Bitcoin‘s dream of reaching the glorious $100K is facing an invisible wall, leaving sellers in a standstill at the 100-day moving average.

This unseen force field has turned into a battle zone for bulls and bears, with the outcome to be decided at this critical junction.

In the Realm of Charts

By Anonymous Analyst

The Daily Realm

The 100-day moving average at $96K remains a stubborn fortress for Bitcoin sellers, as buyers have historically defended this zone. If buyers prevail, we may witness a surge towards the $103K resistance.

However, the bearish threat is lurking, as a decisive breach below this support could ignite liquidations in the futures market, intensifying the selling frenzy. For now, traders must endure the rollercoaster of volatility and unpredictable price swings.

The 4-Hour Realm

In the lower realm, Bitcoin is confined within a bullish continuation flag, with price action reflecting uncertainty. The lower boundary of this pattern has offered temporary support, but a convincing break above the $100K resistance is essential to confirm the bullish momentum towards the all-time high of $108K.

Despite the optimism surrounding this formation, the buying force is insufficient to propel a breakout, highlighting the need for stronger demand. Multiple support zones beneath the current price serve as a safety net against downside risks, increasing the likelihood of a rebound. If the bullish momentum strengthens, the next milestone will be the psychological $100K level.🎯

Sentiment Spectrum

By Anonymous Analyst

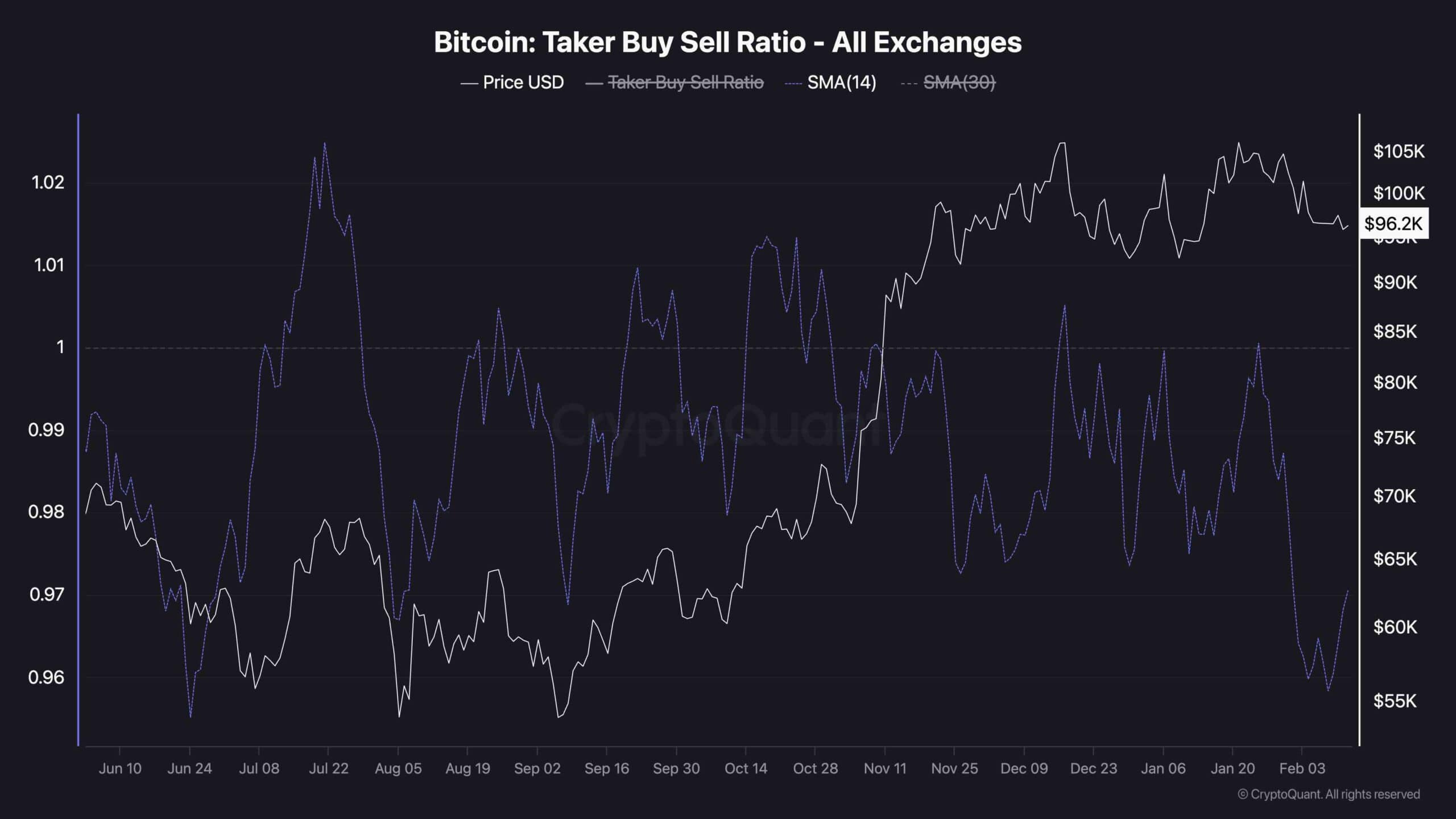

Bitcoin’s recent price indecision has left investors pondering the unseen forces that hinder the market’s upward momentum. A closer examination of futures market metrics uncovers intriguing insights.

The Bitcoin taker buy-sell ratio, which reveals the dominance of buyers or sellers in the futures market, offers a clue. As shown in the chart, the 14-day moving average of this metric has experienced a bullish reversal following a significant decline. This shift suggests that buyers are regaining strength and may soon dominate the futures market.

Should this trend persist and the ratio surpasses the 1.0 threshold, it would signal a surge in buying pressure, potentially fueling the momentum needed for a renewed bullish rally.📈

Read More

- Best Crosshair Codes for Fragpunk

- Monster Hunter Wilds Character Design Codes – Ultimate Collection

- Enigma Of Sepia Tier List & Reroll Guide

- Hollow Era Private Server Codes [RELEASE]

- Wuthering Waves: How to Unlock the Reyes Ruins

- FARTCOIN PREDICTION. FARTCOIN cryptocurrency

- Ultimate Tales of Wind Radiant Rebirth Tier List

- Best Crossbow Build in Kingdom Come Deliverance 2

- Best Jotunnslayer Hordes of Hel Character Builds

- Skull and Bones Timed Out: Players Frustrated by PSN Issues

2025-02-12 16:52