- Ethereum addresses have hit 200,000+ with stablecoins, signaling a shift to utility-driven crypto

- Stablecoins are the new black in Ethereum’s ecosystem, driving liquidity and future cross-border finance

Something’s brewing in the vast Ethereum mainnet, not making headlines but certainly making waves in the data. 🌊

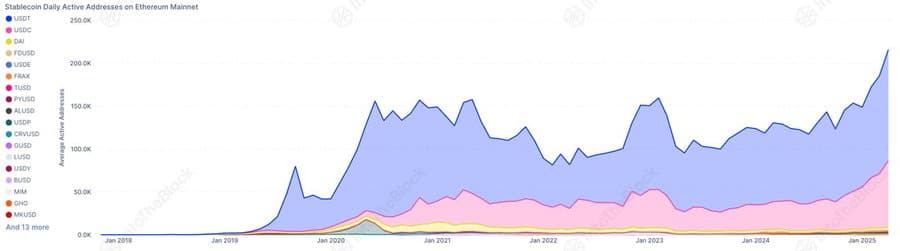

Over 200,000 unique addresses on Ethereum [ETH] are now holding stablecoins, a number that’s just hit an all-time high. And let me tell you, it’s a subtle signal that whispers volumes about where the smart money is flowing and what it’s craving from the crypto realm. 🤑

A Record High in Stablecoin Engagement on Ethereum

USDT has emerged as the dominant stablecoin, while USDC and DAI continue to make steady progress. These coins, once seen as mere trading tools, have now become essential for transactions, value storage, and interactions within Ethereum’s ecosystem. It’s like they’ve gone from being the sidekick to the superhero in one fell swoop. 🦸♂️

This shift reflects the growth of a utility-focused, mature digital economy increasingly anchored by stable digital currencies. It’s the crypto equivalent of a town growing up and realizing it needs a bank. 💰

What This Means for Ethereum and Beyond

The rise in stablecoin activity on Ethereum signals increased market liquidity across DeFi and centralized platforms. This growth supports faster, more efficient transactions and unlocks new opportunities in cross-border finance. 🌍

However, the expansion has drawn heightened regulatory scrutiny, focusing on reserve transparency, AML compliance, and taxation. It’s like the regulators are saying, “Hold on a sec, let’s make sure this isn’t just digital funny money.” 👮♀️

While Ethereum may continue to lead, competition from blockchains like Solana and Base is intensifying. It’s a bit like the Wild West of the digital age, with everyone jockeying for position. 🤠

Whether through multichain growth or deeper Ethereum integration, stablecoins have become the backbone of on-chain finance, no longer a secondary feature. They’re the new traffic lights in the crypto city, guiding the flow of digital value. 🚦

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-04-06 13:13