As the financial world’s jittery soothsayers energetically front-run the Fed’s upcoming chairperson melodrama, Blackrock’s Rick Rieder-a fellow with a near-fatalist passion for crypto assets-has emerged as the not-at-all-surprising frontrunner. This is, naturally, the bizarrely logical outcome of a system where high-stakes gamblers determine monetary policy’s next chapter.

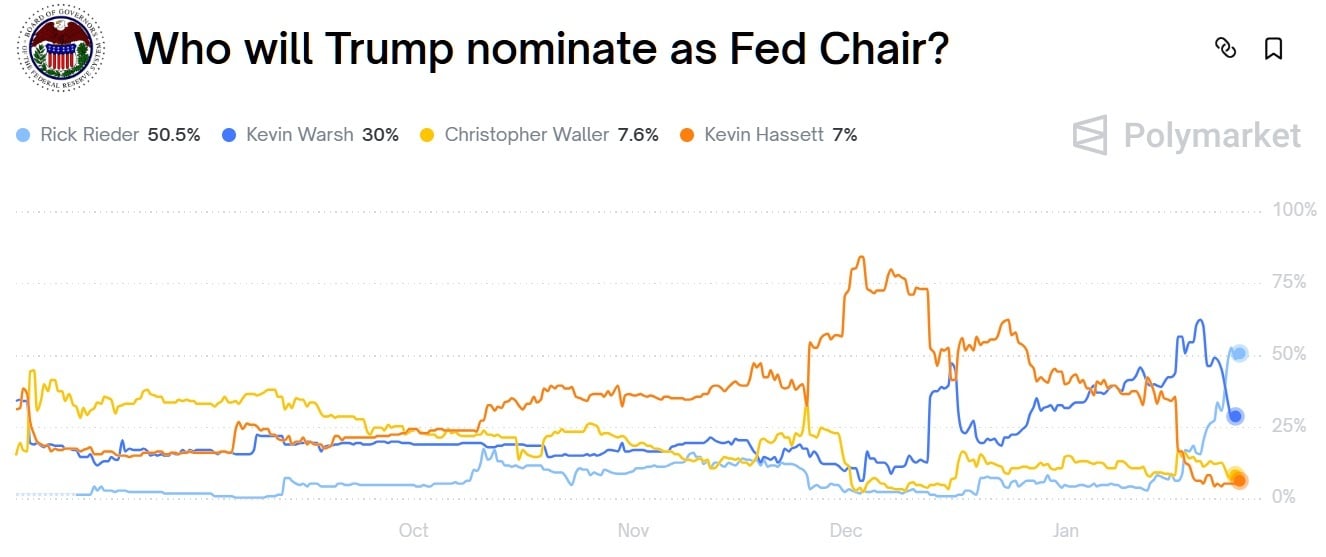

With the Federal Reserve’s succession saga unfolding like a Victorian opera in reverse, Polymarket, that cybernetic oracle of blockchain-based window dressing, reveals a curious trend: Mr. Rieder, Blackrock’s global ciel d’un-ion (chief investment officer of all that’s shiny), now commands 50.5% implied probability to replace the ex-president of financial somnolence-Jerome Powell-dubbed by the chronicles Annual Leader of Unintended Consequences. Market contrarians-those noble few-yet stubbornly cling to Kevin Warsh’s 30% or Christopher Waller’s 7.5%, as if hoping history might bloom anew.

The aggregate trading volume-surpassing $252 million,ora sum sufficient to build a modest cathedral or finance several more years of Fed quantitative easing-suggests this isn’t merely a sideshow but a full-fledged carnival of bets. The chart, alas, reveals that Rieder’s trajectory resembles less a political ascent and more a parabolic rise, sharply diverging from lesser mortals over the past two months. Meanwhile, Powell’s tenure as Chair, scheduled to conclude on May 15, 2026, looms like a retirement villa purchased on a whim by someone who forgot they have a mortgage.

Mr. Rieder, a man whose philosophical leanings suggest he mistakes altcoins for a financial holy grail, has previously insisted that bitcoin is not merely “passing gold benchmarks” but instead “playacting with subatomic permanence.” In a November 2000 missive-to those who counted-Rieder prophetically declared: ..[bitcoin] is so much more functional than passing a bar of gold around…

“[..bitcoins gnawing the marrow of Monetary absurdity. isn’t that a segue to liquid modernity?”

Undeterred by historical anachronism, the Blackrock absolution extended to September 2025-wherein Rieder proposed a 5% crypto allocation as a modest position-though one might suspect a man who calls 5% “high” is merely hedging against the specter of youthful zeal. “We’re running considerably lower than that in crypto,” he intoned with the solemnity of a cleric addressing sin, “but I just think it’s going to go up.” How thrilling! The Age of Arithmetic Enlightenment is nigh.

FAQ ⏰

- Why is Rick Rieder leading dramaturs of finance’s next sovereign?

The oracles of Polymarket-those high priests of speculative arithmetic-have politely whispered that Rieder’s pro-crypto, anti-currency clerisy ideology is a match. - What probability does Polymarket ascribe to Rick Rieder?

A mere 50.5% chance to rewrite the Fed’s script-almost certainly for posterity. - How much wealth confirms this Financial Prime-Minister’s appointment?

$252 million in wagers suggests participants are less speculative gamblers and more financial historians. - What is Rieder’s view on baseline financial comedy?

He regards it as a “functional hard asset,” though his allocation math suggests he’s happy to let others shoulder the risk.

Read More

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Games of December 2025. We end the year with two Japanese gems and an old-school platformer

- Player 183 hits back at Squid Game: The Challenge Season 2 critics

- Future Assassin’s Creed Games Could Have Multiple Protagonists, Says AC Shadows Dev

- Hunt for Aphelion blueprint has started in ARC Raiders

- Hell Let Loose: Vietnam Gameplay Trailer Released

- First Glance: “Wake Up Dead Man: A Knives Out Mystery”

- Will there be a Wicked 3? Wicked for Good stars have conflicting opinions

- These are the last weeks to watch Crunchyroll for free. The platform is ending its ad-supported streaming service

2026-01-26 04:37