Ah, Bitcoin-the celestial body of modern finance, now lurking in the shadows cast by ominous warning signs. As the selling tide surges, long-term holders increasingly feel the urge to part ways with their digital gold, all while demand takes a nosedive across on-chain and exchange indicators. One might wonder if this is the beginning of a magnificent collapse or merely a tempest in a cryptocurrency teapot, yet stability seems as elusive as a polite apology in a room full of philosophers.

Bitcoin Faces Deeper Pullback as 4 Indicators Warn Selling Isn’t Finished

In the grand theater of crypto, stress signals are flashing brighter than a disco ball in a blackout. The Analysis from Cryptoquant, the digital Sherlock Holmes of blockchain, warns that our beloved Bitcoin has been performing a sluggish ballet from about $90,000 to $97,500-until the music stopped. Through a series of charts more confusing than a politician’s promise, it seems the once bullish march has turned into a mournful waltz of decline. The analysis cheekily states:

“All four indicators are currently showing a bearish convergence. US institutional demand is weak, overall demand is negative, and both Dolphins and Whales are in a distribution (selling) phase.”

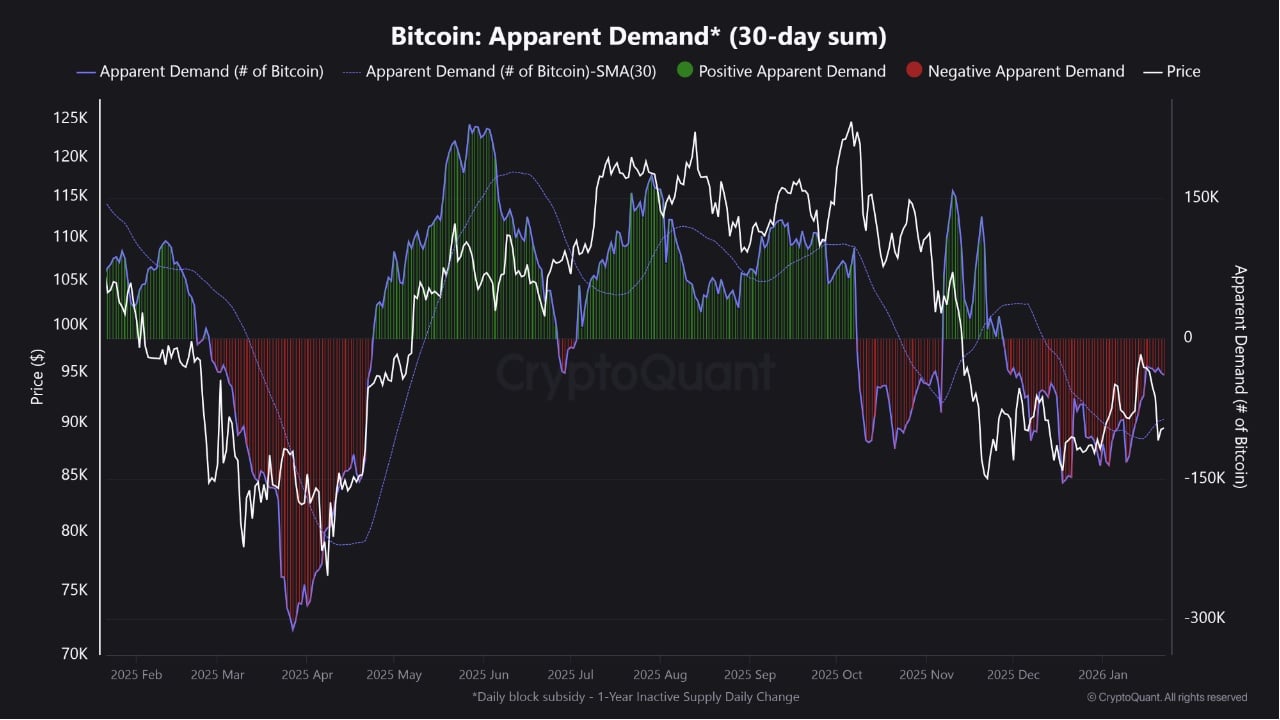

The Apparent Demand chart, which sounds like a suspiciously polite way to say how many people really want Bitcoin, shows a gloomy shift from positive vibes in mid-2025 to a sobering negative chorus by 2026. Long-term holders are dishing out their treasures faster than a Christmas sale, a classic recipe for a price slide that laughs in the face of short-term rallies.

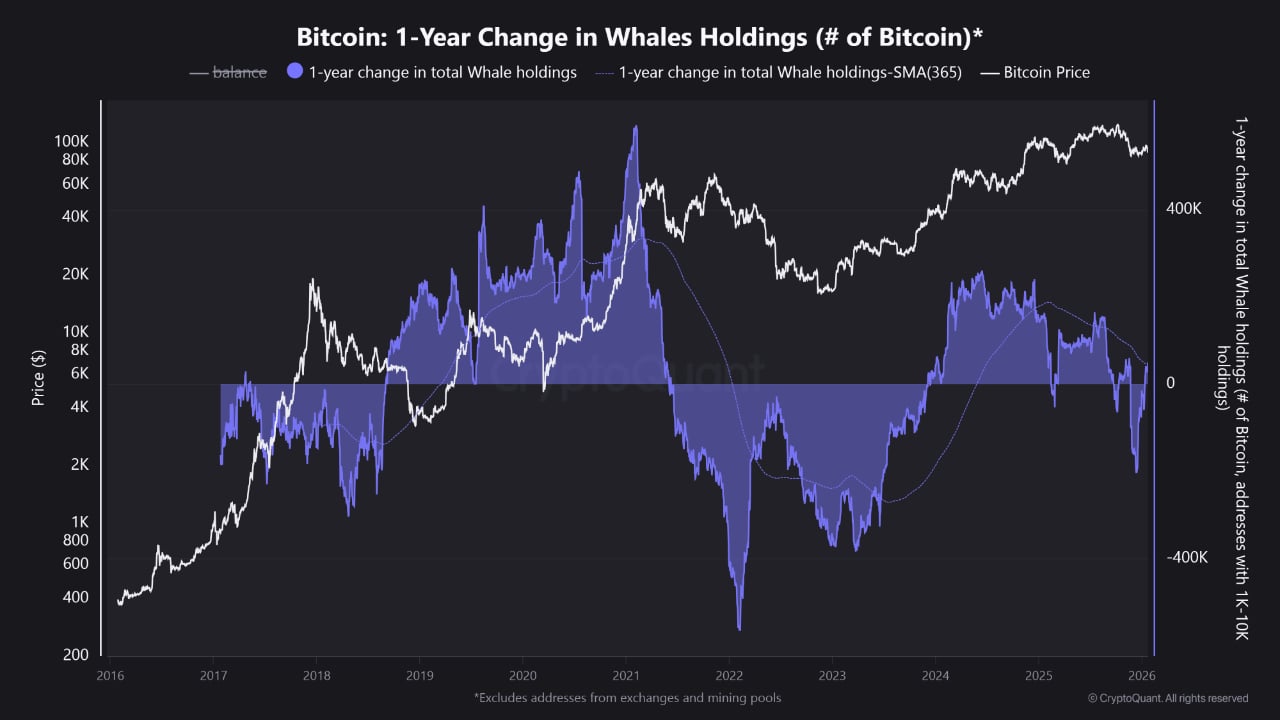

Meanwhile, the whale holdings-those titanic wallets of crypto titans-have gone from enthusiastic accumulation to a sharp decline, akin to a popular party turning into a somber farewell. This suggests the big fish are finally swimming away after a flirtation with the crypto reef.

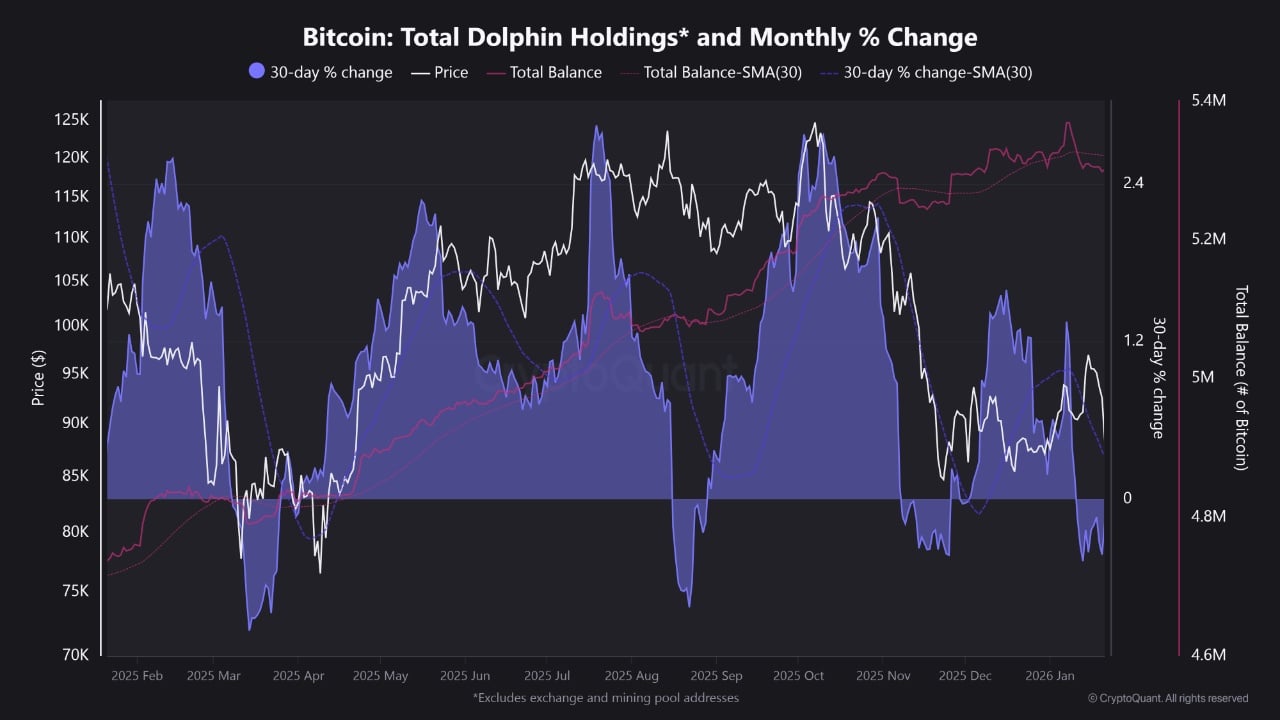

Even the medium-to-large investors, affectionately dubbed dolphins, have caught the bearish bug, turning from eager supporters to cautious skeptics, as their monthly growth metrics decline faster than your patience at a slow waiter.

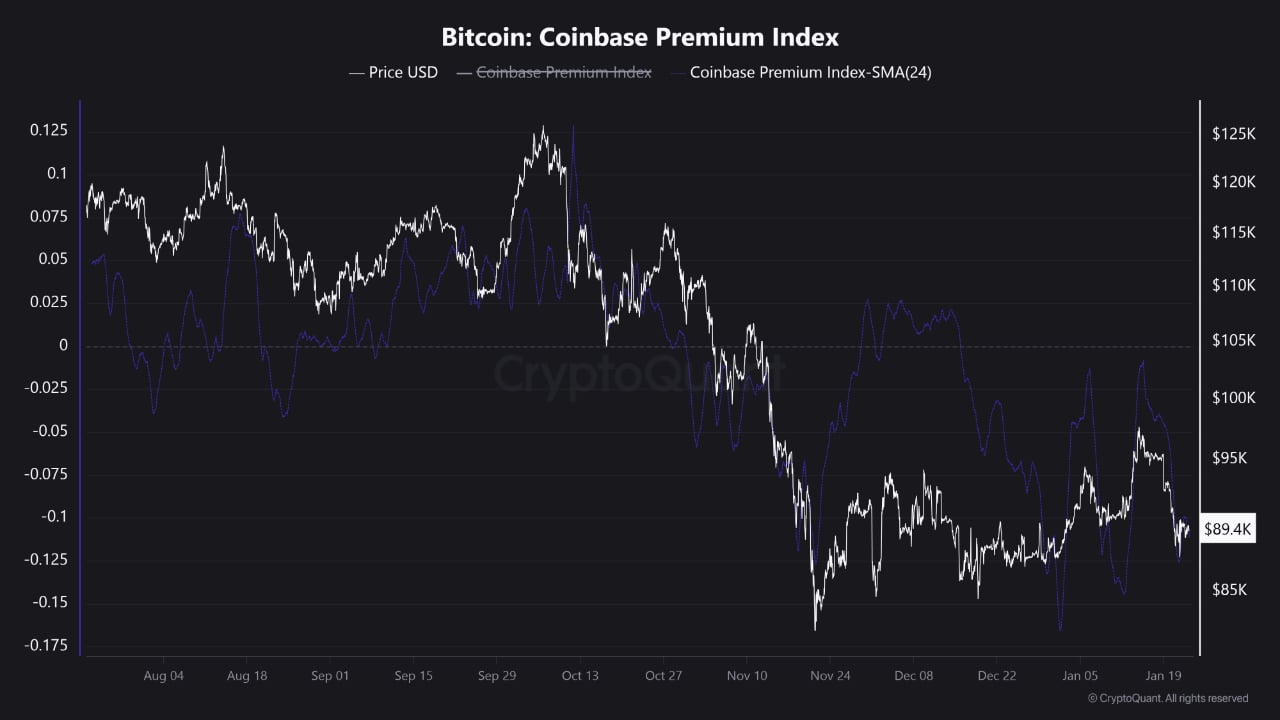

And let’s not forget the Coinbase Premium Index, which is so deeply negative it’s practically in the basement, whispering sweet nothings about U.S. demand being as scarce as a sunny day in London. The domestic appetite for Bitcoin appears weaker than my willpower in a chocolate shop.

All these signals form a delightful mosaic of market overindulgence, with excess supply and declining demand playing their parts in this tragicomedy. While not necessarily the start of a cataclysmic crash, it’s a reminder that perhaps, just perhaps, the crypto clock is striking twelve-casting a shadow of uncertainty over the near future. Yet, with Bitcoin’s eternal cap and the hope of renewed interest lurking in the wings, this could simply be a cryptic pause before the next act of the grand financial opera.

FAQ ⏰

- What is driving the current bearish convergence in bitcoin markets?

Negative on-chain data, whale and dolphin distribution, all screaming for attention like a toddler in a shop-an unmistakable sign that selling pressure is winning the popularity contest. - Why is Cryptoquant warning about long-term holder behavior?

Because those long-term holders are behaving like teenagers at a party-they can’t resist telling everyone they’re leaving, swiftly diminishing the price’s population of fans. - What does a negative Coinbase Premium Index indicate for bitcoin?

It’s basically the financial equivalent of an unpopular kid at a dance-demand from U.S. traders and institutions has gone home, leaving the market to its more adventurous global friends. - Do bearish on-chain signals mean a bitcoin crash is imminent?

Not necessarily. More like the market taking a deep breath before deciding whether to dance or retreat-prolonged consolidation, not necessarily calamity.

Read More

- YouTuber streams himself 24/7 in total isolation for an entire year

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- Gold Rate Forecast

- Ragnarok X Next Generation Class Tier List (January 2026)

- ‘That’s A Very Bad Idea.’ One Way Chris Rock Helped SNL’s Marcello Hernández Before He Filmed His Netflix Special

- Shameless is a Massive Streaming Hit 15 Years Later

- Decoding Infant Cries: A New Approach to Understanding Baby’s Signals

- ZCash’s Bold Comeback: Can It Outshine Bitcoin as Interest Wanes? 🤔💰

- Jason Momoa Sounds Off After Lobo Look Finally Revealed For Supergirl, And Fans Are Loving His New DC Role

- Binance Wallet Dives into Perpetual Futures via Aster-Is This the Future? 🤯

2026-01-24 11:08