They announced it on Monday, as if a number could contain a truth. 999,999 Solana tokens. And equivalents, of course. One must always qualify these pronouncements.

DeFi Dev Corp. and the Illusion of Growth

From Boca Raton—a place where shadows lengthen and promises fade—emerges DeFi Development Corp. (Nasdaq: DFDV). They claim to have added 141,383 Solana between the fourteenth and twentieth of July. A purchase, they say, averaging $133.53 per token. Nineteen million dollars transferred, a fleeting gesture against the vast indifference of the market. A new weight added to the already considerable burden of figures. It brought their total to 999,999 SOL, up from the previously reported 857,749. The pursuit of a round number, is this not the most human of follies? 🤔

And a portion, they tell us—a modest 867 SOL—arose from ‘organic sources.’ Staking rewards and validator revenue. As if the digital harvest is any less tainted than the fields of our ancestors. The whole accumulation, valued at a paltry $181 million on July 20th. A kingdom built on sand, or rather, on the flickering promise of cryptographic ledgers. 💸

They also secured another $19.2 million, a debt incurred through an ‘Equity Line of Credit’ – a gentler term for borrowing, wouldn’t you agree? 740,000 shares issued, diluted hopes traded for fleeting liquidity. Five million remains, earmarked for more Solana acquisitions. The cycle continues. They’ve only tapped 0.4% of the line of credit. A small sliver of available debt, a comforting thought for those who value fiscal prudence…or perhaps not.

The unlocked tokens, naturally, are staked. A neat circularity. Yield is generated. Fees are collected. Third-party stake is processed. They are not alone, these modern alchemists, mixing altcoins – Solana, Ethereum – into the volatile brew of their portfolios. A diversification strategy, they call it. A gambler’s instinct, one might say. 🧐

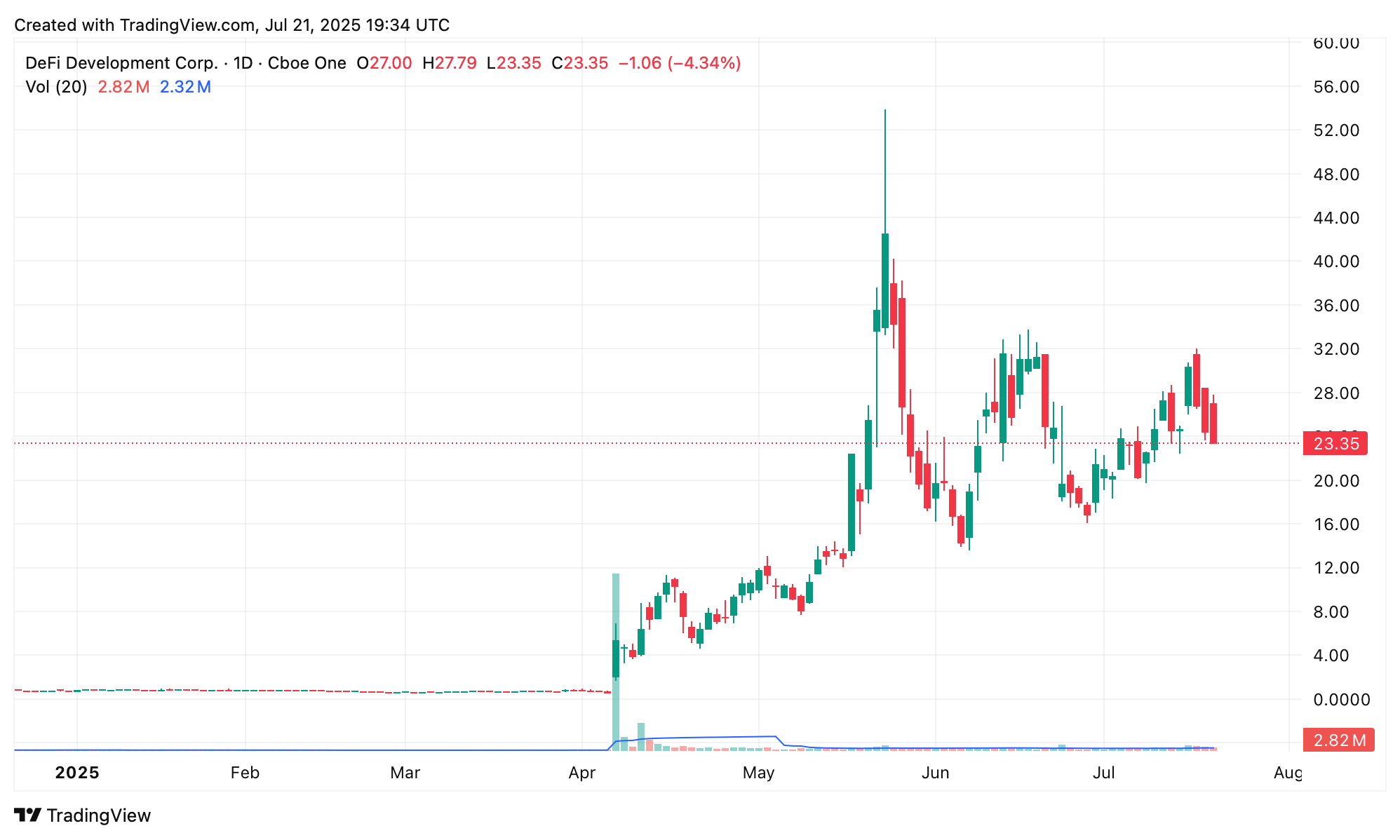

And beyond the tokens, there is an ‘AI-powered online platform’ for commercial real estate. Data, SaaS subscriptions, services… the jargon flows easily, obscuring the essential emptiness. Their stock, however, speaks a different language. A slump. A dip. A tumble. 1.19% today, over 10% in the past week, more than 23% in the last month. The market, it seems, is less easily impressed by numbers. It smells the desperation. It sees the fleeting nature of digital gold. 📉

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Goal Sound ID Codes for Blue Lock Rivals

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- All Songs in Superman’s Soundtrack Listed

- Summer Games Done Quick 2025: How To Watch SGDQ And Schedule

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

2025-07-22 01:27