So, what happened?

- Picture this: Crypto bears, hundreds of thousands of them, trotting smugly into the wild, only to be flattened like pancakes by a wild stampede of digital coins. Over $460 million in short bets—poof! Gone! The biggest vanishing act since May.

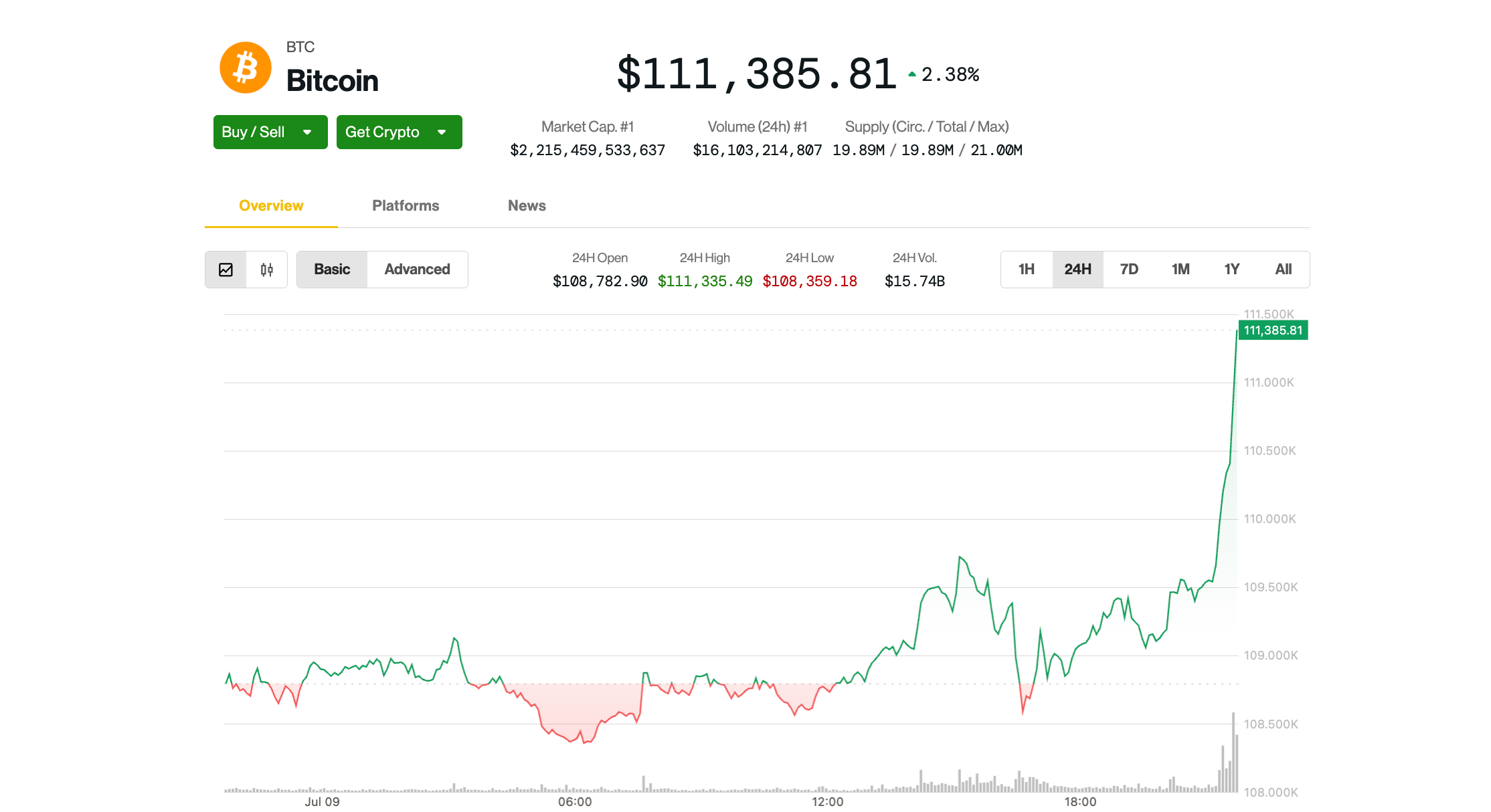

- Bitcoin, that greedy golden gobstopper, whooshed past $111,000, and not to be left behind, Ethereum and Solana came hurtling up like overcaffeinated squirrels. Traders with short positions blinked, and—snap!—their dreams evaporated faster than a whiff of Mrs. Twit’s cabbage stew.

- Over 114,000 unlucky souls—yes, you read that right—found themselves dumped out of their trades, wallets thinned and egos bruised. The majority? Short sellers, showing just how utterly bonkers crypto’s rollercoaster can be when you try to outsmart it with borrowed magic beans.

It all began with a tremendous whoosh in the crypto jungle, as a dozen-odd coins decided to defy gravity in the last 12 hours. Suddenly, short bets worth hundreds of millions blinked out of existence—much like Augustus Gloop after one too many licks of the chocolate river.

Bitcoin rocketed above $111,000 (the math teachers are still fainting 😨), Ethereum leapt over $2,700 like a goat with springs for legs, and Solana clambered up to $158, leaving the naysayers shrieking in the dust.

The grand total? More than 114,000 traders boiled and bubbled out of existence, with losses meaty enough to make even the BFG spit out his snozzcumber. Of the $527 million in vanishing trades, $463 million were shorts—a classic tale of “I told you so”—with an especially saucy $51.5 million gurgling away from one unlucky fellow in a single bet. Ouch.

But why does this happen, you ask? Well, in the wild world of leveraged trading, it’s a bit like borrowing Aunt Spiker’s broomstick—one hiccup and you’re flat on your face. When the prices zig instead of zag, exchanges swoop in, gobbling up your trades to “save you” from further calamity (and perhaps to snicker a bit on the side).

This time, as BTC and ETH cartwheeled skyward, the squeezed shorts set off a domino effect, flinging more traders out of the market than Mr. Wonka flings blueberry children out of his chocolate factory.

Savvy traders (the sort who’d never trust a snozzberry) sometimes even stalk these liquidations, gobbling up opportunities like a fox in a chicken coop. Big spikes in liquidations can be the market’s sneaky way of hinting where it’ll turn next. But beware: when the coins run wild, the only certainties are chaos and confetti—and probably a broken piggy bank or two.

As of now, Bitcoin itself is only up a modest 2% this week (fancy that!), while ETH and XRP are flouncing about with 7% gains, making it clear that sometimes the sidekicks throw a much bigger party than the leading man.

Asia Morning Briefing: Nvidia’s Rally to $4 Trillion Might Have Helped BTC, But Correlation Is Waning

U.S. Digital Assets Tax Policy Getting Hearing During ‘Crypto Week’

Bitcoin Tops $111K, on Brink of Breaking Record High; Ether’s 6% Jump Leads Major Cryptos

Revolut Seeks $1B in New Funding at $65B Valuation: FT

Cathie Wood’s ARK: Bitcoin’s Bullish Momentum Slows as Long-Term Holder Stacks Hit Record

FLOKI Lists on Webull Pay, Unlocking Access to 24M Users Amid Volatile Trading

Crypto Industry Pitches Market Structure Ideas to U.S. Senators in Hearing

Circle Has USDC Revenue Sharing Deal With Second-Largest Crypto Exchange ByBit: Sources

Asia Morning Briefing: Nvidia’s Rally to $4 Trillion Might Have Helped BTC, But Correlation Is Waning

Key Market Dynamic Keeps Bitcoin, XRP Anchored to $110K and $2.3 as Ether Looks Prone to Volatility

U.S. House Ditching Its Stablecoin Bill to Back Trump’s Choice From Senate

Pump.fun to Launch PUMP Token via ICO on July 12

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Lost Sword Tier List & Reroll Guide [RELEASE]

- 50 Goal Sound ID Codes for Blue Lock Rivals

- KPop Demon Hunters: Real Ages Revealed?!

- Umamusume: Pretty Derby Support Card Tier List [Release]

- Basketball Zero Boombox & Music ID Codes – Roblox

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- The best Easter eggs in Jurassic World Rebirth, including callbacks to Jurassic Park

- League of Legends MSI 2025: Full schedule, qualified teams & more

2025-07-10 06:50