Ah, the crypto market, that fickle mistress of modern finance, hath once again succumbed to the whims of mortal folly. On this fateful day, February 11, the digital coins of our collective delusion tumbled like leaves in the autumn of economic uncertainty. The traders, those poor souls, reacted with the predictability of Pavlov’s dogs to the latest U.S. non-farm payrolls data and the looming specter of the consumer inflation report. A tragedy, you say? Nay, a farce, played out on the grand stage of human greed and ignorance.

- The crypto market, ever the drama queen, dipped on February 11 after the “strong” US non-farm payrolls data. Strong, they say? A mirage, perhaps, in the desert of economic reality.

- The economy, in its infinite wisdom, added over 130k jobs in January, as the unemployment rate fell to 4.3%. A triumph, or merely the last gasp of a dying beast?

- Prices also fell, as the odds of a US strike on Iran rose. Ah, the sweet scent of war, the ultimate market mover.

The Crypto Market’s Descent into the Abyss

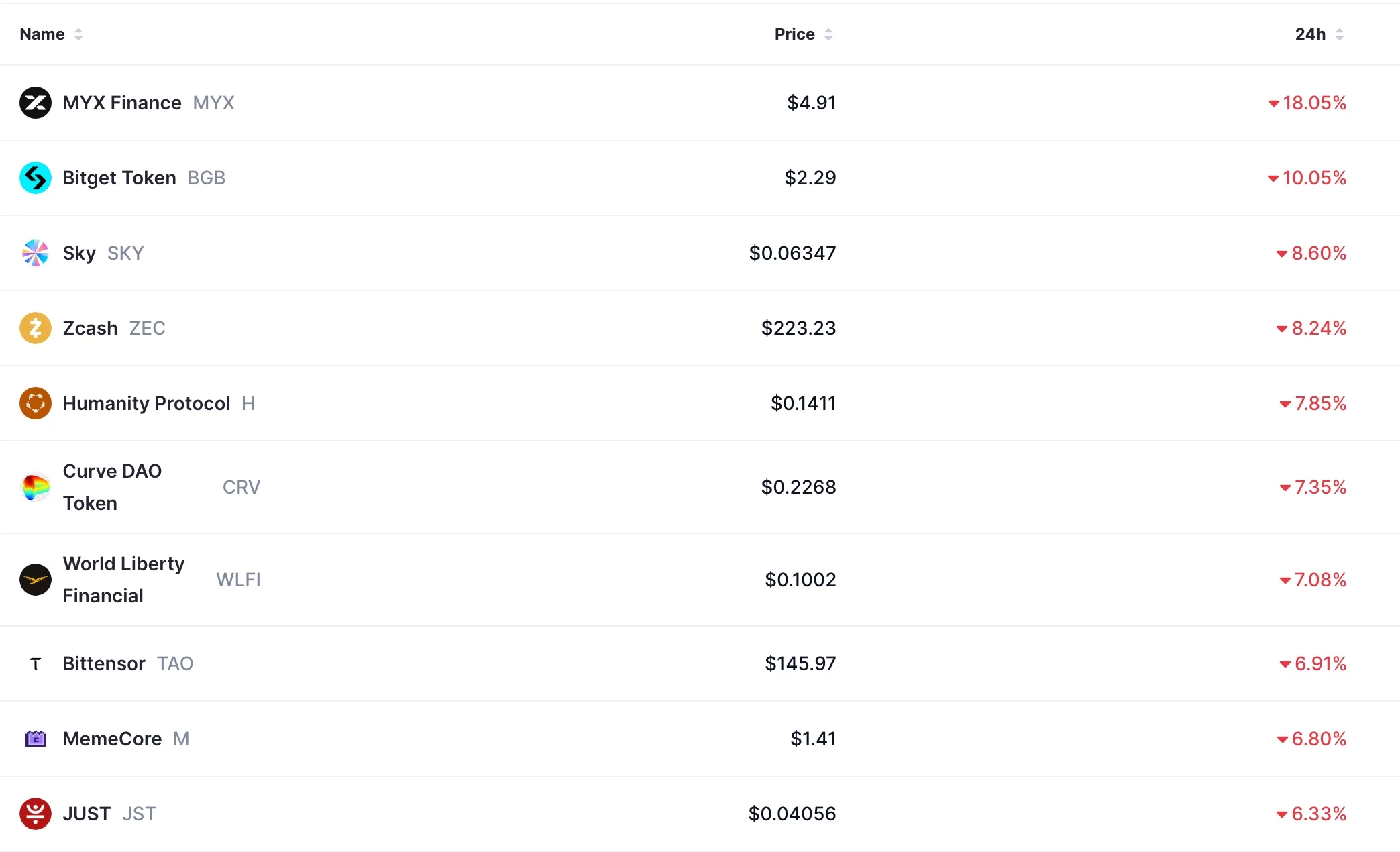

Bitcoin (BTC), that golden calf of the digital age, and its lesser brethren, the altcoins, continued their downward spiral after the latest US NFP data. BTC, once the darling of the financial world, dropped below $67,000, while MYX Finance plummeted by over 18% in the last 24 hours. Other unfortunate souls, like Humanity Protocol, Decred, World Liberty Financial, and Binance Coin, followed suit. A massacre, you say? Nay, a mere correction in the grand scheme of human folly.

The Bureau of Labor Statistics, those keepers of the economic flame, released a report showing that the economy added 130,000 jobs in January, a modest improvement over December’s 50,000. The unemployment rate, that barometer of societal health, improved to 4.3%, while average hourly earnings slowed to 3.7%. Numbers, mere numbers, yet they hold the power to move markets and shatter dreams.

These figures, they tell us, reveal an economy still adding jobs, even as corporate giants like Amazon, Gemini, and Target announce layoffs to cut costs. Government workers, those stalwart servants of the state, fell by 42,000, while manufacturing payrolls rose by a paltry 5,000. A tale of two cities, perhaps, or merely the chaos of a world in flux.

Yes, but…

2025 was weaker than thought: Former Fed economist Claudia Sahm, that Cassandra of the financial world, highlights that more than a million jobs were lost in revisions, with four months of outright payroll declines. 2025, she declares, was a “hiring recession.” A recession, you say? But of course, what else could it be in this theater of the absurd?

Good news in January, but the downward revisions are huge. More than a million fewer jobs than previously estimated by the end of 2025. And four months last year with outright declines in payrolls.

– Claudia Sahm (@Claudia_Sahm) February 11, 2026

Strength Is Narrow, Not Broad: Most gains came from health care, social assistance, and construction; government payrolls fell, and many sectors saw modest or negative growth. A “low hire, low fire” labor environment, they call it. Stability, or stagnation? The line, as always, is blurred.

2025 was a hiring recession.

We already knew that. Today’s data reinforced just how bad it was.

Only 181,000 job gains ->Worst outside of a recession since 2023.The job market appears to be stabilizing. But this is still a frozen “low hire, low fire” labor market, especially…

– Heather Long (@byHeatherLong) February 11, 2026

In other words, the Fed, those high priests of monetary policy, may have misjudged the strength of the economy. Tighter policy, they say? Perhaps they have overplayed their hand, like a gambler at the roulette table.

Looking ahead, the next key catalyst for the crypto market is the U.S. inflation report, due out on Friday. Economists, those soothsayers of the modern age, expect the report to show that inflation slowed in January. Slowed, you say? But of course, the beast of inflation is never truly tamed.

Trump, Netanyahu, and the Dance of War

The crypto market, ever sensitive to the winds of geopolitical turmoil, retreated as investors prepared for a potential strike on Iran by President Trump. Trump, that modern-day Caesar, is considering expanding his armada by adding another aircraft carrier to the region. A show of force, or a prelude to disaster?

All this unfolds as Trump prepares to meet with Israeli Prime Minister Benjamin Netanyahu, that eternal advocate for regime change in Iran. Netanyahu, ever the hawk, is pushing for the U.S. to include ballistic missiles and Iran’s support of rebels in the ongoing talks. War, they say, is the continuation of politics by other means. How fitting.

Data compiled by Polymarket shows that the odds of a Trump attack on Iran have jumped in recent days. No surprise, then, that the price of crude oil and safe havens like the Swiss franc and gold have continued to rise. Bitcoin and the crypto market, those supposed safe-haven assets, have proven themselves to be anything but. A bitter pill to swallow, no doubt.

The crypto market also dipped as the Fear and Greed Index remained in the extreme fear zone, and futures open interest continued to fall. Open interest, once a towering giant at over $255 billion, has now shrunk to below $100 billion. A sign of the times, perhaps, or merely the latest act in this grand tragedy of human ambition and folly.

Read More

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Games of December 2025. We end the year with two Japanese gems and an old-school platformer

- Hunt for Aphelion blueprint has started in ARC Raiders

- Player 183 hits back at Squid Game: The Challenge Season 2 critics

- My Favorite Coen Brothers Movie Is Probably Their Most Overlooked, And It’s The Only One That Has Won The Palme d’Or!

- Decoding Cause and Effect: AI Predicts Traffic with Human-Like Reasoning

- Future Assassin’s Creed Games Could Have Multiple Protagonists, Says AC Shadows Dev

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Sony State Of Play Japan Livestream Announced For This Week

2026-02-11 20:18