- Ah, poor short-term BTC holders, facin’ losses like a cowpoke in a cactus patch! 🐄💸 BTC’s slipped below its 200-day Moving Average, don’t ya know?

- And for all you long-term investors out there, just sit back, sip some sarsaparilla, and bide your time – a bullish trend reversal is as elusive as a unicorn in the Wild West 🦄🕰️

Well, shucks! The “Liberation Day” that U.S. President Donald Trump’s been hollerin’ about is fixin’ to arrive. Meanwhile, U.S. tech stocks took a tumble in overnight tradin’, with Tesla [TSLA] and Nvidia [NVDA] losin’ 5% and 3%, respectively – that’s like losin’ your favorite horse in a poker game! 🐴😬

The Kobeissi Letter done went and noticed that economic policy uncertainty has reached its highest point since 2020. Circle April 2nd on your calendar, folks, it’s the day to watch – like awaitin’ the sunrise after a long, dark night 📆🌅

And don’t even get me started on the U.S. jobs report, comin’ atcha on April 4th! That’s like addin’ more gunpowder to a already volatile mix 📊🔥

Gold ETFs, on the other hand, are seein’ more capital inflows than a saloon on payday – likely due to all this economic uncertainty. And that, partners, has put Bitcoin [BTC] and its crypto pals on the back foot, like a gunslinger in a quick draw 🤠💰

AMBCrypto dug deep into them on-chain metrics to figure out if BTC can stabilize around $78k or if investors should prepare for more losses. So, saddle up and let’s take a gander! 🐴📊

Bitcoin’s fixin’ to enter overbought territory, but don’t go celebratin’ just yet… 🎉

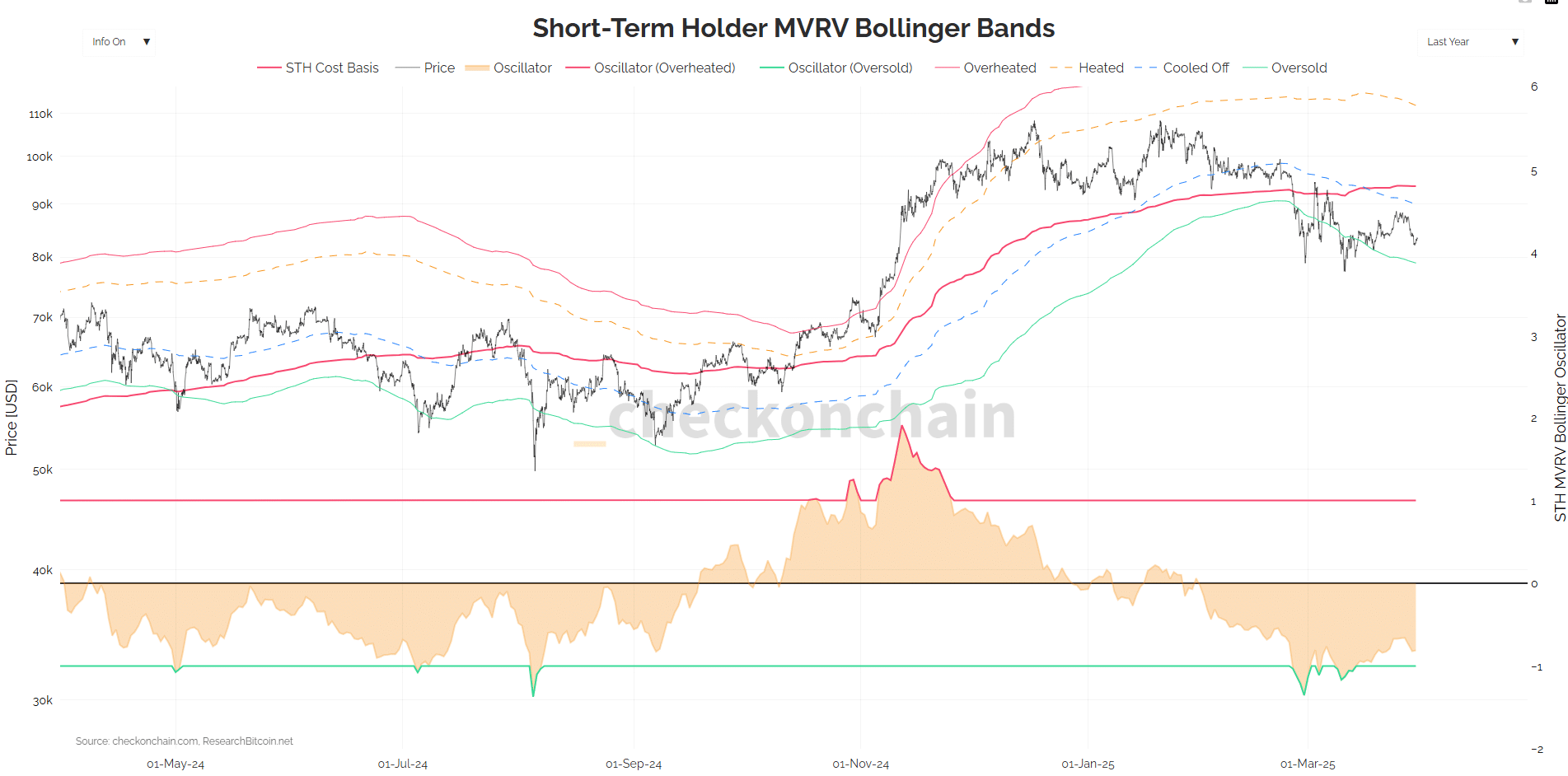

Seems the short-term holder MVRV Bollinger Bands chart shows that oscillator’s been in oversold conditions since late February – that’s like bein’ stuck in the mud, folks! 🌀🌿

And would you look at that? The price of Bitcoin’s below the cost-basis of short-term holders, calculated usin’ the realized price of coins moved within the last 155 days. That’s like tryin’ to sell a horse with a broken leg 🐴😔

Bitcoin’s price got all “heated up” in November and December, but since then, it’s cooled off faster than a cow in a snowstorm ❄️🐄. It’s likely to move below the oversold level, which stands at $78.95k, last I checked.

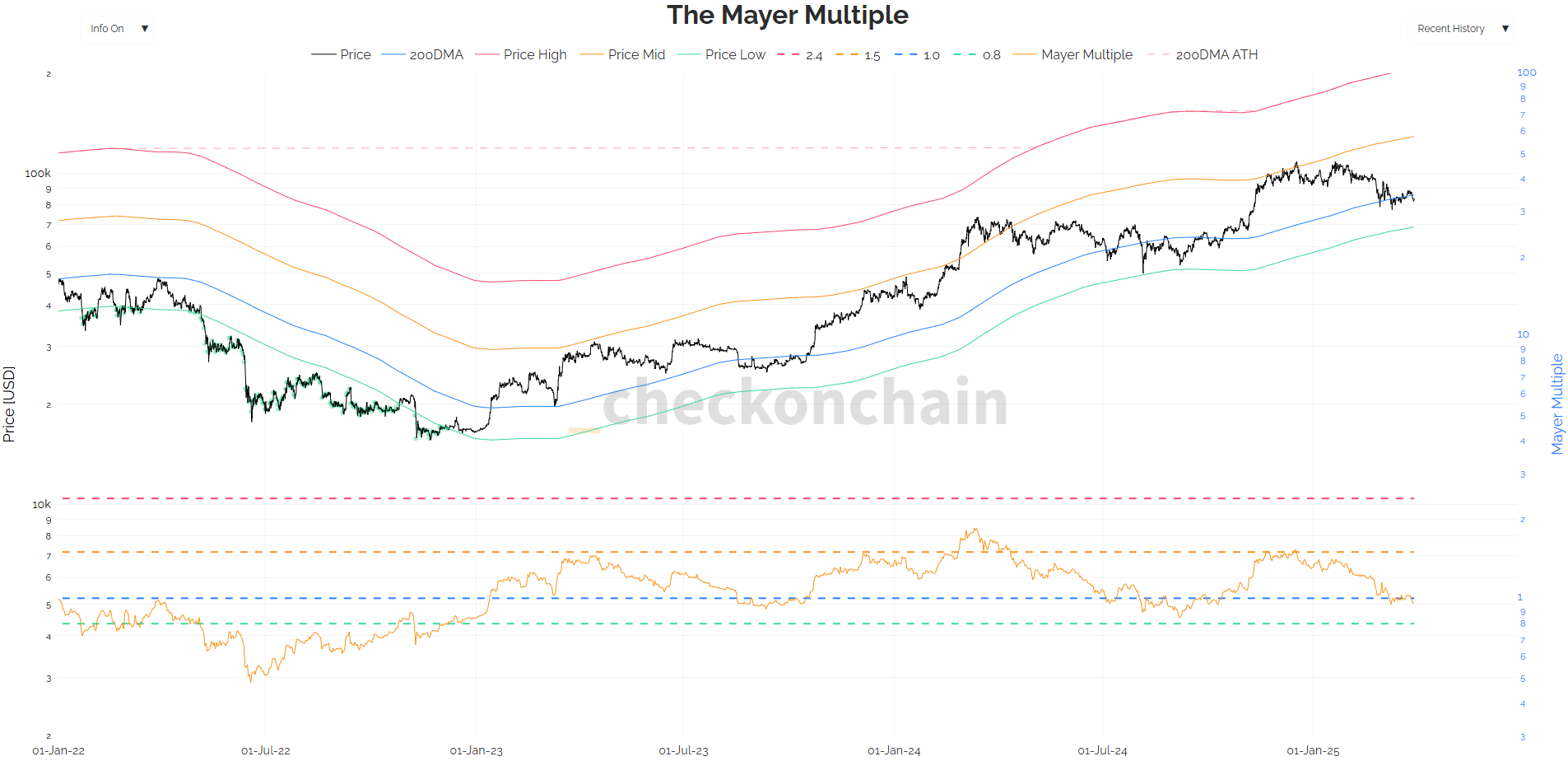

The Mayer multiple’s the key to determinin’ if Bitcoin’s fairly priced or just plain overvalued. It’s calculated by divvying Bitcoin’s market price by its 200-day Moving Average (MA). Currently, it’s sittin’ pretty at 0.96 – that’s like findin’ a golden nugget in a stream! 🌊🏵️

Two weeks ago, BTC fell below its 200DMA and has been tradin’ just below it since. Last time that happened was August 2024, and well, let’s just say it wasn’t pretty 📉😬

So, investors lookin’ to buy BTC on the cheap should keep an eye on that 0.8 Mayer multiple, representin’ the $68.74k level. That’s when Bitcoin’ll be considered “cheap” – like findin’ a bargain at the local general store 🛍️👍

In conclusion, long-term investors, just hunker down and weather the economic storm, like a cowboy in a tornado 🌪️🤠. Once the market sentiment shifts, the trend might just shift bullishly 🔄📈

Till then, you can either Dollar Cost Average (DCA) into BTC or wait for them nasty price drops from giant liquidation events to grab more BTC – like a vulture waitin’ for its next meal 🦅🍴

Read More

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Stellar Blade x Nikke DLC: Full Walkthrough | How to Beat Scarlet + All Outfit Rewards

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Sony Doesn’t Sound Too Concerned About Switch 2, Even After A Record-Breaking Debut

- League of Legends: Bilibili Gaming’s Epic Stomp Over Top Esports in LPL 2025 Playoffs

- League of Legends: Anyone’s Legend Triumphs Over Bilibili Gaming in an Epic LPL 2025 Playoff Showdown!

- Lucky Offense Tier List & Reroll Guide

- League of Legends: T1’s Lackluster Performance in LCK 2025 Against Hanwha Life Esports

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

2025-03-31 16:11