What to know (because apparently, you’ve got FOMO):

By Francisco Rodrigues (All times ET unless someone forgot their watch)

Bitcoin’s had a little 2% bounce, like a toddler after nap time, clawing its way back to $68K. Meanwhile, the Fear and Greed Index is still stuck on “extreme fear” because apparently, crypto investors love a good panic attack. Been there for 20 days straight. Must be a record.

André Dragosch from Bitwise says consolidation is expected, which is finance-speak for “brace yourselves for more sideways nonsense.” Remember when BTC dropped to $60K? That was the “capitulation,” which sounds dramatic but basically means “everyone sold in a panic.” He claims Bitcoin doesn’t usually bounce back like a superhero after a fall. The most likely case? “Sideways to down.” Romantic.

But hey, there’s hope! Prediction markets are practically licking the envelope, putting the odds of the U.S. Clarity Act passing near 80% in 2026. Because nothing says “blockchain innovation” like a good old legislative cliffhanger. Bitwise’s Sentiment Index is “neutral,” which in crypto terms means “meh, pass the popcorn.”

Dragosch also insists Bitcoin is “undervalued” compared to gold, global money supply, and the “macro growth outlook.” Sure. ETP flows are weaker than your morning coffee, but hey, once the herd starts stampeding back in, watch for a catch-up so dramatic it’ll need its own Netflix special.

Caution? Yeah, big holders are dumping coins on Binance like it’s a yard sale. Classic sell signal. Classic crypto, really. Dragosch waves it off, claiming Bitcoin isn’t the canary in the macro coal mine-it’s more like the parrot squawking “party on” while the mine collapses. Global liquidity’s growing faster than your ex’s ego, so bear markets? Not today, Satan.

Prediction markets cut U.S. recession odds from “oh god” to “meh.” Traders are bracing for a “tight rise” in inflation numbers. Because nothing says “weekend vibes” like waiting for the Fed to ruin your Saturday plans. Stay alert! Or don’t. Your call.

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead” (or just binge Netflix).

- Crypto

- Crickets. Literally. Heard any good blockchain podcasts lately?

- Macro

- Feb. 20. 8:30 a.m.: U.S. Core PCE price index MoM for December est. 0.4% (Prev. 0.2%); YoY est. 2.9% (Prev. 2.8%)

- Feb. 20, 8:30 a.m.: U.S. GDP growth rate QoQ Adv for Q4 est. 3. (Prev. 4.4%)

- Feb. 20, 9:45 a.m.: U.S. S&P Global manufacturing PMI flash for February est. 52.6 (Prev. 52.4).

- Feb. 20, 10 a.m.: U.S. Michigan consumer sentiment final for February est. 57.3 (Prev. 56.4)

- Earnings (Estimates based on FactSet data)

- Nothing scheduled. Shocker.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead” (or just panic-buy RAM).

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead” (or binge TikTok).

- Day 4 of 5: ETHDenver. Because obviously, it’s the party that never ends.

Market Movements

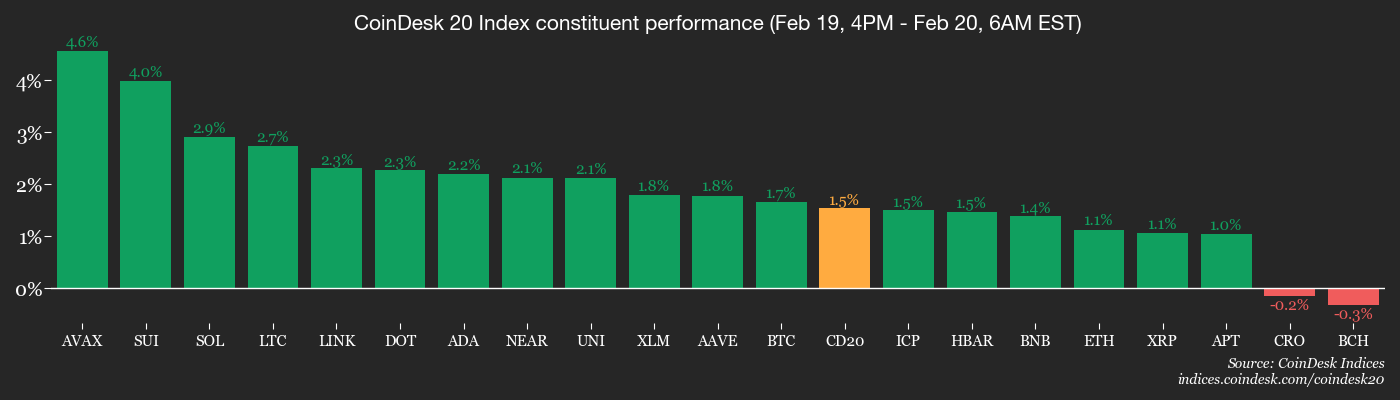

- BTC is up 1.97%-because nothing says “I’m stable” like a 2% swing before breakfast.

- ETH is up 1.1% at $1,969.19 (24hrs: +0.12%). So… barely.

- CoinDesk 20 is up 1.5% at 1,960.80 (24hrs: +1.14%).

- Ether CESR Composite Staking Rate is up 2 bps at 2.83%.

- BTC funding rate is at -0.0047% (-5.1936% annualized) on Binance. Free money? Nope, just vibes.

- DXY is unchanged at 97.95. Because why move when you can ghost?

- Gold futures are up 0.97% at $5,046.00. Shiny and useless.

- Silver futures are up 3.9% at $80.66. Silver’s jealous of gold.

- Nikkei 225 closed down 1.12% at 56,825.70. Oops.

- Hang Seng closed down 1.1% at 26,413.35. So close to “meh.”

- FTSE is up 0.69% at 10,700.09. Yay?

- Euro Stoxx 50 is up 0.48% at 6,088.42. Minimal effort.

- DJIA closed on Thursday down 0.54% at 49,395.16. Party pooper.

- S&P 500 closed down 0.28% at 6,861.89. Meh.

- Nasdaq Composite closed down 0.31% at 22,682.73. Bye.

- S&P/TSX Composite closed up 0.61% at 33,594.98. Canada wins?

- S&P 40 Latin America closed up 0.83% at 3,738.74. Fiesta!

- U.S. 10-Year Treasury rate is down 0.4 bps at 4.071%. Snooze.

- E-mini S&P 500 futures are up 0.2% at 6,890.75. Yawn.

- E-mini Nasdaq-100 futures are up 0.29% at 24,930.00. Tiny gains.

- E-mini Dow Jones Industrial Average Index futures are up 0.12% at 49,516.00. So… not really.

Bitcoin Stats

- BTC Dominance: 59.04%-because why share the spotlight when you can hog it?

- Ether-bitcoin ratio: 0.02883 (-0.93%). ETH’s still the awkward sidekick.

- Hashrate (seven-day moving average): 1,046 EH/s. Mining’s alive, I guess.

- Hashprice (spot): $29.88. Mining’s profit margin: “existential crisis.”

- Total fees: 2.36 BTC / $157,285. Not enough to buy dinner.

- CME Futures Open Interest: 119,935 BTC. Big bets, small faith.

- BTC priced in gold: 13.5 oz. Gold’s like, “loser.”

- BTC vs gold market cap: 4.54%. Still irrelevant.

Technical Analysis

- The chart shows bitcoin’s weekly price moves against the dollar. (Yawn.)

- BTC/USD weekly is still chilling at its 200-week EMA like it’s waiting for the bus. No RSI divergences, just vibes.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $165.94 (+1.15%), +1.98% at $169.23 in pre-market. Because nothing says “confidence” like a pre-market bounce that could crash by lunch.

- Circle Internet (CRCL): closed at $61.92 (-1.95%), +2.08% at $63.21. Rollercoaster, anyone?

- Galaxy Digital (GLXY): closed at $21.63 (-0.46%). Quietly sad.

- Bullish (BLSH): closed at $32.37 (+1.63%), -1.05% at $32.03. Bi-polar.

- MARA Holdings (MARA): closed at $7.96 (+6.13%), +1.63% at $8.09. Hope is free.

- Riot Platforms (RIOT): closed at $16.22 (+4.71%), +1.36% at $16.44. Small gains, big dreams.

- Core Scientific (CORZ): closed at $17.98 (+4.11%). “Success!”

- CleanSpark (CLSK): closed at $9.82 (+5.93%), +1.43% at $9.96. Almost there.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $40.69 (+1.62%). WGMI? More like “Why gamble my money?”

- Exodus Movement (EXOD): closed at $10.42 (+5.47%). Exodus: “I’m out!” Also, not.

Crypto Treasury Companies

- Strategy (MSTR): closed at $129.45 (+3.39%), +2.48% at $132.66. Buy BTC, save the whales.

- Strive (ASST): closed at $8.12 (+0.87%), +0.99% at $8.20. Tiny gains.

- SharpLink Gaming (SBET): closed at $6.80 (+3.03%). Gambling on crypto? Groundbreaking.

- Upexi (UPXI): closed at $0.67 (-3.33%), +3.48% at $0.69. Volatility is free.

- Lite Strategy (LITS): closed at $1.10 (+0.00%). Perfectly mediocre.

ETF Flows

Spot BTC ETFs

- Daily net flows: -$165.8 million. Great. The money is fleeing faster than a cat from a bath.

- Cumulative net flows: $53.91 billion. Someone’s still buying the dip.

- Total BTC holdings ~1.26 million. Not enough to save the world.

Spot ETH ETFs

- Daily net flows: -$130.1 million. ETH’s having a sale.

- Cumulative net flows: $11.55 billion. Fire sale, anyone?

- Total ETH holdings ~5.73 million. Still not Ethereum 2.0?

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Gold Rate Forecast

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Brent Oil Forecast

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- Critics Say Five Nights at Freddy’s 2 Is a Clunker

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2026-02-20 15:33