In the vast and tumultuous sea of digital fortunes, where the winds of speculation blow with unrelenting fury, the past day has witnessed a spectacle both tragic and absurd. Bitcoin, Ethereum, and their lesser brethren have been cast into the abyss of a sharp retrace, a fall so precipitous that it has triggered a cascade of liquidations on the derivatives exchanges. Ah, the folly of man, ever chasing the mirage of wealth, only to be swallowed by the very sands he sought to conquer! 🌪️💔

The Great Crypto Flush: $600 Million Down the Drain

According to the chronicles of CoinGlass, a harbinger of financial doom, the recent tumult in the cryptocurrency market has been accompanied by a deluge of liquidations on the derivatives side. “Liquidation,” a term as cold and unforgiving as the winter in Yasnaya Polyana, refers to the forcible closure of open contracts that have amassed losses beyond a certain threshold. For the long investors, this calamity befalls when the asset’s price plummets, while for the shorts, it strikes when the price soars. A cruel game of chance, is it not? 🎲💥

The extent to which a cryptocurrency must move to liquidate a position depends on the percentage threshold decreed by the platform and the leverage chosen by the trader. In times of sharp price swings, those who have gambled with high leverage are the first to be sacrificed at the altar of volatility. And so, the derivatives market, a theater of greed and hubris, has once again claimed its victims. As the data reveals, liquidations have surpassed $650 million in the last 24 hours, a sum that would make even the most profligate nobleman blush. 📉🤑

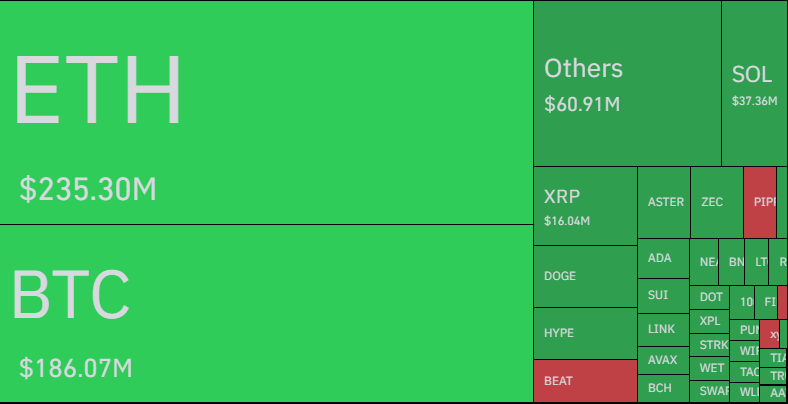

Of this staggering sum, $584 million involved long positions alone, a figure so disproportionate it borders on the farcical. Nearly 90% of the total liquidations, a testament to the merciless nature of the market’s whims. And who has borne the brunt of this carnage? Not Bitcoin, as one might expect, but Ethereum, with over $235 million in contracts liquidated. A surprising twist, is it not? Ethereum’s price drawdown has been more severe, leaving its traders in a state of despair. 🦄🌀

Among the altcoins, Solana has emerged as the unexpected victor in this game of financial ruin, with $37 million in positions flushed, surpassing even XRP ($16 million) and Dogecoin ($12 million). A curious outcome, given that SOL’s losses were more modest. Ah, the irony of it all! 🪙🤡

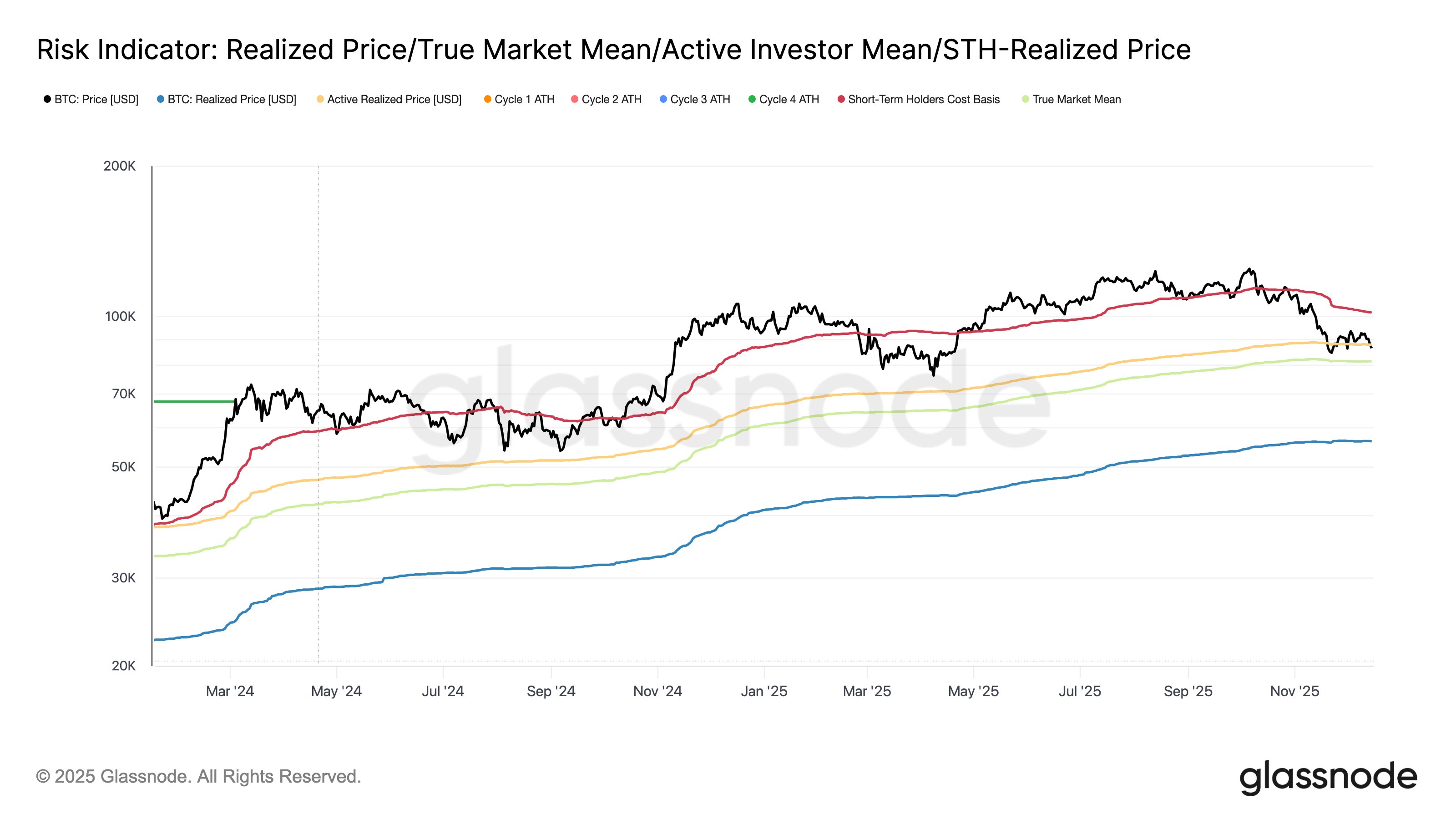

In other news, the latest decline in Bitcoin’s price has seen it fall below a key on-chain price level, as revealed by the analytics firm Glassnode. The Active Realized Price, the cost basis of the active participants on the Bitcoin network, currently stands at $87,900, a figure that now looms above the cryptocurrency’s spot price. Thus, the active investors find themselves in a state of net unrealized loss, a bitter pill to swallow. 🧊💔

The Current State of Bitcoin

At the time of this writing, Bitcoin hovers around $87,200, a decline of more than 3% over the past seven days. A minor setback, perhaps, in the grand scheme of its volatile existence. Yet, for those who have been caught in the maelstrom of liquidations, it is a reminder of the precarious nature of their endeavors. 🌊📉

And so, we are left to ponder the folly of man, ever chasing the elusive dream of wealth, only to be undone by the very forces he seeks to harness. In the world of cryptocurrency, as in life, the only certainty is uncertainty. Let us hope that the lessons of this carnage are not lost on those who would dare to play this dangerous game. 🕊️🤔

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- Gold Rate Forecast

- Ragnarok X Next Generation Class Tier List (January 2026)

- Answer to “A Swiss tradition that bubbles and melts” in Cookie Jam. Let’s solve this riddle!

- Silent Hill f: Who is Mayumi Suzutani?

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Hell Let Loose: Vietnam Gameplay Trailer Released

- Zombieland 3’s Intended Release Window Revealed By OG Director

2025-12-17 08:13