As a seasoned researcher with a background in financial markets and cryptocurrencies, I have seen my fair share of market turbulence. The recent events surrounding Bitcoin after the FOMC meeting of 2024 were no exception – the landscape flipped upside down like a pancake on a hot griddle!

The withdrawal of funds from ETFs and the decline in the Coinbase Premium Index to yearly lows had me scratching my head, thinking that perhaps US investors had lost their appetite for BTC. However, the on-chain data telling a different story – massive accumulations by US investors!

It seems that the warning from Fed Chair Jerome Powell about potential rate cuts in 2025 due to rising inflation spooked investors into withdrawing funds from riskier assets like Bitcoin and crypto. But, as we saw on January 3, the market can be unpredictable. The total net inflows for the day shot up to $908.1 million – a welcome change after the previous days’ outflows!

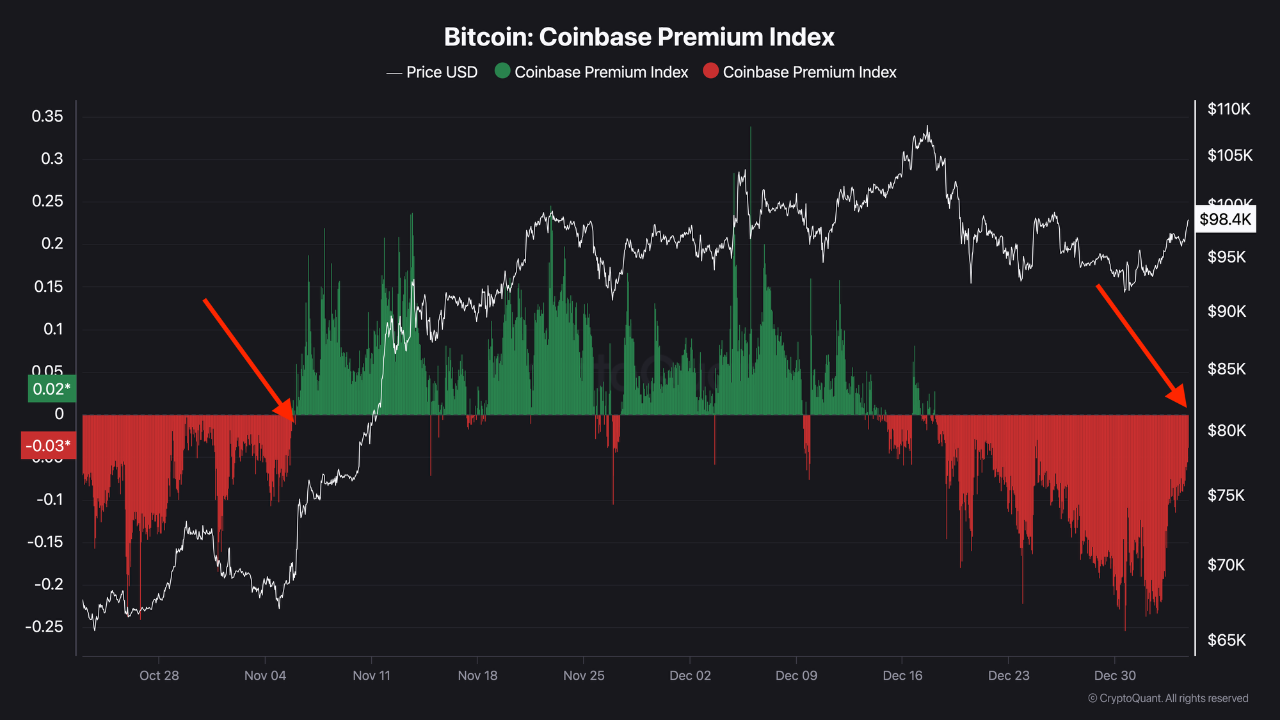

The Coinbase Premium Index, which had plunged to a yearly low, has now returned to neutral territory almost immediately. This indicates that “sentiment by the US and institutional investors is back.”

In conclusion, while the market may seem volatile at times, it’s important to keep a close eye on the data and make informed decisions. As for my joke, here goes: Why did Bitcoin cross the road? To get to the other blockchain!

After the final FOMC meeting of 2024 in the U.S., the bitcoin environment underwent a significant shift. Local investors started withdrawing their investments from ETFs, and the Coinbase Price Index plummeted to its lowest point for the year.

Conversely, on-chain indicators reveal a resurgence of U.S. investors in Bitcoin, as they have been making significant purchases.

ETFs Demand Returns

At a recent significant gathering within the U.S. Federal Reserve, Chairman Jerome Powell expressed concern that potential reductions in interest rates in 2025 might be limited or non-existent due to escalating inflation. Consequently, American investors swiftly began withdrawing investments from riskier ventures such as Bitcoin and cryptocurrencies.

Over a four-day trading period, over $1.5 billion was withdrawn from US Bitcoin exchange-traded funds (ETFs). Only one day, December 26, showed positive growth. The days following, December 27, 30, and January 2, however, witnessed more money leaving these ETFs than entering. Notably, even BlackRock’s IBIT, the largest Bitcoin ETF globally, displayed negative records during this period.

On Friday, January 3rd, something shifted dramatically. The total net inflows for that day skyrocketed to an impressive $908.1 million, as per FarSide data. IBIT followed closely with $253.1 million, but was outperformed by Fidelity’s FBTC with a staggering $357 million. Ark Invest’s ARKB also made a significant impact, pulling in $222.6 million. This marked the day with the highest net inflows since November 21st.

Coinbase Premium Index

As a seasoned investor with over two decades of experience under my belt, I’ve learned to closely monitor various indicators when assessing market trends and investor behavior. One such metric that has piqued my interest lately is the Coinbase Premium Index, which provides insights into US investors’ overall sentiment towards Bitcoin and cryptocurrencies.

In my opinion, this index offers valuable data by measuring the difference between the BTC price on Coinbase and Binance. When this gap widens positively, it signifies that US-based investors are buying heavily, while a negative spread suggests they’re selling off their holdings. Over time, I have found that understanding these shifts can help me make more informed decisions about my investments in the cryptocurrency market.

In my own personal experience, I’ve seen firsthand how the Coinbase Premium Index can serve as a useful tool for identifying potential buying or selling opportunities. For instance, during periods of strong US investor demand, I have found that investing in Bitcoin through platforms like Coinbase can yield substantial returns due to increased liquidity and higher prices relative to other exchanges. Conversely, if the index indicates weak investor sentiment, it may be prudent to hold off on making new investments or even consider selling positions to take advantage of lower prices elsewhere.

All in all, while the Coinbase Premium Index is just one metric among many that investors should consider when navigating the cryptocurrency market, I believe its insights into US investor behavior can provide a valuable edge in making informed investment decisions.

Lately, the metric hit its lowest point for the year, according to reports, which also marked a time when ETF investments were decreasing following the FOMC meeting. However, data from CryptoQuant indicates that it quickly returned to a neutral state soon after reaching this low. This suggests that “the mood among US and institutional investors has recovered.

Read More

- Can RX 580 GPU run Spider-Man 2? We have some good news for you

- Space Marine 2 Datavault Update with N 15 error, stutter, launching issues and more. Players are not happy

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Persona Players Unite: Good Luck on Your Journey to the End!

- Pacific Drive: Does Leftover Gas Really Affect Your Electric Setup?

- DAG PREDICTION. DAG cryptocurrency

- Streamer Life Simulator 2 (SLS2) console (PS5, PS4, Xbox, Switch) release explained

- Tekken Fans Get Creative with Photo Requests for ‘Scientific Research’

- WLD PREDICTION. WLD cryptocurrency

- Granblue Fantasy: Players Crave More Content, Hope for a Sequel

2025-01-04 15:30