Imagine, dear reader, the grand spectacle: the mighty BlackRock BUIDL and the sprightly VanEck VBILL, those illustrious children of finance, have now been invited to the dazzling dance of Ripple’s RLUSD – a stablecoin so faithful to the dollar it might as well be its twin brother! All thanks to a mysterious union, nay, a partnership, blossoming between the enigmatic Securitize and the ever-ambitious Ripple.

On a day that shall be forever remembered-September 23, to be exact-the heralds at Securitize’s website sounded the trumpet in a press release that rippled through the digital halls. Securitize, a veritable titan of tokenizing the real world’s riches, wielding over $4 billion of assets as of May 2025, commands this new alchemy of turning solid assets into… well, tokens, naturally.

But don’t get your hopes up all at once! This marvelous RLUSD exchange is first reserved for BlackRock’s beloved BUIDL, while VanEck’s VBILL watchers anxiously await their turn, promised for the “coming days” – an ominously vague term, as all such promises tend to be. ⏳

“Making RLUSD available as an exchange option for tokenized funds is a natural next step as we continue to bridge traditional finance and crypto,” declared one Jack McDonald, Stablecoin SVP at Ripple-who sounds suspiciously like a man who enjoys bridges, whether one could walk across them or merely gaze at their glittering promise.

Meanwhile, Carlos Domingo, the co-founder and CEO of Securitize (a name most fitting for one who ‘securitizes’ everything in sight with the seriousness of a clerk balancing his ledgers on a stormy night), chimed in with grand verbosity: This accord is “a major step forward in automating liquidity for tokenized assets.” Automation! Liquidity! Sounds like magic, or possibly something even less comprehensible. 🤖

“Together, we’re delivering real-time settlement and programmable liquidity across a new class of compliant, on-chain investment products-bringing the full potential of blockchain to institutional finance,” he added, as though unveiling a new religious doctrine for the high priests of Wall Street.

Tokenized Funds: BlackRock’s BUIDL and VanEck’s VBILL – Names That Would Make Any Bureaucrat Proud

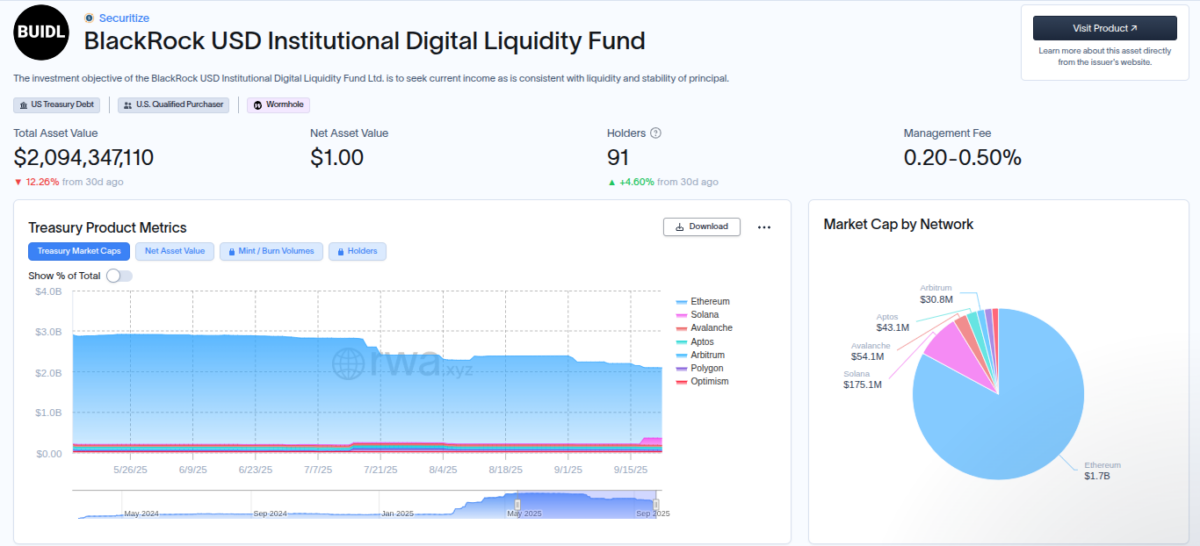

BlackRock, that ever-industrious giant, unleashed BUIDL upon the world on March 20, 2024, hand in hand with Securitize, to offer the chosen few a chance to dip their fingers in the cold waters of US Treasury, cash, and repurchase agreements. Currently, 91 brave souls hold the reins of this fund, which gallops with over $2 billion in assets, according to the divinely inspired data from RWA.xyz.

BUIDL, that nimble beast, prances upon seven blockchains: Ethereum ETH $4 154 with a steady gaze of 0.0% volatility, Solana SOL $214.1 jittery at 1.5%, Avalanche AVAX $33.82 nervously sweating at 6.9%, Aptos APT $4.28 treading lightly at 1.3%, Arbitrum ARB $0.43 barely wobbling at 0.5%, and finally, the ever-obedient Polygon and Optimism OP $0.69 at a modest 0.2%. This fund, dear reader, distributes income daily – a daily dose of fortune that would make any peasant envious – charging a noble management fee of 0.20-0.50%, while monthly transfer volumes whisper sweet nothings of $425 million. Truly, a DeFi dame’s delight!

BlackRock USD Institutional Digital Liquidity Fund | Source: RWAxyz

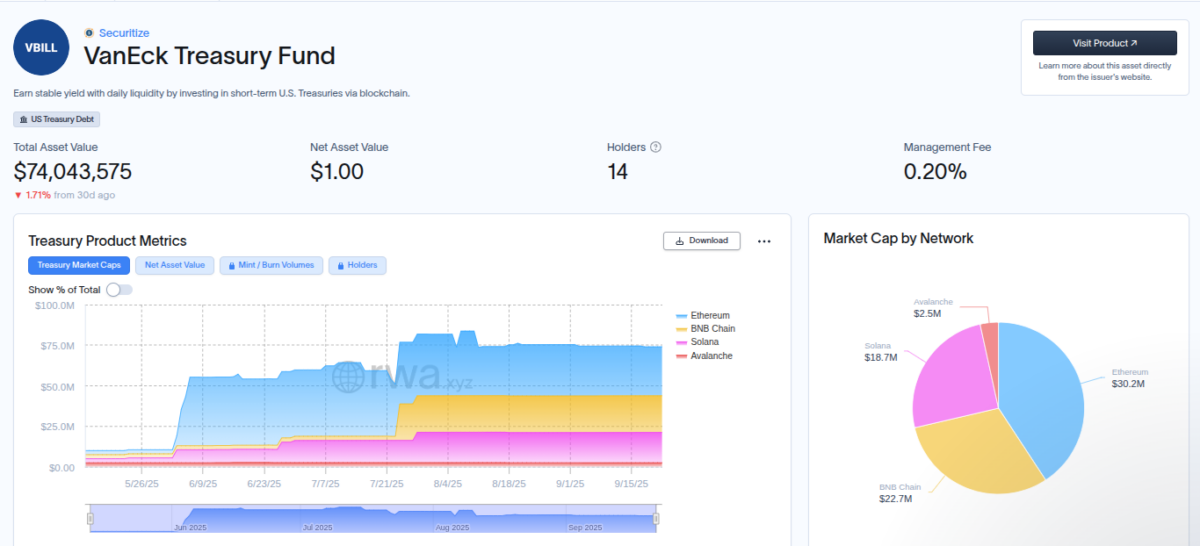

But wait, the tale grows richer! VanEck, never to be outdone, leapt into this tokenized frenzy with their Treasury Fund, VBILL, debuted on May 13, 2025, again with Securitize as their trusty squire. The newest knight in the realm of blockchain access, VBILL courts the qualified investors-those with at least $100,000 jingling in their pockets-and boasts 14 holders who control a modest $74 million AUM. VBILL graces no less than four blockchains: Ethereum, BNB Chain BNB $1 010 nervously boasting a 2.8% volatility, Solana, and Avalanche.

VanEck Treasury Fund | Source: RWAxyz

And now, with liquidity promised to work around the clock-24 hours a day, 7 days a week, mind you!-the market might just find itself tickled by the prospect of these tokenized treasures. As whispers from the hallowed halls of Wall Street reach even the lowliest tavern, the word “tokenization” has become the latest buzz, a delicacy savored by institutional investors and Nasdaq alike, which is busily courting the Securities and Exchange Commission (SEC) to create a grand bazaar of tokenized stock trading. Oh, what a time to be alive, juggling assets invisible yet worth more than your wildest dreams! 🥳

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- Gold Rate Forecast

- James Cameron Gets Honest About Avatar’s Uncertain Future

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- Silent Hill f: Who is Mayumi Suzutani?

- Southern Charm Recap: The Wrong Stuff

- Avengers: Secret Wars Adds WandaVision Star to MCU Movie’s Cast

2025-09-24 02:46