Behold, the Revelations:

- Oh, the Irony! Norway’s sovereign wealth fund, an unsuspecting Bitcoin 🐐!

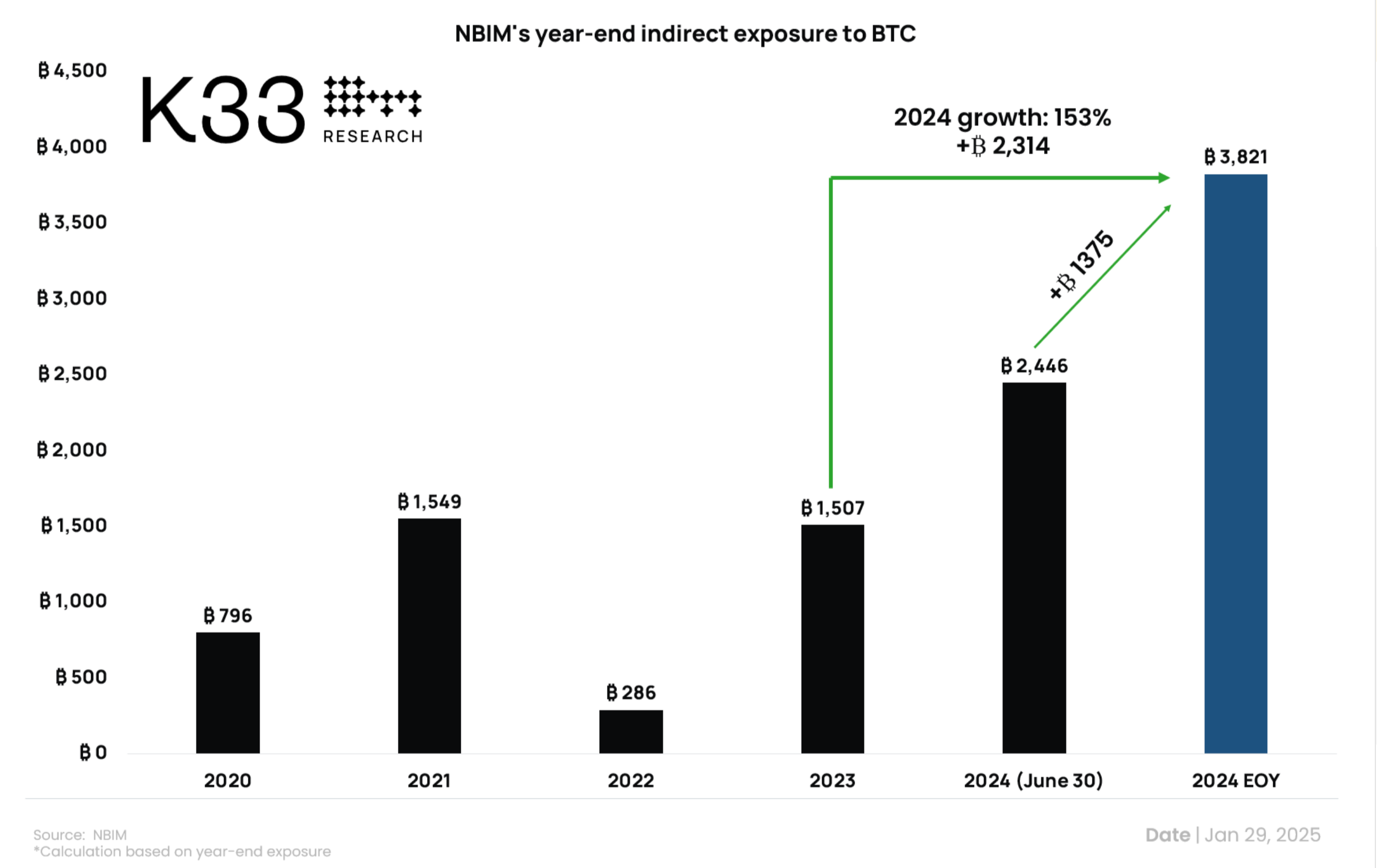

- Indirect exposure skyrockets by 153%, a tale of modern finance.

- Investments in MicroStrategy, Coinbase… the crypto chessboard expands.

In a twist of cosmic jest, the world’s largest sovereign wealth fund, Norway’s Norges Bank Investment Management (NBIM), has been quietly amassing a fortune in indirect Bitcoin (BTC) exposure. A sum of $356.7 million, enough to make even the most seasoned financier raise an eyebrow, was revealed by K33 Research. 🙀

As the clock struck midnight on New Year’s Eve 2024, the fund held within its grasp 3,821 BTC, a staggering 153% increase from the previous year’s meager 1,507 BTC. From humble beginnings in 2020, when it held a mere 796 BTC, NBIM’s indirect Bitcoin exposure has grown like a weed in the garden of global finance.

But NBIM’s dalliance with the crypto world doesn’t stop there. It has dipped its toes into the waters of crypto-related public companies, holding stakes that would make any investor green with envy. At the close of 2024, its portfolio boasted a 0.72% stake in MicroStrategy (MSTR), worth a cool half a billion dollars, alongside shares in Tesla (TSLA), Coinbase (COIN), Metaplanet (3350), and MARA Holdings (MARA). 🎉

And let us not forget, dear reader, that NBIM’s coffers overflowed with a record-breaking profit of $222.4 billion, thanks in part to the AI boom. Yet, K33 analyst Vetle Lunde reminds us that NBIM’s indirect Bitcoin exposure is merely a consequence of sector-weighted portfolios. As crypto proxies swell in value, so too does their weight in the portfolio. 📈

When approached for comment, NBIM remained mum, leaving us to ponder the depths of its crypto intrigue. 💭

Read More

- INJ PREDICTION. INJ cryptocurrency

- SPELL PREDICTION. SPELL cryptocurrency

- How To Travel Between Maps In Kingdom Come: Deliverance 2

- LDO PREDICTION. LDO cryptocurrency

- The Hilarious Truth Behind FIFA’s ‘Fake’ Pack Luck: Zwe’s Epic Journey

- How to Craft Reforged Radzig Kobyla’s Sword in Kingdom Come: Deliverance 2

- How to find the Medicine Book and cure Thomas in Kingdom Come: Deliverance 2

- Destiny 2: Countdown to Episode Heresy’s End & Community Reactions

- Deep Rock Galactic: Painful Missions That Will Test Your Skills

- When will Sonic the Hedgehog 3 be on Paramount Plus?

2025-01-30 15:55