Around 21,600 Bitcoin options contracts are set to expire this coming Friday, January 17th, with an estimated total value of approximately $2.2 billion.

As a researcher studying the cryptocurrency market this week, I’ve noticed that the expiry event is slightly larger than last week’s, but based on previous observations, it seems unlikely to cause any significant disruptions. Interestingly, after experiencing a dip to $90,000, Bitcoin has managed to rebound and return to its six-figure territory once more. This resilience could suggest a positive outlook for the market moving forward.

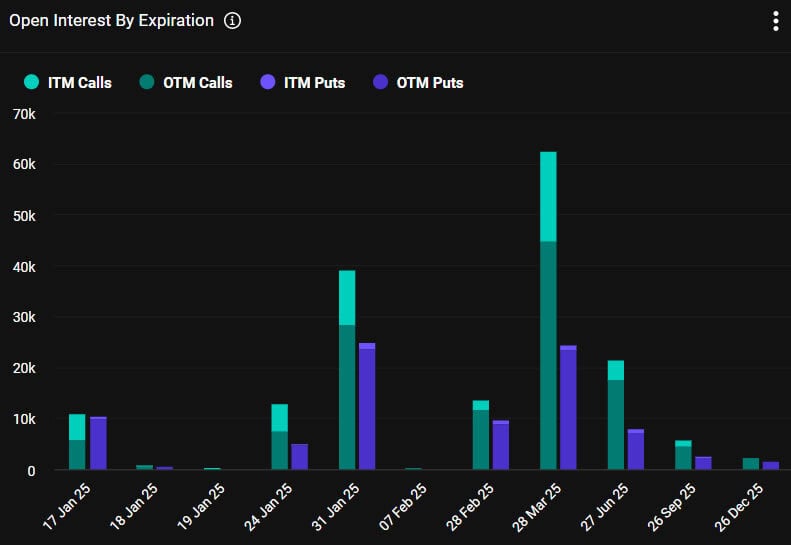

Bitcoin Options Expiry

This week’s set of Bitcoin options is seeing a nearly balanced stance between buyers (bulls) and sellers (bears), as the number of open long (call) and short (put) contracts approaching expiration is almost identical, with a put/call ratio of 0.94.

The unfulfilled value or quantity of Bitcoin options contracts that haven’t yet expired is most significant at the strike price of $120,000. This amount is growing by approximately $1.8 billion, as reported by Deribit.

At the $110,000 and $110,000 strike prices, there’s approximately $1.3 billion and $1.2 billion respectively in Options Involvement (OI). These figures suggest that derivatives traders are continuing to maintain a positive outlook.

On January 16th, the team at cryptocurrency derivatives provider Greeks Live expressed a predominantly optimistic outlook, suggesting that many traders anticipate further price increases towards approximately $110,000. However, they also warned against potential overshooting or overextension.

Significant barriers to further price increase were observed at previous peak prices of around $108,000 and $99,000, acting as resistance. At the same time, these levels could potentially act as a foundation or support if the market experiences a short-term downturn. However, there is some debate about whether the price might dip to approximately $90,000 in the immediate future.

Multiple traders have taken positions with $108K worth of short call options, which expire on January 24, recognizing a substantial potential for price increases.

In another message, Greeks stated that “the difference in implied volatility (IV) between January and March has shrunk, indicating that the market is expecting heightened doubt as Donald Trump gets closer to his inauguration.

In other news, Deribit stated that the increase in US PPI and CPI inflation data contributed to a rise in Bitcoin spot markets. Moreover, they mentioned that purchasing call options for Bitcoin with a strike price of $120,000 when its value was at $95,000 boosted the implied volatility as these calls were accumulated.

Apart from the Bitcoin options that expire today, there are approximately 182,000 Ethereum contracts set to expire as well, amounting to a total value of about $617 million. The put/call ratio for these Ethereum contracts is 0.35. This means that Friday will see a combined notional value of crypto options expiry worth around $2.8 billion.

Crypto Markets March Higher

On Friday, the total value of the cryptocurrency market soared to an impressive $3.73 trillion, with Bitcoin spearheading the surge as it increased by 2% during the day.

On a bustling Asian Friday morning, Bitcoin surged to reach an intraday peak of approximately $102,000, pushing its weekly growth nearly up to the 10% mark.

ETH‘s performance was underwhelming, not advancing beyond $3,400 and instead witnessing a broadening in the ETH/BTC ratio once more.

Today, Ripple‘s XRP neared its record peak of $3.38, while Solana (SOL), Cardano (ADA), Hedera (HBAR), and Chainlink (LINK) were all showing strong performance.

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-17 09:40