- Top institutional investors—Grayscale, Fidelity, and Ark Invest—have been accumulating Bitcoin like it’s going out of style. 🤑

- The market is eyeing a bullish move, once Bitcoin decides to stop playing hard to get with the short-term holder fiat basis. 📈

Bitcoin [BTC], which has been about as decisive as a cat at a crossroads, seems to be finally leaning towards the bullish end. 😼

The asset has gained a whopping0.92%, which in Bitcoin terms is like winning the lottery twice in a row. Market confidence is returning, much like a prodigal son but with less drama. 🎉

Top investors prioritizing BTC amidst minimal gains

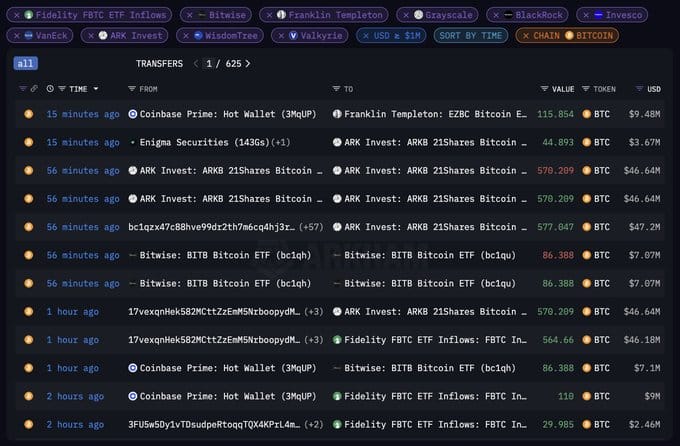

There’s been a notable purchase of Bitcoin in the past24 hours from top institutional investors, who are adding to their glittering hoards despite market-shaking tariffs implemented by President Trump. Because, why not? 🤷♂️

According to a report from Arkham, which sounds like a place Batman would vacation, Grayscale, Fidelity, and Ark Invest are the main investors involved in this trade. Institutional investors have purchased at least2,099 BTC as of press time, which is a lot of digital gold. 💼💰

When the big fish decide to swim in the Bitcoin pond, especially when the water’s at a lower level, it suggests a price rally could be as imminent as a wizard’s spell. 🧙♂️📈

Are the bulls fully in on BTC’s rally?

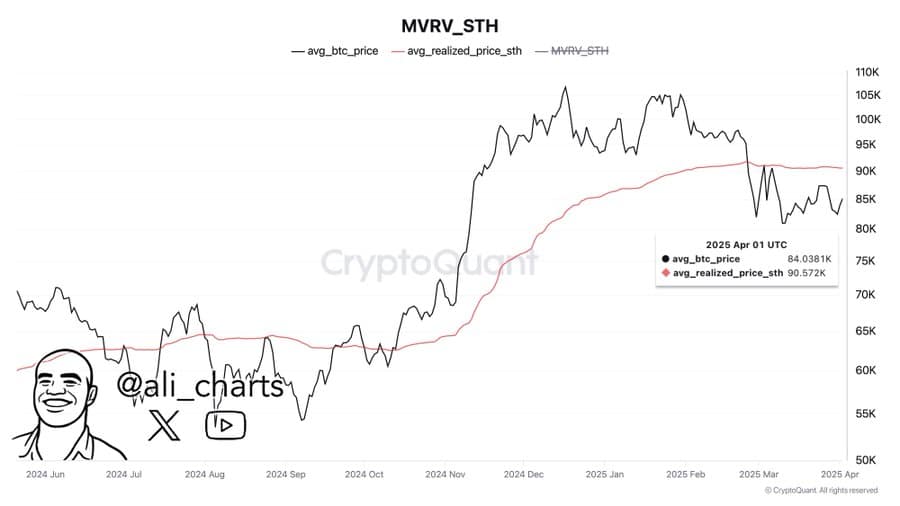

To confirm whether the bulls are fully supporting a Bitcoin rally, AMBCrypto analyzed the short-term holders’ realized price—a historic reference point used to determine whether the market is bullish or bearish. Because, as we all know, history loves to repeat itself like a catchy tune stuck in your head. 🎶

Currently, the market value realized by short-term holders remains at $90,570. This means Bitcoin needs to reclaim this level, like a king reclaiming his throne after a brief holiday. 👑

As seen on the chart, Bitcoin is attempting to reclaim this level, with its current price at $84,580, pointing upwards like a rocket ready for launch. 🚀

Analysis of other key metrics suggests the rally could come sooner than expected, much like an early Christmas present. 🎁

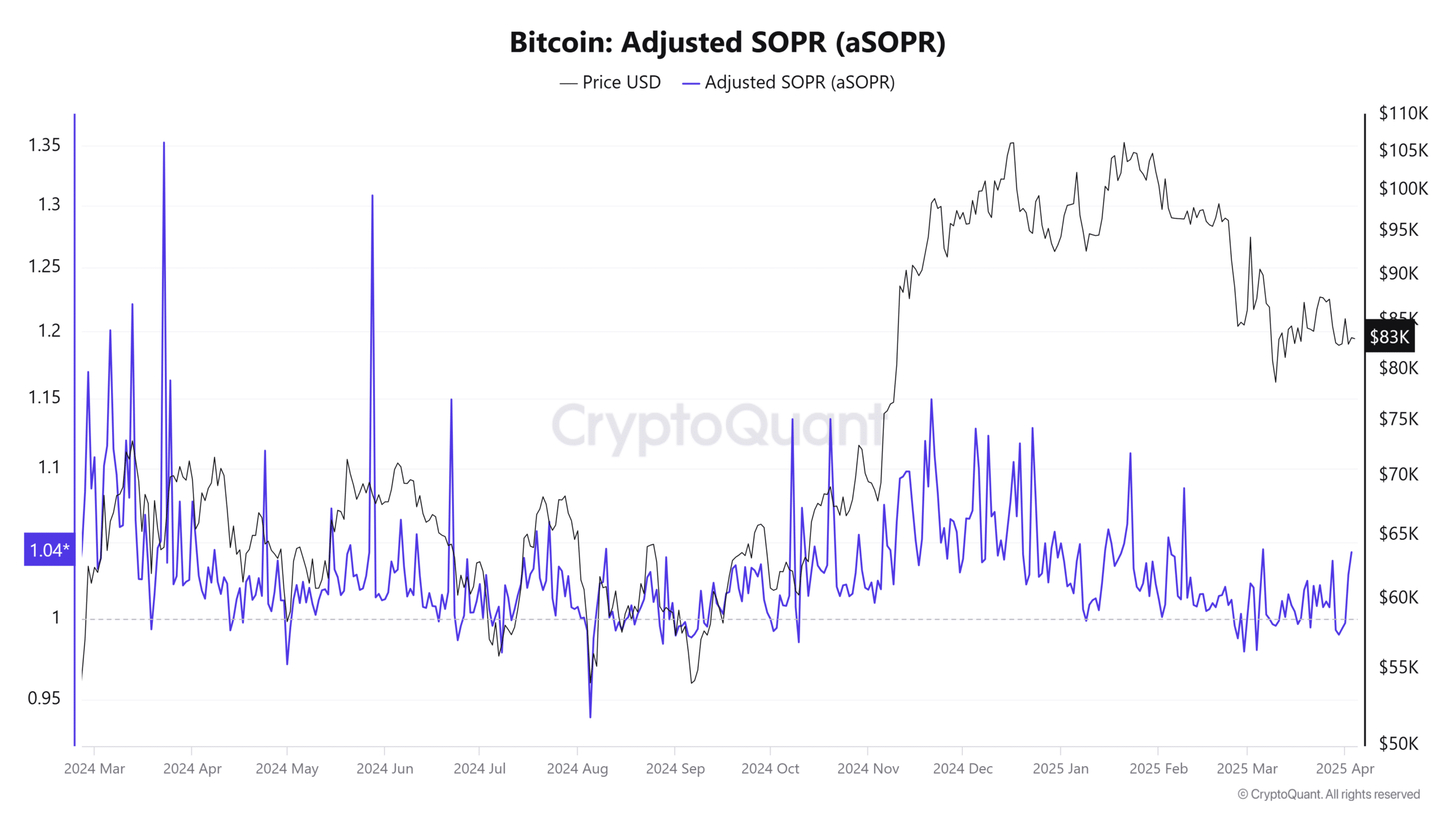

The Adjusted Spent Output Profit Ratio (aSOPR), which tracks whether investors are selling at a profit or loss, shows that investors are selling at a profit. Shocking, we know. 😱

Selling at a profit implies there could be downward pressure on Bitcoin, as more tokens are expected to be sold with limited demand. It’s like a fire sale, but with digital coins. 🔥

However, analysis of Bitcoin’s Net Unrealized Profit/Loss (NUPL)—a metric used to determine the number of investors in profit or loss—shows that only a small percentage are currently in profit. It’s a bit like finding out only a few people got the joke. 😅

The Bitcoin NUPL is slightly above0, with a reading of0.4, indicating that only a small percentage of traders are in profit. This suggests that profit-taking could slow down soon, thus having little impact on the overall market. It’s like a storm in a teacup, but with less tea and more crypto. 🍵➡️💱

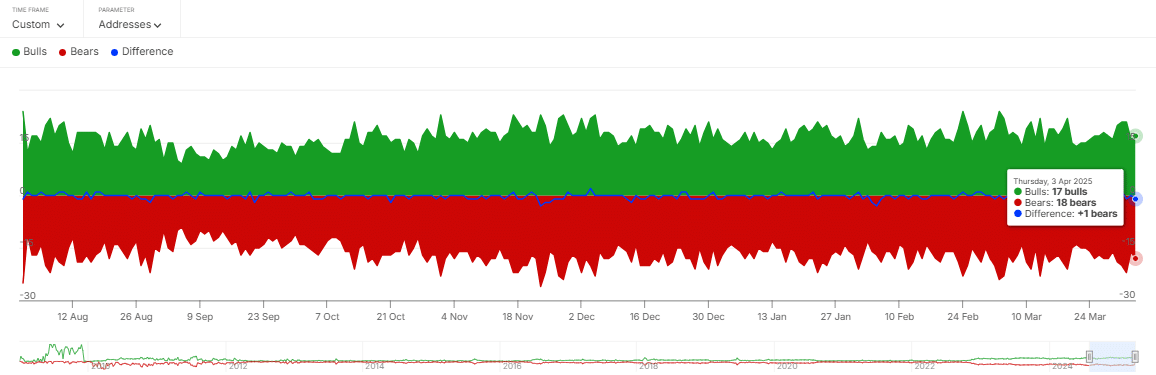

In addition, the Bull-Bear Ratio—an indicator used to determine the number of bullish and bearish large investors in the market—shows there are17 bulls and18 bears. It’s a tight race, like two snails competing in a marathon. 🐌🏁

This minimal difference suggests the bulls are closing in on the bears, and it’s only a matter of time before the market balances or the bulls overtake the bears. It’s the financial equivalent of a suspense thriller. 🎬

Overall, analysis shows that the chances for a rally remain high, with selling pressure gradually waning. Should this trend continue, it presents an opportunity for a major price breakout as buying sentiment grows. It’s like watching a phoenix rise from the ashes, but with more numbers and less fire. 🔥➡️📊

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- How to watch the South Park Donald Trump PSA free online

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

2025-04-04 17:18