What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

Ah, Friday! A day that once signified the end of the workweek but now resembles a scene from “The Walking Dead,” as crypto markets rise from their graves in a spectacularly green fashion. Yes, yesterday’s catastrophic plunge has been brushed aside like crumbs from a long-forgotten sandwich, all thanks to a classic oversold rebound.

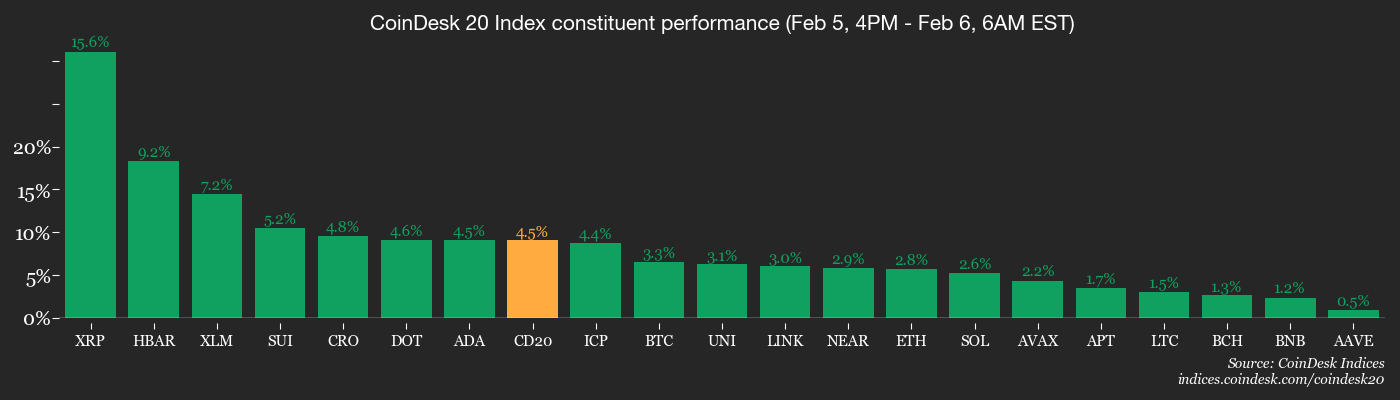

Bitcoin is back in the limelight, strutting around at $65,000, after playing coy at $60,000. It’s a little like watching my cat pretend to be aloof, only to suddenly demand dinner. The BlackRock ETF news is swirling, indicating that long-term holders might be throwing in the towel-classic bear market behavior akin to a last gasp before the lights go out. Meanwhile, XRP, SOL, ETH, and their crew are trying to regain their footing, with the CoinDesk 20 Index adding nearly 9% since midnight UTC. It’s like a high school reunion where everyone pretends they’re doing great while secretly wondering how they lost their hair.

But hold onto your hats-despite this mini-celebration, put options on Bitcoin are still hot commodities. Why, you ask? Because fear is the seasoning in this economic stew. Speaking of which, President Trump signed a funding bill to end the government shutdown, but with the Department of Homeland Security running out of cash faster than my bank account post-payday, we could be in for another circus act by February 14. Love is in the air, folks!

Meanwhile, oil prices are doing a little dance across the Atlantic, thanks to escalating Iran-U.S. tensions. Because nothing says stability quite like geopolitical conflicts leading to global inflation, right? This could send investors scrambling for safety, leaving risk assets like crypto feeling rather unloved.

More critically, many digital asset holders are currently swimming with the fishes, thanks to recent market crashes. If they start capitulating and selling at a loss, it could dampen any hopes of a rally. And let’s be honest, rebuilding confidence after a crash is like trying to put toothpaste back in the tube-it’s messy and usually results in a lot of regret.

Digital Assets Forum (London)

Market Movements

- BTC is up 4.55% from 4 p.m. ET Thursday at $66,022.00 (24hrs: -6.74%)

- ETH is up 4.14% at $1,924.90 (24hrs: -7.3%)

- CoinDesk 20 is up 4.75% at 1,905.03 (24hrs: -7.49%)

- Ether CESR Composite Staking Rate is up 39 bps at 3.48%

- BTC funding rate is at -0.0142% (-15.5862% annualized) on Binance

- DXY is unchanged at 97.81

- Gold futures are down 0.19% at $4,880.30

- Silver futures are down 4.39% at $73.35

- Nikkei 225 closed up 0.81% at 54,253.68

- Hang Seng closed down 1.21% at 26,559.95

- FTSE is up 0.01% at 10,309.76

- Euro Stoxx 50 is up 0.27% at 5,941.80

- DJIA closed on Thursday down 1.20% at 48,908.72

- S&P 500 closed down 1.23% at 6,798.40

- Nasdaq Composite closed down 1.59% at 22,540.59

- S&P/TSX Composite closed down 1.77% at 31,994.60

- S&P 40 Latin America closed down 1.01% at 3,616.07

- U.S. 10-Year Treasury rate is down 1.8 bps at 4.192%

- E-mini S&P 500 futures are up 0.3% at 6,841.00

- E-mini Nasdaq-100 futures are up 0.36% at 24,740.50

- E-mini Dow Jones Industrial Average Index futures are up 0.16% at 49,075.00

Bitcoin Stats

- BTC Dominance: 58.77% (+0.47%)

- Ether-bitcoin ratio: 0.02917 (0.43%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $29.76

- Total fees: 5.59 BTC / $377,330

- CME Futures Open Interest: 115,230 BTC

- BTC priced in gold: 13.5 oz.

- BTC vs gold market cap: 4.4%

Technical Analysis

- The chart shows bitcoin’s weekly price swings in candlestick format since 2019.

- Prices are rapidly approaching their average over 200 weeks, represented by the red line.

- BTC has consistently put in bear-market bottoms around this average, suggesting the current pullback could be in its final stages-kind of like that last bite of a stale donut.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $146.12 (-13.34%), +5.97% at $154.84 in pre-market

- Circle Internet (CRCL): closed at $50.23 (-8.76%), +5.40% at $52.94

- Galaxy Digital (GLXY): closed at $16.84 (-16.47%), +6.35% at $17.91

- Bullish (BLSH): closed at $24.90 (-8.46%), +3.98% at $25.89

- MARA Holdings (MARA): closed at $6.73 (-18.72%), +6.39% at $7.16

- Riot Platforms (RIOT): closed at $12.06 (-14.71%), +5.14% at $12.68

- Core Scientific (CORZ): closed at $14.81 (-8.27%), +1.99% at $15.11

- CleanSpark (CLSK): closed at $8.27 (-19.13%), -3.33% at $7.99

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $35.23 (-12.56%), +2.24% at $36.02

- Exodus Movement (EXOD): closed at $9.42 (-11.96%), -1.27% at $9.30

Crypto Treasury Companies

- Strategy (MSTR): closed at $106.99 (-17.12%), +6.71% at $114.17

- Strive (ASST): closed at $9.86 (-16.75%)

- SharpLink Gaming (SBET): closed at $6.07 (-14.27%), +4.12% at $6.32

- Upexi (UPXI): closed at $1.09 (-19.85%), +7.34% at $1.17

- Lite Strategy (LITS): closed at $0.95 (-10.27%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$434.1 million

- Cumulative net flows: $54.3 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$80.8 million

- Cumulative net flows: $11.86 billion

- Total ETH holdings ~5.87 million

While You Were Sleeping

Bitcoin surges back above $65,000 after $700 million wipeout in Asia whipsaw (Coindesk): Bitcoin rebounded above $65,000 after its worst one-day drop since November 2022. About $700 million in leveraged crypto positions were liquidated in a few hours. A real nail-biter for those involved, to say the least!

Stocks reel as AI fears dominate market action (Reuters): Global markets retreated as a stock rout on Wall Street spread worldwide, with volatility gripping precious metals and cryptocurrencies while AI fears weighed on equities. Who knew robots could be so scary?

Weak earnings drag IREN, Amazon; bitcoin stocks rebound in pre-market (CoinDesk): IREN earnings were weaker than expected, while Amazon missed EPS estimates and beat on revenue. Talk about mixed messages-it’s like getting a text from an ex!

Big tech to spend $650 billion this year as AI race intensifies (Bloomberg): The high spending projections raise concerns about energy supplies, prices, and the potential distortion of economic data. It’s enough to give any accountant a heart attack!

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- James Cameron Gets Honest About Avatar’s Uncertain Future

- YouTuber streams himself 24/7 in total isolation for an entire year

- Code Vein II shares new character trailers for Lyle McLeish and Holly Asturias

- Zombieland 3’s Intended Release Window Revealed By OG Director

- Amanda Seyfried “Not F***ing Apologizing” for Charlie Kirk Comments

- Now you can get Bobcat blueprint in ARC Raiders easily. Here’s what you have to do

- Abandon All Hope

2026-02-06 16:45