The Hong Kong central bank, in its infinite wisdom 🤔, has decided to dabble

further in these digital currency tests. It seems they are quite taken with

these trinkets. Chainlink, of course, is involved. One wonders if they

aren’t simply throwing good money after bad.

Hong Kong And Australia Test Digital Cash, Or So They Claim 🙄

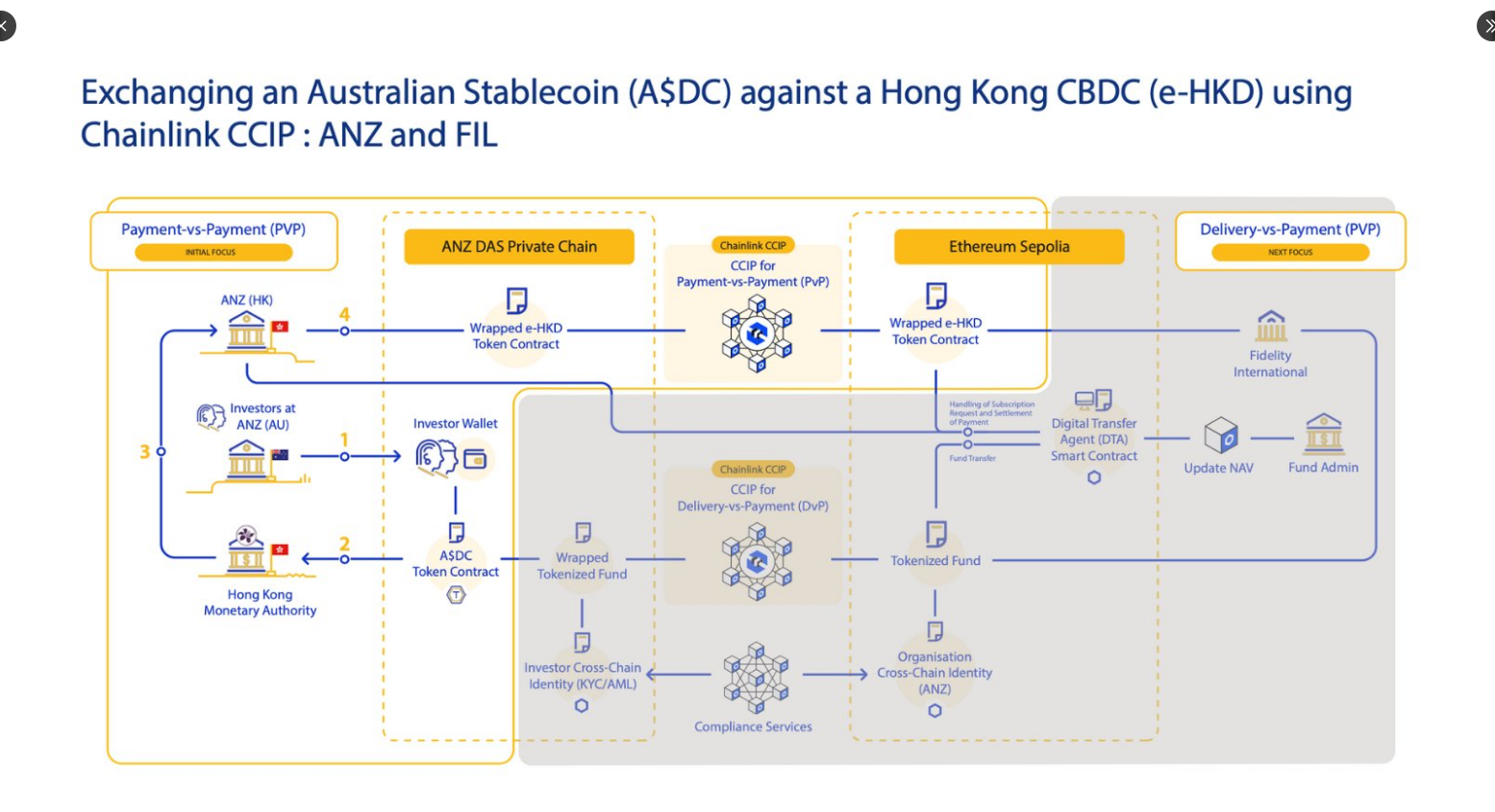

The premise, as I understand it, is to shuffle tokenized Hong Kong dollars

across borders, trading them for something called A$DC. A stablecoin, they

say, backed by Australian dollars. The promise? Settlement times reduced

from days to mere seconds. As if time itself bends to the will of these

digital dreams.

They say this could be a model for other central banks. A model of what,

exactly? Of chasing fleeting novelties while the world continues its slow,

inexorable march toward oblivion?

Chainlink’s Cross-Chain Interoperability Protocol, or CCIP, will be the

tool of choice. The goal, ostensibly, is simple: move money in real time,

ensuring both sides receive their due. A noble pursuit, if one were to

believe in the inherent nobility of money.

Phase two commences with Hong Kong and Australia swapping e-HKD for A$DC,

aiming for instant settlement. A grand experiment, no doubt, filled with

potential and, more likely, disappointment.

We’re excited to share that Chainlink is facilitating the secure exchange

of a Hong Kong CBDC and an Australian dollar stablecoin as part of an

ongoing use case in Phase 2 of the e-HKD+ Pilot Program.Congratulations to participants @Visa, ANZ, China AMC, and Fidelity…

— Chainlink (@chainlink) June 9, 2025

Chainlink Tools In Use, Or So It Is Advertised 😒

Chainlink, it seems, is more than just a name. It brings its technology to

bear. CCIP, acting as a bridge between blockchains, handles the

cross-chain messages. The Digital Transfer Agent, or DTA, grapples with

compliance, ensuring rules are met across different lands.

Visa and ANZ lend their services to payment processing, while Fidelity

International and ChinaAMC manage the tokenized funds. A diverse cast,

indeed, all playing their part in this digital charade.

They say this project is more than a small test, involving real money and

real risks. Risks, of course, managed by a Payment-versus-Payment model,

ensuring funds are only released upon mutual confirmation. A comforting

thought, perhaps, for those who still find comfort in such things.

LINK, the token of Chainlink, experienced a jump of 6% upon the news. A

fleeting moment of joy in a world of endless sorrow. It now trades at

$14.70, buoyed by hopes of Bitcoin reaching $110,000. Such optimism, it

seems, springs eternal, despite all evidence to the contrary.

Crypto traders, ever the gamblers, chase short-term gains, tempting as they

may be. But such gains are as ephemeral as morning dew, quickly vanishing

when the story fades.

Bitcoin, despite its rallies, remains tethered to the whims of equity

swings. A mix of bulls and bears populate the futures data, a testament to

the enduring skepticism that pervades even the most fervent of markets.

Volatility, that constant companion, stands ready to shake out the weaker

hands at the first sign of trouble. A sudden shift in sentiment, a fresh

macro shock, and all gains may be swiftly reversed. Such is the nature of

this game, a cruel jest played upon the hopes and fears of humankind.

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Basketball Zero Boombox & Music ID Codes – Roblox

- Lottery apologizes after thousands mistakenly told they won millions

- Umamusume: Pretty Derby Support Card Tier List [Release]

- KPop Demon Hunters: Real Ages Revealed?!

- Ultimate AI Limit Beginner’s Guide [Best Stats, Gear, Weapons & More]

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- How to play Delta Force Black Hawk Down campaign solo. Single player Explained

2025-06-10 20:49