What you should know (if you aren’t living under a rock):

- In a twist of fate, real-world assets have become a $10 billion behemoth, with Maker, BlackRock’s BUIDL, and Ethena’s USDtb each amassing more than $1 billion in total value locked (TVL), as if it were mere pocket change! 🤑

- USDtb, the stablecoin with the backing of tokenized BlackRock money-market fund shares, has grown faster than a weed, with over 1,000% TVL growth in just a month! 🚀

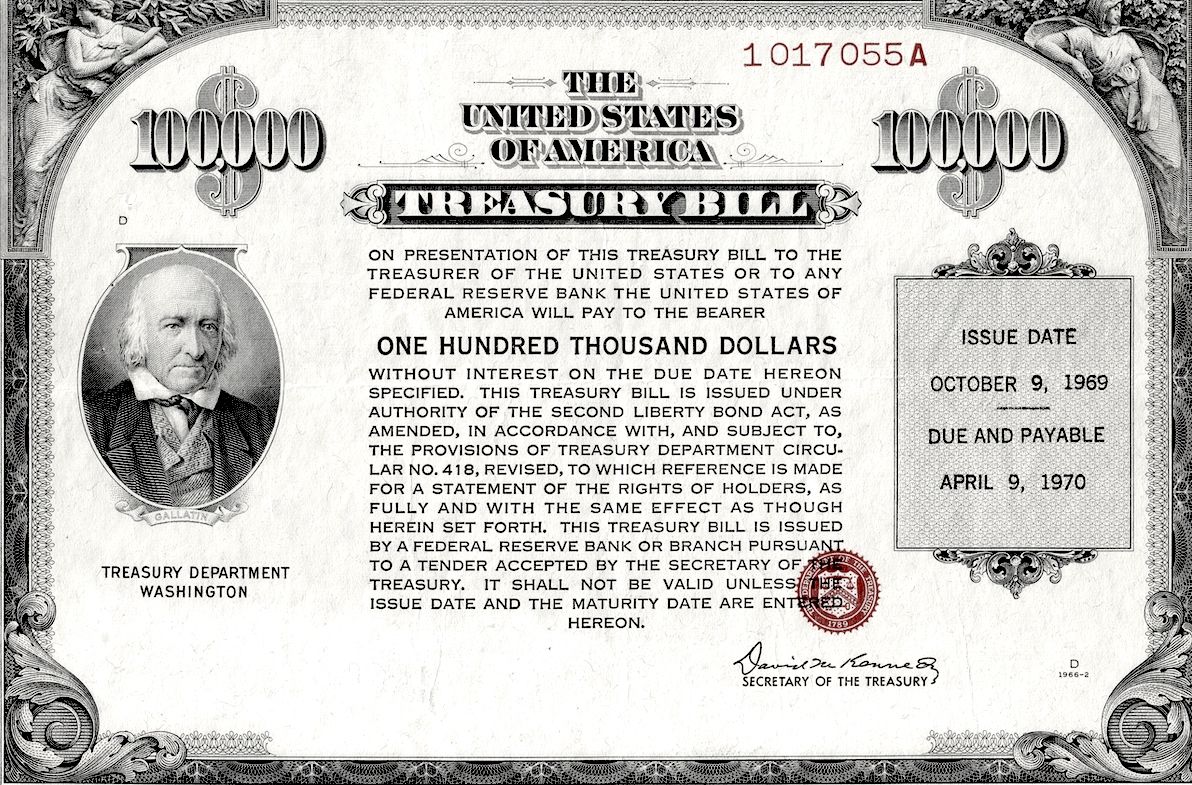

- Treasury-backed tokens are the new belle of the ball, showing that investors prefer the safety of a warm blanket over the risky dance of bearish crypto. 🐻🛏️

Oh, the irony! Real-world assets (RWAs) have now blossomed into a $10 billion garden, according to the meticulous data-gathering of DeFiLlama. Maker, BlackRock’s BUIDL, and Ethena’s USDtb are each contributing more than $1 billion to the total value locked (TVL) potluck. 🍲

USDtb, the stablecoin that says “hold my beer” to Ethena’s USDe, has seen the most meteoric rise, adding over 1,000% in TVL in just a month. 🍺🌟

USDtb is backed by the tokenized shares of BlackRock’s money-market fund, while USDe tries to keep up with crypto-assets and perpetual futures strategies for crypto yields. Who knew stablecoins could be so dramatic? 🎭

In a tale as old as time, CoinDesk reported that Treasury-backed tokens hit a record $4.2 billion market cap in the first quarter, thanks to the likes of Ondo Finance’s OUSG, USDY tokens, BlackRock and Securitize’s BUIDL, Franklin Templeton’s BENJI, and Superstate’s USTB. 📈🏦

It seems Treasury-backed tokens are the prom kings and queens, dominating the scene according to RWA.xyz. Tokenized commodities, with Paxos Gold leading the charge, are a distant second at $1.26 billion. 🏆🏮

Analysts say this preference for safer assets is like choosing a cozy armchair over a rollercoaster ride during a bearish crypto market. T-bills are the new cool kids on the block, outshining the yield offerings of major DeFi protocols like Compound. 🛋️🎢

Read More

- Who Is Harley Wallace? The Heartbreaking Truth Behind Bring Her Back’s Dedication

- Basketball Zero Boombox & Music ID Codes – Roblox

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- TikToker goes viral with world’s “most expensive” 24k gold Labubu

- 100 Most-Watched TV Series of 2024-25 Across Streaming, Broadcast and Cable: ‘Squid Game’ Leads This Season’s Rankers

- Revisiting Peter Jackson’s Epic Monster Masterpiece: King Kong’s Lasting Impact on Cinema

- 50 Goal Sound ID Codes for Blue Lock Rivals

- League of Legends MSI 2025: Full schedule, qualified teams & more

- KFC launches “Kentucky Fried Comeback” with free chicken and new menu item

- All Songs in Superman’s Soundtrack Listed

2025-03-21 13:14