- The ETH/BTC ratio’s precipitous plunge has set tongues wagging: is Ethereum a lost cause? 🤔

- Speculators, those eternal optimists, still cling to the hope of ETH reaching $4k by 2025 🙏

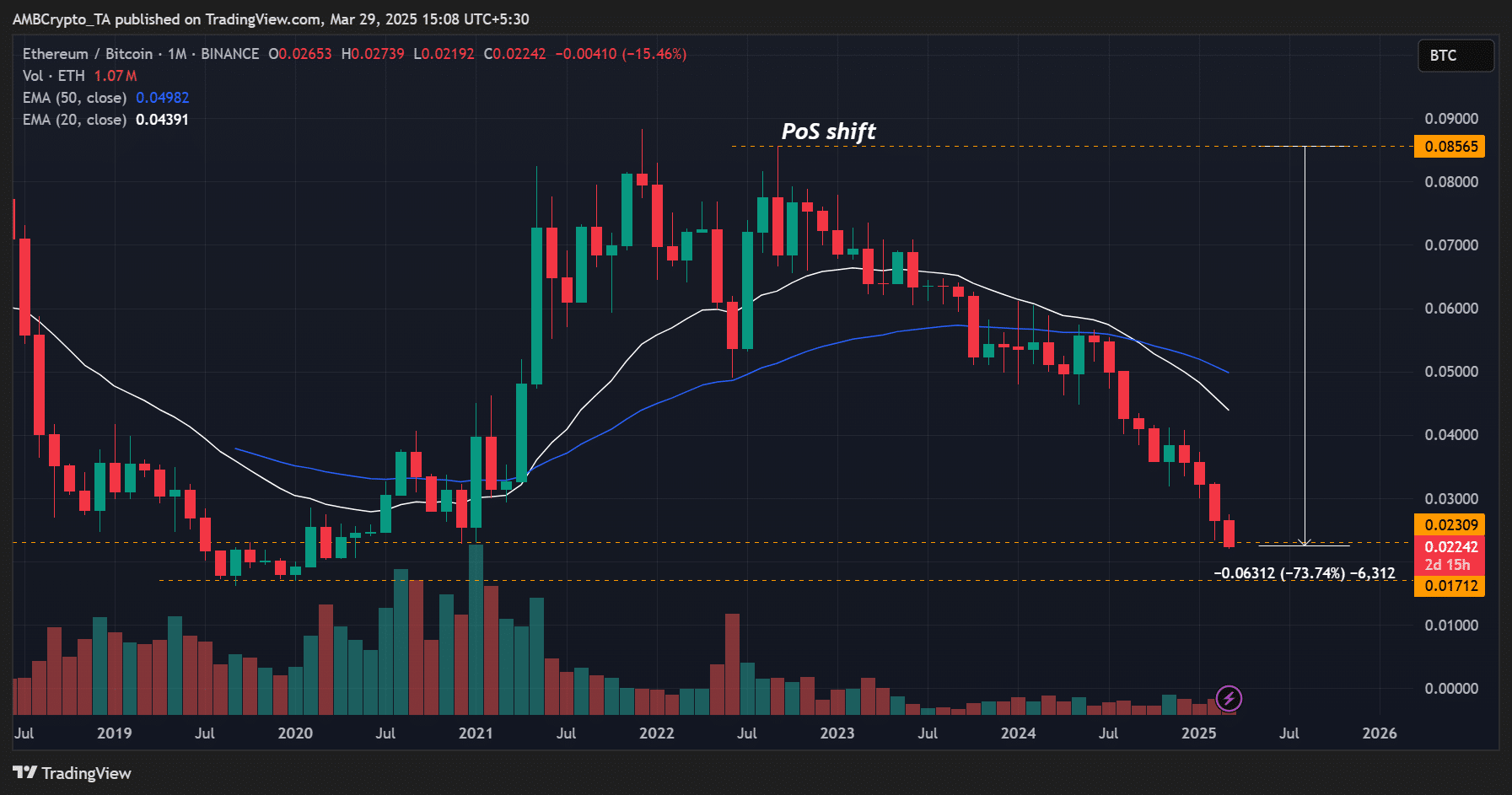

Like a once-beloved mistress now fallen out of favor, Ethereum [ETH] has been languishing against Bitcoin for a dismal three years. The ETH/BTC ratio, that most unforgiving of metrics, has sunk to a new low of 0.022, a veritable cry for help. 😩

Alex Thorn, Galaxy Digital’s Head of Research, lamented,

“Ether’s decline against Bitcoin since its switch from proof of work to proof of stake is a staggering 74%… one might say it’s a case of ‘out with the old, in with the worse’.”

In this sea of despair, some community members have taken to calling for a return to the halcyon days of PoW (proof-of-work), as if BTC’s antiquated ways held the key to ETH’s redemption. 🙄

Is ETH Worth the Wager? 🎲

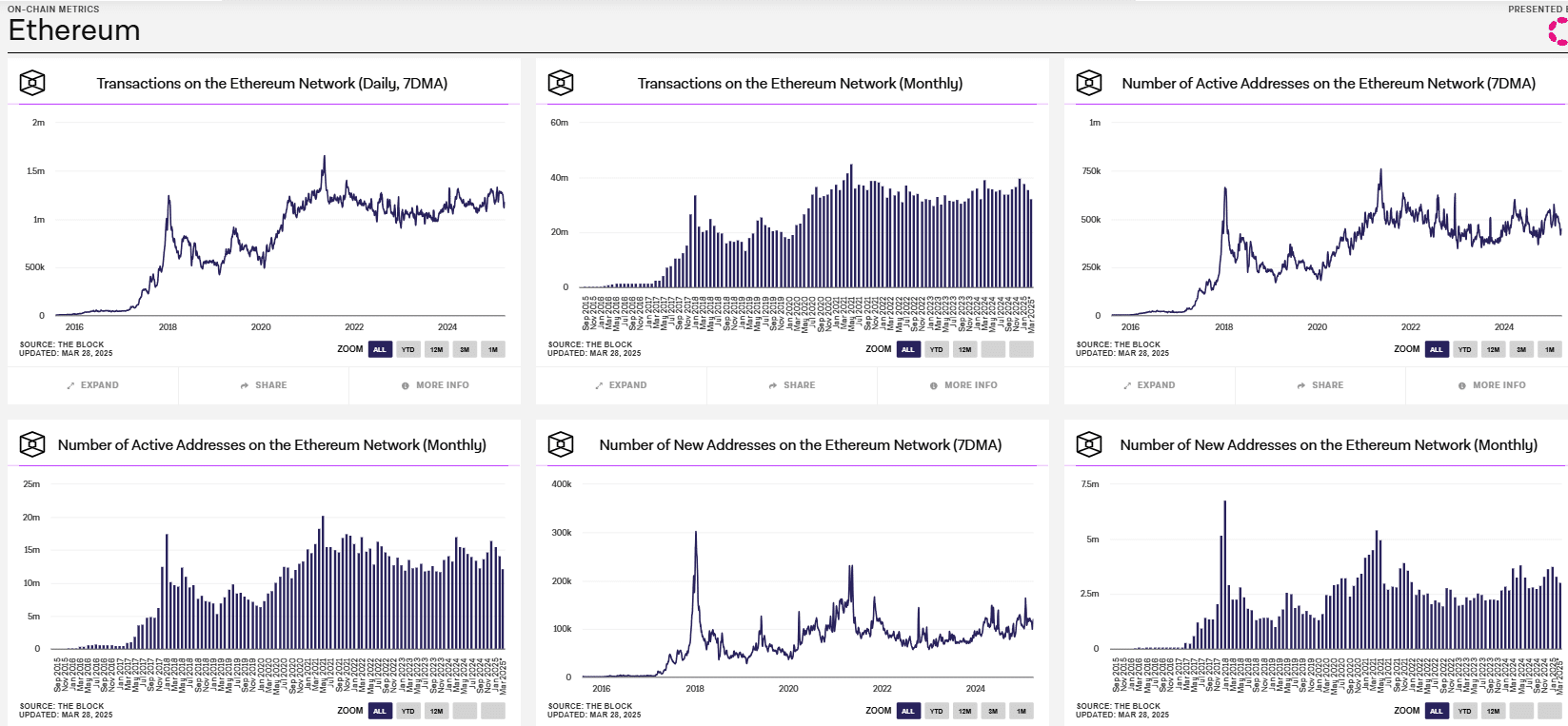

Quinn Thompson, founder of VC Lekker Fund, minced no words: “ETH is dead, Jim.” He cited dwindling network activity, among other ailments, proclaiming,

“Make no mistake, $ETH as an investment is completely dead. A $225 billion market cap network in decline… it’s a utility, perhaps, but an investment? Ha! 😂”

Nic Carter, partner at Castle Island Ventures, echoed this sentiment, laying the blame squarely at the feet of L2s, those supposed ‘innovations’ that have, in his words,

“…killed ETH’s value, an avalanche of its own tokens, a self-inflicted wound, if you will.”

Thompson ominously forecasted that the ETH/BTC ratio’s double-digit decline during the 2023-2024 bull cycle might pale in comparison to the carnage of a bear cycle. 🐻

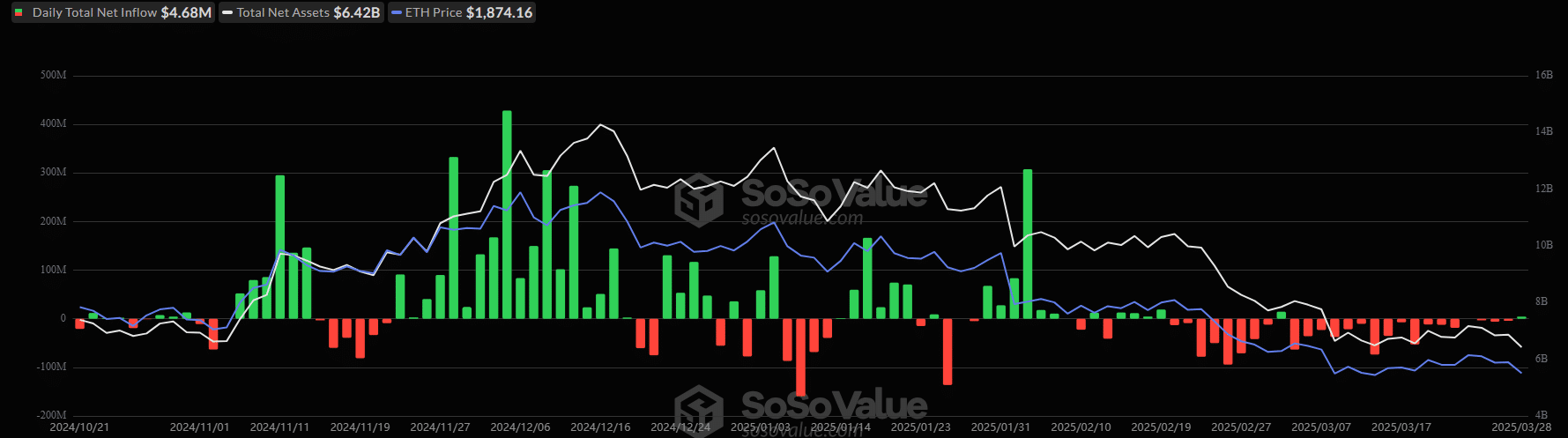

Meanwhile, ETF flows have been a study in contrasts: U.S spot BTC ETFs have raked in over $1 billion for 10 consecutive days (save for a minor blip last Friday), while U.S spot ETH ETFs have hemorrhaged over $400M in outflows since March, with only two brief moments of respite. 📉

It seems the zeitgeist on social media has soured on ETH, mirroring the lackluster appetite of institutional investors. 👎

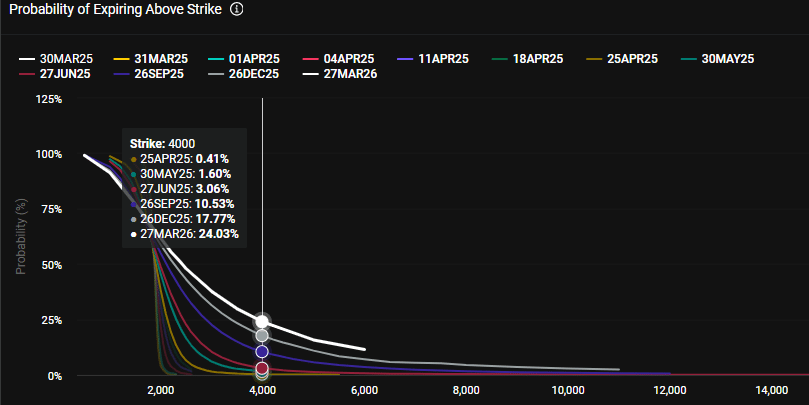

And yet, against all odds, speculators on Polymarket remain bullish, with a $4k price target for 2025 garnering the highest volume ($710k). Option traders on Deribit, however, are more cautious, assigning only a 10% chance of reaching $4k by September. At the time of writing, ETH languished at $1.87k, a far cry from its December highs of $4k. 🤷♂️

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- How to watch the South Park Donald Trump PSA free online

2025-03-30 05:19