In the gentler season when the markets pretend to be respectable rather than riotous, Bitcoin’s march toward the mid-60s has revived a familiar parable: the ominous whisper of 42K. Liquidity and mood shuttle about like footmen with the wrong livery, tripping over one another in the marble hall of finance.

- Bitcoin’s slide toward the mid-60Ks has rekindled the old conversation about 42K, with liquidity and sentiment behaving like choleric footmen in a grand house.

- Spot Bitcoin ETF flows have proved capricious actors: late-January exoduses and capricious rebounds into February, all performed with the gravity of a farcical absurdity.

- The genteel chorus of “crypto winter” reappears in polite press circles, amplifying nervous selling and the pleasant habit of deleveraging with contrite dignity.

- Maxi Doge ($MAXI) leans into the high-volatility theatre, with competitions and staking schemes that seem designed to keep the crowd engaged as the clock ticks.

Bitcoin’s tone has shed its previous swagger of “buy the dip” and adopted something more akin to anxious risk management, quick as a cat and twice as puzzled.

$BTC rose to trade near $66K, a rebound that followed a plummet rich in melodrama, while $ETH meanders near $1.9K. The mainstream financial press has stiffened its upper lip, tossing around the phrase “crypto winter” as if it were a stern curate delivering judgment on a reckless youth.

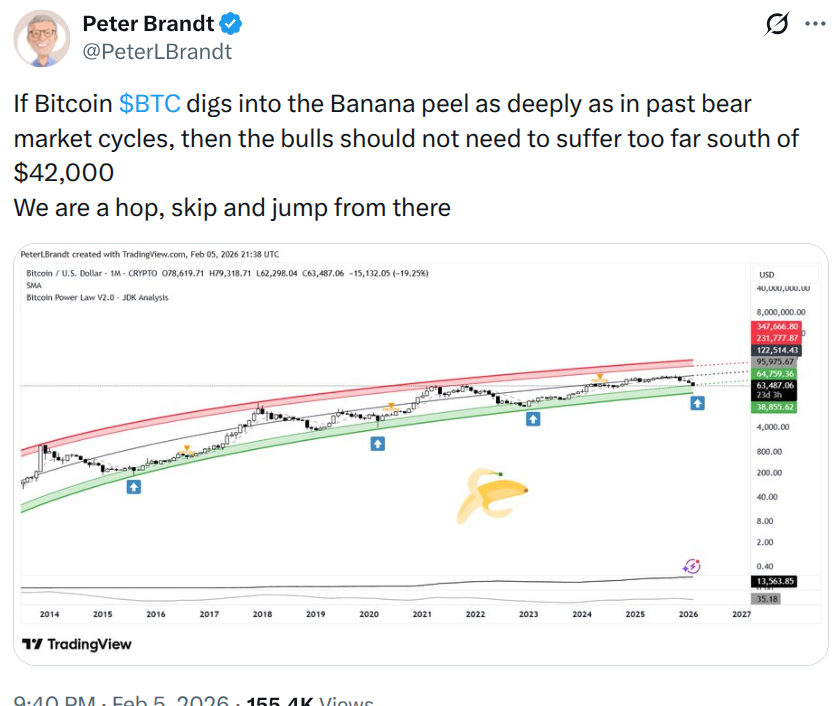

That is the backdrop against which veteran chart-watcher Peter Brandt’s “$42K” chatter keeps resurfacing in trader parlours. Not because 42K is some sacred talisman, but because in a momentum market round numbers exert a gravity all their own-pulling positions, shaping hedges, and, crucially, becoming self-fulfilling when liquidity slumbers.

Let’s be honest: liquidity has been a quiet thing where it matters most. The ETF bid flickers like a nervous candle in a draught.

Farside’s flow tracker reveals violent day-to-day swings, a spectacle that would make even the most seasoned Bitcoin MAXI break into a cold sweat and mutter about risk controls in a most un-British fashion.

In such weather, capital redistributes itself. Some traders retreat to cash; others seek the glow of high-beta memes for asymmetric upside, because if you’re going to take on risk, you might as well have fireworks. Maxi Doge ($MAXI) is the kind of leverage king that some find irresistibly dashing.

Maxi Doge ($MAXI) Turns Volatility Into A Game With Yield

When the tape behaves as if it were in a casino run by a rather enthusiastic chemistry student, meme coins present a different product altogether: a communal appetite for risk, stirred and served by the camaraderie of the degenerate crowd.

That is Maxi Doge’s milieu. An Ethereum ERC-20 token built around “Leverage King” bravado-think thousandfold energy, gym-bro humour, and a taste for competitive trading-crafted for folk who feel outgunned by whales and the tyranny of large capital, yet enjoy the theatre of a spirited wager.

The team leans into the degen mood with holder-only trading competitions, leaderboard rewards, and a Maxi Fund treasury aimed at liquidity and partnerships. In a market where traders are glued to charts and funding rates, this “lift, trade, repeat” motto is less a slogan than a coping mechanism, a small exercise in maintaining sanity among the digital mobs.

buy your $maxi now

$MAXI Money

The capital side has its own theatre. The presale has momentum: over $4.5M raised, and you can still buy in at a token price around $0.0002802. But that price is almost as elusive as a decent waiter in a crowded club, for a rise is anticipated in the coming days. Learn how to buy Maxi Doge with our ‘How to Buy Maxi Doge’ guide.

The sub-cent entry price paired with a multi-million raise tends to keep meme traders amused during choppy seas, preserving the illusion of immense upside without requiring heroic sums.

Whales are not neglecting the legs of the animal either. The largest purchase reported: $314K. That kind of participation does not guarantee a moonshot, but it does ensure the token remains a topic on the dining-table conversations of the right circles.

The staking scheme adds further persuasion. Maxi Doge offers a dynamic APY with daily automatic distribution from a 5% staking pool for up to a year. In plain English, it’s an incentive to endure the noise a little longer.

CHECK OUT THE MAXI DOGE PRESALE ON ITS OFFICIAL SITE

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- James Cameron Gets Honest About Avatar’s Uncertain Future

- Code Vein II shares new character trailers for Lyle McLeish and Holly Asturias

- Zombieland 3’s Intended Release Window Revealed By OG Director

- YouTuber streams himself 24/7 in total isolation for an entire year

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Woman hospitalized after Pluribus ad on smart fridge triggers psychotic episode

- What time is It: Welcome to Derry Episode 8 out?

2026-02-06 17:46