Ah, the fickle dance of the markets, where numbers waltz and wallets weep. The short-term technical tea leaves suggest our dear Optimism Coin is on a downward toboggan ride, with indicators as bearish as a grumpy troll guarding a bridge. Unless the bulls decide to stop napping and reclaim their lost resistance levels, it’s all doom and gloom with a side of 🍷 sorrow.

🚩🐻🚫 Highlight Flags, Bearish Shenanigans, and Supply Zone Rejections (Oh My!)

In a recent missive from the wizards at Finora AI – Türkiye (yes, the land of kebabs and crypto wisdom), the team noted that Optimism’s short-term market structure is about as cheerful as a tax audit. Multiple indicators are pointing downward faster than a Discworld wizard falling off a broomstick. The price action, bless its heart, has repeatedly face-planted at the $0.4566-$0.4582 supply zone, triggering rejections more brutal than a Granny Weatherwax glare.

According to their crystal ball (or automated projection, same thing), if the coin pulls a fake breakout followed by a bearish formation-engulfing candle, pin bar, or break of structure (BOS)-it’s short-term short entry time. Targets? $0.4502, $0.4475, and $0.4444. Because why stop at one level of pain when you can have three?

But wait! If the price sweeps liquidity below $0.4475 and decides to channel its inner phoenix with a bullish reversal (Quasimodo or OTE retracement), a short-term long entry might be on the cards. Targets: $0.4524 and $0.4566. Stop-loss levels? Above $0.4614 for shorts and below $0.4444 for longs. Because nothing says “fun” like a well-placed stop-loss.

📉📊 Market Data: Momentum’s Gone on Holiday, Volume’s Taking a Nap

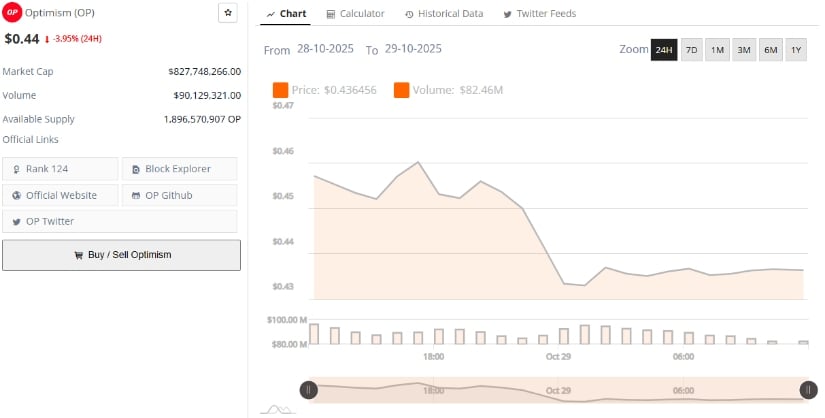

Data from BraveNewCoin reveals Optimism is trading at $0.44, down 3.95% in the last 24 hours. Ouch. The network’s market cap is a modest $827.74 million, ranking #124 globally-right between “forgotten meme coin” and “that one NFT project nobody talks about.” Daily trading volume? $90.12 million, with a circulating supply of 1.89 billion tokens. Liquidity? Moderate. Interest? As cool as a vampire’s bathtub.

Trading volume has been dropping faster than a dropped ice cream cone since mid-October, suggesting speculative interest is about as lively as a Ankh-Morpork pub on a Monday morning. Most activity is stuck between $0.43 and $0.46, proving buyers are as hesitant as a first-time tightrope walker.

📈📉 TradingView Indicators: Bears, Bears Everywhere, Not a Bull in Sight

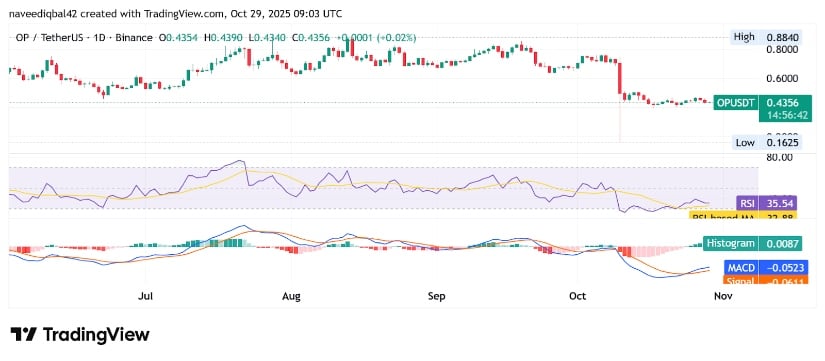

At the time of scribbling, OP/USDT is priced at $0.4355, attempting a recovery as feeble as a wet kitten. The RSI is at 35.51, and the RSI-based moving average is at 32.88-both screaming “bearish momentum!” like a town crier with a megaphone. The oscillator? Below 50, because selling pressure loves to hog the spotlight.

The MACD indicator joins the chorus, with a main line at -0.0523 and a signal line at -0.0611. The histogram prints a modest positive value of 0.0087, suggesting short-term relief might be as fleeting as a Lancre summer. The price remains below its 50-day moving average, ensuring any rebound is about as sustainable as a promise from a used carpet salesman.

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- NBA 2K26 Season 5 Adds College Themed Content

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- All Itzaland Animal Locations in Infinity Nikki

- Silver Rate Forecast

- Gold Rate Forecast

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Brent Oil Forecast

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

2025-10-29 23:27