Market observers-those bespectacled soothsayers of finance-have decreed that this week shall be the pièce de résistance for XRP, as five spot ETFs pirouette upon the same stage for the first full week. 21Shares’ XRP fund (TOXR), like a tardy debutante, arrived today, joining Bitwise, Grayscale, Franklin Templeton, and Canary Capital in this grand ballet of speculative fervor. Reports whisper that ETF inflows have already swelled beyond $660 million in less than a lunar cycle, with not a single outflow marring the pristine ledger for ten consecutive trading days-a feat rivaling the endurance of a Soviet-era bureaucrat.

Five ETFs, One Stage, No Clowns (Allegedly)

Bitwise, ever the glutton, has swollen its XRP holdings to 80 million tokens-enough to choke a small blockchain. ETF managers now cradle over $687 million in assets, a sum representing just north of 300 million XRP on record. 21Shares, ever the modest newcomer, arrived with a $500,000 seed basket and the audacity to charge a 0.50% management fee. The competition among issuers promises to reveal, with the subtlety of a sledgehammer, just how desperately these funds intend to hoard XRP in the long term.

The Demand Model: A Mathematician’s Fever Dream

Mohamed Bangura, a man who presumably enjoys spreadsheets more than human interaction, shared a price-path sensitivity simulation that sent analysts into raptures. The model assumed a baseline ETF demand of 74.5 million XRP per day, a total exchange supply of 2.7 billion XRP, and an escrow release of 300 million XRP every 30 days-a scenario so precise it borders on numerology.

Next week is a big milestone for XRP.

We will have the first full week of trading with 5 pure spot ETF’s running in competition.

It’s going to tell us ALOT by the end of week what we can expect for these funds acquiring XRP for the long term.

– Chad Steingraber (@ChadSteingraber) November 30, 2025

Elasticity values of 0.2, 0.5, and 1.0 were tested over 180 days-a period during which most humans would have lost interest. The results? Low elasticity drains exchange-held supply faster than a vodka bottle at a Russian wedding, while higher elasticity produces price spikes sharper than a Nabokovian aphorism. Naturally, traders now scrutinize liquidity statistics with the intensity of a lepidopterist examining a rare specimen.

Liquidity Pressure: The OTC Desert

Jake Claver, CEO of Digital Ascension Group (a title that sounds more like a cult than a company), warned that private OTC and dark-pool channels may be drier than a British comedy. He estimates that roughly 800 million XRP of private liquidity vanished in the first week of ETF accumulation-a disappearance worthy of Houdini.

Since much ETF buying occurs off-exchange, price action has remained as subdued as a librarian’s cough. But markets, ever the drama queens, may soon convulse when funds are forced to scavenge coins from public exchanges like pigeons fighting over crumbs.

Whales: The Great Reshuffling

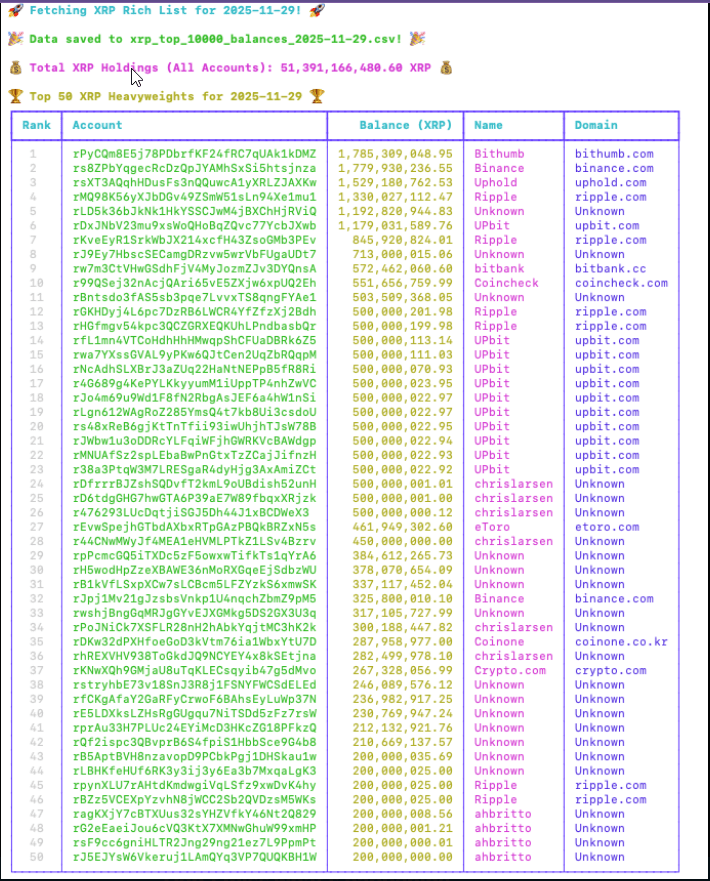

Meanwhile, the ledger reveals that large holders-those oceanic behemoths of crypto-have been shuffling balances with the finesse of a croupier. The top 10,000 wallets now clutch 51.39 billion XRP, roughly 85% of circulating supply. In a single day, 78 new wallets swallowed 77.324 million XRP. One particularly voracious wallet gulped 35 million XRP, another nibbled 3.63 million, and six others sipped 1.99 million each-a feeding frenzy worthy of a Tolstoyan banquet.

XRP RICH LIST SHOCKWAVE (11/29/2025)

Fresh data shows the top 10,000 wallets now control 51.39B+ XRP, and today’s ledger activity screams new whales + stealth accumulation.

78 new accounts grabbed 77M+ XRP in one day.

246 existing wallets increased balances by another…

– XRP 🅧 Army | Chacha72kobe4er (@Mullen_Army) November 30, 2025

Up to 44 new wallets reportedly amassed over 300 million XRP each, while 246 existing wallets bloated their combined balance by 17.91 million XRP-a silent accumulation during recent market weakness, as stealthy as a cat burglar in loafers.

The Grand Finale: Liquidity’s Last Stand

Analysts, those tireless narrators of financial theater, insist the current setup is less a demand story and more a stress test of liquidity. ETF holdings of roughly 300 million XRP are substantial, yet laughably small compared to potential daily demand-should inflows persist and additional funds join the fray.

If OTC channels evaporate and ETFs are forced to forage on exchanges, volatility may erupt with the suddenness of a sneeze in a silent library. Traders and portfolio managers will scrutinize order books, OTC reports, and ETF filings with the fervor of Kremlinologists deciphering Politburo speeches. The supply picture, ever the elusive muse, shall reveal itself in due time-or not at all.

Read More

- Lacari banned on Twitch & Kick after accidentally showing explicit files on notepad

- YouTuber streams himself 24/7 in total isolation for an entire year

- The Batman 2 Villain Update Backs Up DC Movie Rumor

- Adolescence’s Co-Creator Is Making A Lord Of The Flies Show. Everything We Know About The Book-To-Screen Adaptation

- Gold Rate Forecast

- Rumored Assassin’s Creed IV: Black Flag Remake Has A Really Silly Title, According To Rating

- New survival game in the Forest series will take us to a sci-fi setting. The first trailer promises a great challenge

- Warframe Turns To A Very Unexpected Person To Explain Its Lore: Werner Herzog

- Jane Austen Would Say: Bitcoin’s Turmoil-A Tale of HODL and Hysteria

- James Cameron Gets Honest About Avatar’s Uncertain Future

2025-12-02 05:16