or grim comedown.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- Gold Rate Forecast

- Ragnarok X Next Generation Class Tier List (January 2026)

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- Silent Hill f: Who is Mayumi Suzutani?

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Zombieland 3’s Intended Release Window Revealed By OG Director

2025-09-26 12:13