Behold, a man who once sniffed out rot in the almighty American mortgage machine now peers into the abyss of our current economic canoe. Michael Burry, the Scion Asset Management voyager, brandishes a chart like a sorcerer’s wand, prophesying doom from Wells Fargo and Bloomberg’s arcane graphs.

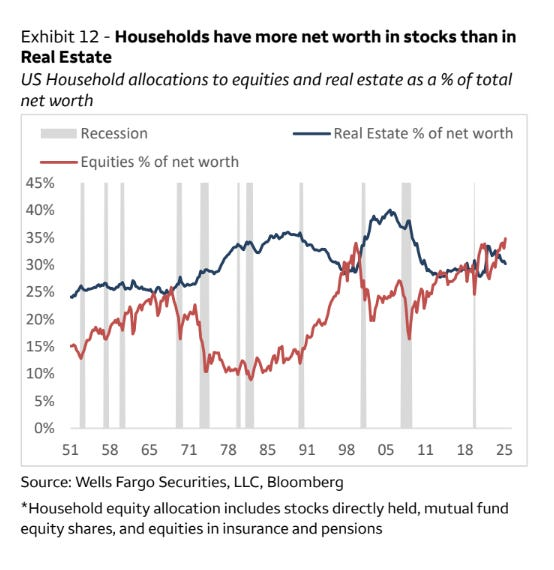

This parchment, he claims, unveils a ghastly truth: American households now corral more wealth in stocks than in the comforting embrace of real estate. A spectacle last witnessed in the late 60s and 90s, eras synonymous with bear markets waltzing in for decades. “Interesting,” Burry muses, sarcasm dripping like honey from a spoon, “perhaps the stock market’s main premise is to leave no man standing.”

Burry, the modern-day Cassandra of finance, elaborates: “Zero interest rates, pandemic largesse, inflation hurricanes, and AI’s cryptocurrency carnival-stocks have triumphed over homeowners’ modest 50% gains. Why? Because Americans now trade stocks like Pokéballs and believe in ‘AI’ as if it’s the next Jesus, backed by trillions and a bipartisan yawn.”

On his recent Against the Rules podcast pilgrimage, Burry laments passive investing’s tyranny. “Fifty percent of portfolios are blob-like, slithering with index funds,” he sighs. “When the market collapses, it’s not just Nasdaq’s party crashing-it’s the entire feast burning down, thanks to a nation of gamblers who’d swap their homes for Dogecoin.”

With a grin as sharp as financial ruin, Burry declares: “Beware, dear citizens. The bear is licking its chops, and the menu includes your 401(k).” 🐻🔥

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- Super Animal Royale: All Mole Transportation Network Locations Guide

- Gold Rate Forecast

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

- Brent Oil Forecast

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- YouTuber streams himself 24/7 in total isolation for an entire year

2025-12-19 11:22