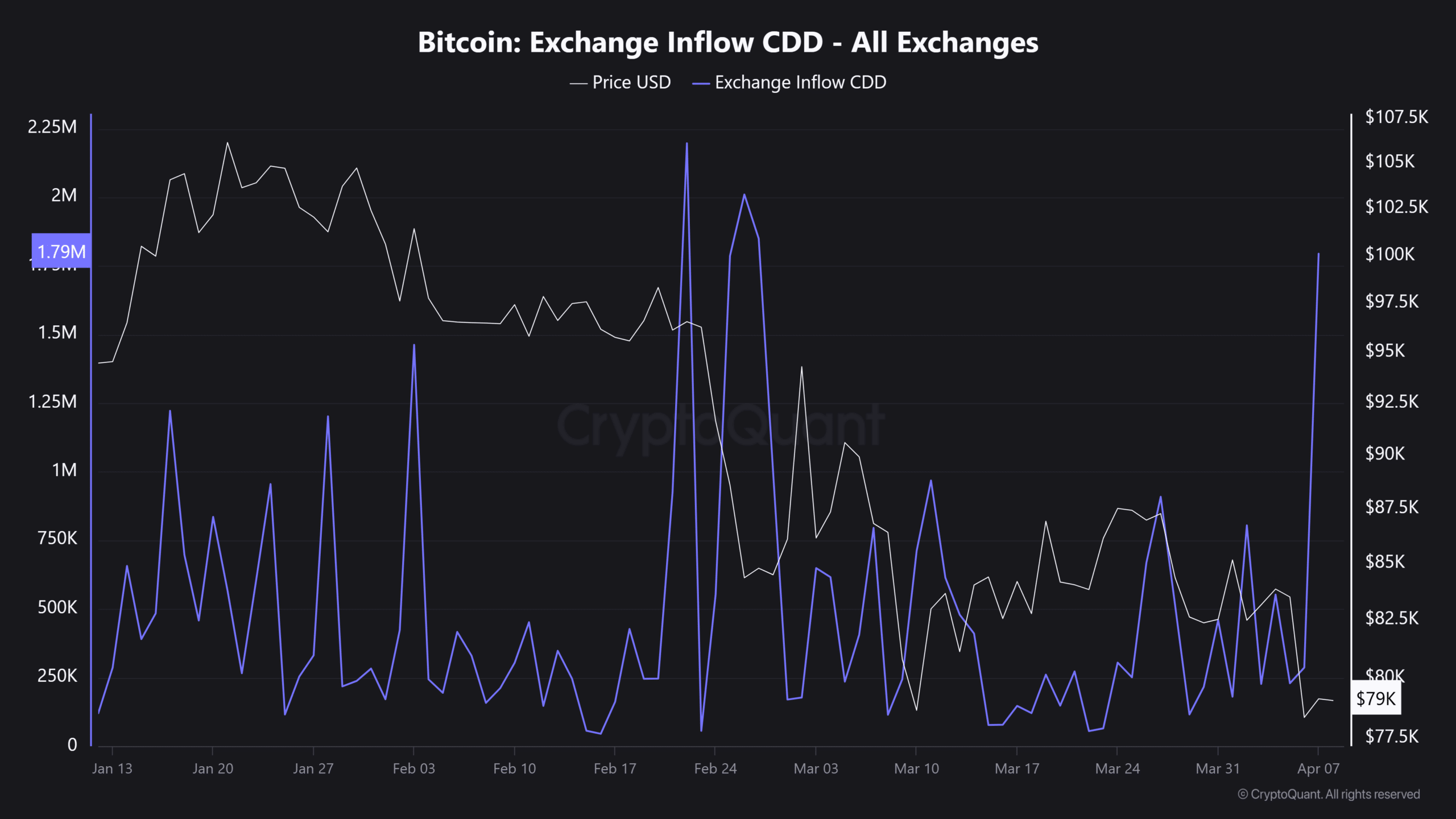

Hark! Bitcoin, that fickle mistress 💰, hath dipped below $75k, a nadir unseen in five months! The Exchange Inflow CDD, like a meddling courtier, doth spike. The question doth arise: Have long-term holders, those staid philosophers 👴, lost their nerve, or is this merely a cunning shift of liquidity, a dance of ducats? 🤔

A rising CDD, much like a rash on a nobleman’s face, often presages sell-offs. Yet, ’tis also whispered it may signify capital pirouetting into derivatives, seeking shelter or, perchance, a reckless gamble. 🎭

Should these inflows persist, like a nagging cough 🤧, selling pressure might build. But if ’tis but repositioning, a mere changing of garments, Bitcoin may be but girding itself for its next high-volatility escapade. 🎢

Historical CDD Spikes and Their Market Impact – A Comedie of Errors 🎭

History, that old gossip 👵, tells us CDD spikes have produced outcomes as mixed as a jester’s motley. While they sometimes herald sharp corrections, akin to a pratfall on stage 🤡, there have been instances where Bitcoin rallied post-spike, like a phoenix rising from the ashes 🔥.

Thus, signifying smart money repositioning, a clever chess move ♟️, rather than panic selling, a frantic scattering of coins. 🏃♂️💨

On the 22nd of February, for instance, a notable CDD surge aligned with BTC‘s 19% drawdown from $96,186 to $78,173 within a week. On-chain data confirmed a 12k BTC drop in Long-Term Holder (LTH) supply, reinforcing a distribution event, a sort of digital estate dispersal. 💸

However, on the 5th of March 2024, Bitcoin rallied to its then all-time high of $73k, marking a 16% surge within a week. Notably, this rally followed a 6.4% single-day red candlestick, a blot upon the ledger 🩸.

Hence, suggesting a potential exhaustion shakeout before price continuation. It is a common market behaviour where price dips to shake out weak hands before reversing higher, much like a landlord evicting the poor before raising rents. 😈

However, there’s a key development. Similar to the February rally, LTH supply saw a sharp decline, indicating that Bitcoin was being moved to exchanges. Yet, BTC’s price appreciation defied expectations, as if mocking the soothsayers. 🔮

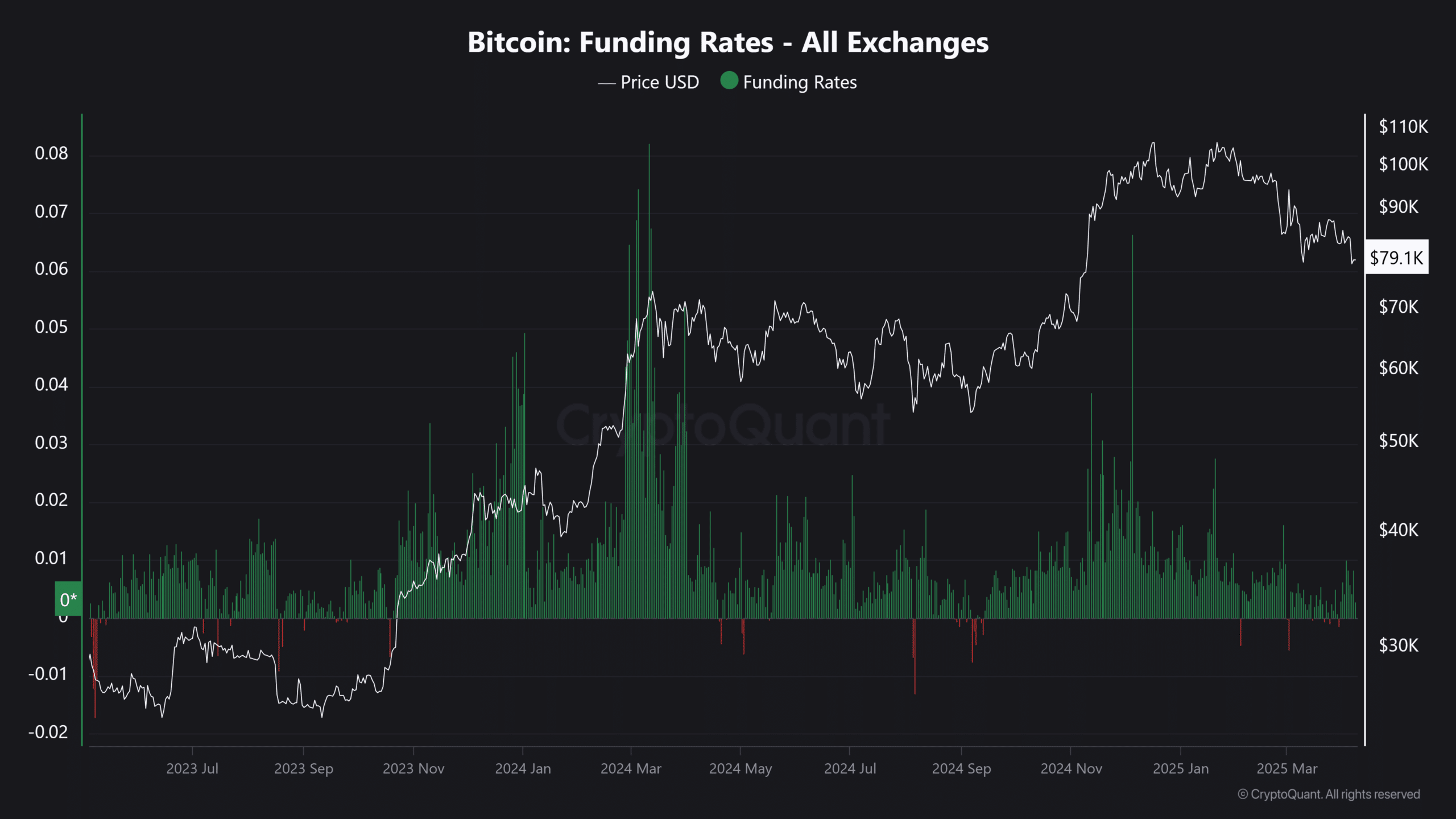

Upon further investigation, a crucial insight emerged. During the March rally, Open Interest (OI) surged from $32.01 billion to $35.81 billion. 📈

This confirms that Futures markets were actively driving price action. In other words, LTH liquidity wasn’t purely spot-driven but fueled by leveraged long positions, akin to a play fuelled by borrowed costumes and props. 🎭

Bitcoin at a Decision Point: Retest or Rebound? – A Dramatic Choice! 🎭

On the 6th of April, Bitcoin’s exchange inflow CDD stood at 286k. Just a day later, it surged to approximately 1.8 million—a massive 529% spike! This indicated that older BTC was being moved to exchanges, like ancient relics brought to market. 🏺

The key question now is whether this spike will lead to a February-style correction or mirror March’s resilience. Will it be a tragedy or a farce? 🎭

Interestingly, the day after this surge, BTC rebounded 1.10% to close at $79,164, suggesting that the market absorbed the initial wave of liquidity, like a sponge soaking up spilled wine. 🍷

On-chain trends offer additional insights. Short-Term Holder (STH) supply has dropped to a four-month low, while LTH supply remains steady, indicating that long-term conviction remains intact, like a stubborn stain on a nobleman’s coat. 👔

Meanwhile, Funding Rates (FR) are aligning with March levels, reinforcing the idea that derivatives activity is playing a dominant role in price action, a puppeteer pulling the strings of fate. 🧵

Moreover, Open Interest (OI) has reclaimed the $51 billion mark, signaling high liquidity flowing into leveraged trades, like a river of gold coursing through the city. 💰

However, with Funding Rates skewed towards longs, overleveraged positions could face liquidation if STHs continue to sell off, like a house of cards collapsing in a breeze. 🌬️

The silver lining? Despite the CDD spike, no major sell-off pressure has materialized—yet. If Bitcoin follows its March rally structure, it could recover lost resistance levels faster than expected, like a mischievous spirit escaping its bottle. 👻

Read More

- 50 Goal Sound ID Codes for Blue Lock Rivals

- Quarantine Zone: The Last Check Beginner’s Guide

- 50 Ankle Break & Score Sound ID Codes for Basketball Zero

- Ultimate Myth Idle RPG Tier List & Reroll Guide

- Lucky Offense Tier List & Reroll Guide

- Mirren Star Legends Tier List [Global Release] (May 2025)

- Every House Available In Tainted Grail: The Fall Of Avalon

- Enshrouded Hemotoxin Crisis: How to Disable the Curse and Save Your Sanity!

- Basketball Zero Boombox & Music ID Codes – Roblox

- How to use a Modifier in Wuthering Waves

2025-04-08 19:09