Ah, Bitcoin. That digital bauble, shimmering with the promise of untold riches—or utter ruin. One so-called “technical analyst,” a species prone to gazing into crystal balls 🔮 fashioned from candlestick charts, has declared that Bitcoin, that capricious sprite, shall ascend to a dizzying $325,000. The audacity! The sheer, unadulterated chutzpah of it all! And the timeline, my dears, is so wonderfully preposterous, it threatens to curdle the very cream in your coffee ☕.

Bitcoin’s Absurdly Hypothetical Ascent to $325K?

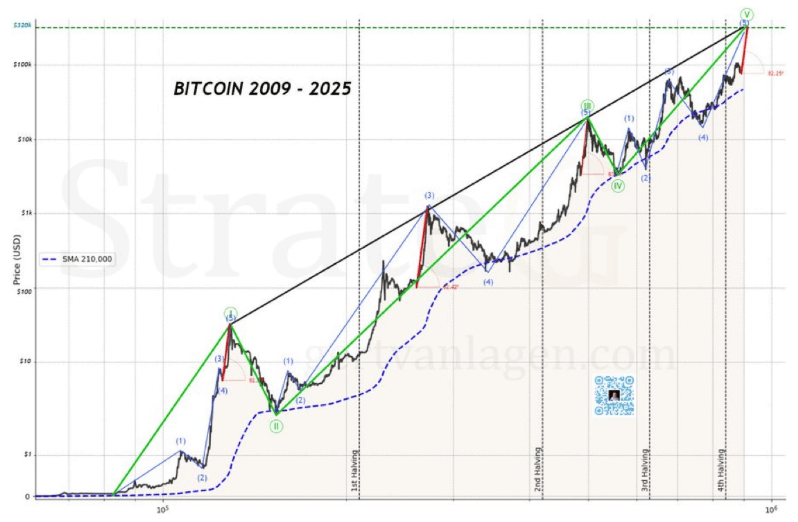

This audacious prognostication emanates from the digital lips of one Gert van Lagen, a name redolent of, well, nothing particularly trustworthy. Mr. van Lagen, a “prominent crypto analyst” (as they all are, until proven otherwise), has scrawled upon the digital ether a chart, a veritable palimpsest of lines and angles, purporting to chart Bitcoin’s trajectory from its humble, almost embarrassing, origins in 2009 to the imagined glories of 2025. He invokes the mystical Elliott Wave Theory, a concept as reliable as a politician’s promise 🤥, to argue that Bitcoin is currently surfing Wave 5, the “last wave” of this “mega-cycle.” One shudders to think what the “mega” prefix entails.

According to this analysis, Bitcoin, like a caffeinated kangaroo 🦘 on a trampoline, is poised for a “parabolic blow-off.” The mind reels! Such vulgarity! But fear not, dear reader, for it merely signifies a sudden, precipitous surge in price, followed, naturally, by an equally dramatic collapse. Such is the nature of these digital bubbles, inflated with hot air and the fervent dreams of speculators.

Each past bull market, we are told, has ended with a “near-vertical explosive surge,” where the price behaves with the decorum of a drunken sailor on shore leave 🍻. The angle of this surge, apparently, must be at least 82 degrees. One wonders if Mr. van Lagen employs a protractor and a magnifying glass to ascertain these crucial angles.

Our esteemed analyst has further adorned his chart with a “rising wedge pattern,” a geometric abstraction that sounds vaguely obscene. The lower boundary of this wedge, we are assured, is supported by the “210,000 block SMA,” a phrase so devoid of meaning to the average mortal that it might as well be written in ancient Sumerian.

Furthermore, the upper trendline intersects with the “forecasted market top” of $325,000. A coincidence, perhaps? Or a carefully orchestrated illusion designed to lure unsuspecting investors into the digital quicksand? One suspects the latter. This prediction, we are cautioned, “relies heavily” on Bitcoin behaving with the predictable regularity of a Swiss watch. A ludicrous proposition, given its inherent volatility.

The truly astonishing aspect of Mr. van Lagen’s prophecy is the timeline. He predicts that Bitcoin will reach this ludicrous target by July 5, 2025, a mere month away! One can almost hear the champagne corks popping, the yachts being purchased, the Lamborghinis revving their engines 🏎️.

This timeline, we are told, is “grounded in the movements observed in previous post-halving cycles.” Ah, yes, the halving cycles. Those mystical events that supposedly trigger these orgiastic surges in price. A comforting narrative for those who require a semblance of order in the chaotic realm of cryptocurrency.

These “halving events,” we are reminded, have triggered “strong bull markets.” The current rally, naturally, follows Bitcoin’s fourth halving event, which occurred on April 20, 2024. The “repetitive and cyclic nature” of Bitcoin’s price movements is thus reinforced. Or is it merely a self-fulfilling prophecy, driven by the collective delusion of the masses? 🤔

A Catastrophic Correction Lurks Beneath the Surface

But wait! There’s more! Beyond the tantalizing prospect of a $325,000 Bitcoin, Mr. van Lagen offers a chilling caveat: a “high time frame price crash” of apocalyptic proportions. Years, perhaps, of relentless decline. The very thought is enough to send shivers down the spine of even the most hardened crypto enthusiast.

Once the five-wave structure is complete, Bitcoin, we are told, will enter its “first true Wave 2 correction.” Historically, Wave 2 retracements are “deep.” Given the “backdrop of global tightening and recession risks,” the post-peak environment promises to be a veritable wasteland of shattered dreams and financial ruin. So, invest wisely, dear reader. Or perhaps, not at all. 😉

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Jump Stars Assemble Meta Unit Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- League of Legends: T1’s Lackluster Performance in LCK 2025 Against Hanwha Life Esports

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- League of Legends MSI 2025: Full schedule, qualified teams & more

- Sony Doesn’t Sound Too Concerned About Switch 2, Even After A Record-Breaking Debut

2025-05-24 21:07