Markets

What to know:

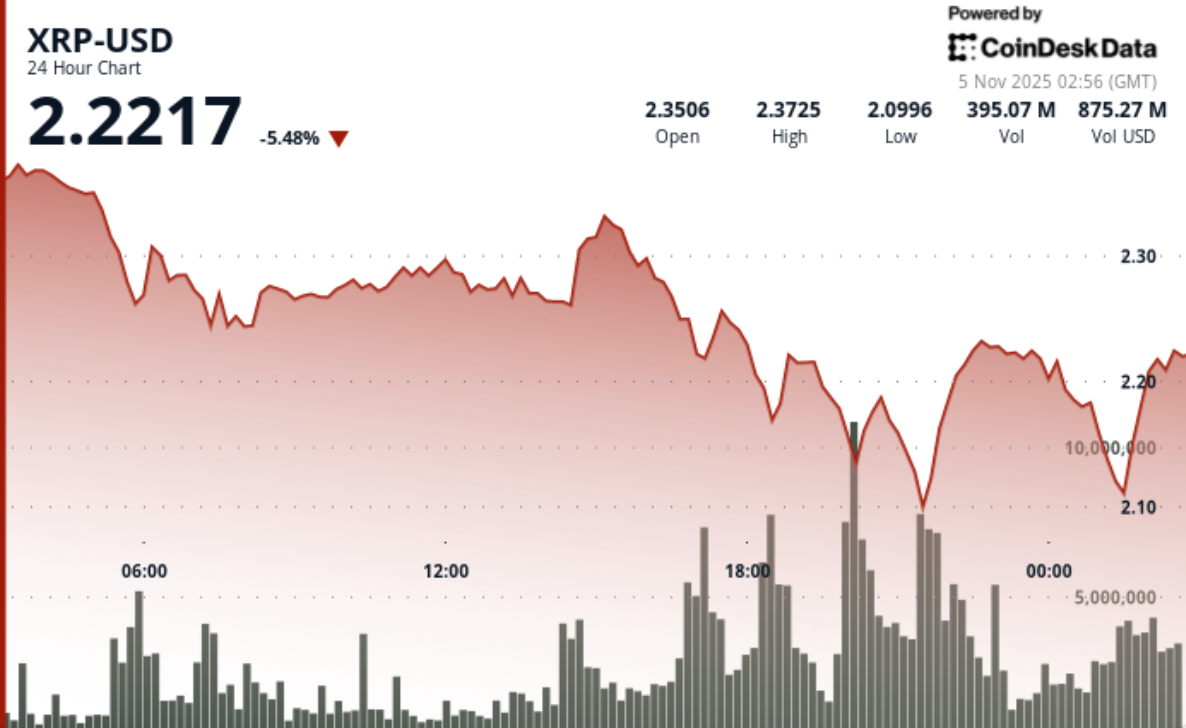

- XRP, that once-proud token, has tumbled 6.4% to a mere $2.20, a fall as graceless as a socialite slipping on a banana peel at the opera. 🍌🎭

- Trading volume surged 126% above average, a spectacle of institutional panic selling that would make even the most stoic investor blush. 💼💨

- Traders, those ever-hopeful souls, cling to the $2.08 support level like a drowning man to a life preserver, praying to avoid the abyss of $2.00. 🆘

Ah, XRP, how the mighty have fallen! On Tuesday, it plunged with the dramatic flair of a Shakespearean tragedy, breaking below key support levels on volume so exceptional, one might mistake it for a standing ovation at a particularly dull play. 🎭📉 The bearish momentum, a relentless critic, has set its sights on the $2.00 psychological zone, a level as ominous as a raven at midnight. 🦅

News Background

- XRP, once a darling of the crypto ball, fell 6.4% to $2.20, sliding from an intraday high of $2.35 as institutional sellers played their part with ruthless efficiency. The token danced across a 12.4% range, a solo performance as the broader crypto market stabilized, highlighting XRP’s isolated melodrama. 🎭💔

- Trading volume spiked to 356.7 million, a 126% surge above the average, confirming that institutions were indeed the choreographers of this bearish ballet. 💃🐻

- Strong resistance at $2.37 proved as unyielding as a Victorian matron, rejecting rebound attempts with the coldness of a winter’s breeze. ❄️

- The failure to sustain gains above prior support marked a structural shift from accumulation to active distribution, a plot twist worthy of Wilde himself. 📉✨

Price Action Summary

- Price action turned sharply bearish after the $2.17 breakdown, driving XRP to a session low of $2.08 before stabilizing around $2.20, a recovery as fleeting as a summer romance. 🌞💔

- Intraday data revealed a brief recovery from the $2.11 base, with price climbing 4.5% to $2.209 on a short-term volume burst of 5.8M tokens, though the rally stalled at $2.216 as liquidity faded like a forgotten promise. 💸🌫️

- The late-session bounce coincided with news that Ripple’s RLUSD stablecoin crossed $1 billion in market capitalization, but technical dynamics remained the primary driver, a reminder that even the most glittering news cannot mask a flawed performance. 📰✨

- Momentum loss above $2.22 signaled limited conviction behind the recovery, leaving XRP trapped below prior breakdown levels, a prisoner of its own making. 🔒

Technical Analysis

- The session confirmed a decisive bearish bias as XRP formed consecutive lower highs and lower lows from the $2.37 resistance peak, a pattern as predictable as a Wildean wit. 📉🤭

- The pattern validates a short-term downtrend reinforced by volume expansion during selloffs and contraction during rebounds – a classic signature of institutional distribution, a dance as old as time itself. 💼💃

- Momentum indicators turned negative, with the relative strength index trending near neutral after falling from overbought territory earlier in the month, a fall from grace as dramatic as any Wildean protagonist. 📉🎭

- The failure to reclaim the $2.17 line suggests further weakness unless renewed demand emerges around the $2.08-$2.11 consolidation base, a glimmer of hope in this otherwise bleak narrative. 🌟

- While XRP’s structure hints at a possible oversold recovery, volume divergence and failed retests imply rallies may continue to face heavy resistance until broader market sentiment improves, a tale as old as the markets themselves. 📈🚫

What Traders Should Know

- Traders, those eternal optimists, are watching whether XRP can hold above the $2.08 support to avoid accelerating losses toward the $2.00 psychological level, a fate as dreaded as a bad review from a critic. 🆘💔

- A sustained recovery above $2.22 would be required to re-establish bullish footing, while failure to maintain current levels risks another wave of liquidation, a prospect as grim as a rainy day in London. ☔💸

- Institutional volume spikes during declines confirm active repositioning rather than retail-driven volatility, a reminder that the big players are always in control. 💼🎮

- For tactical traders, the $2.17-$2.22 zone represents the key inflection range that could define short-term direction, a crossroads as fraught with tension as a Wildean drawing room. 🚦✨

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- A Knight Of The Seven Kingdoms Season 1 Finale Song: ‘Sixteen Tons’ Explained

- Gold Rate Forecast

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Mario Tennis Fever Review: Game, Set, Match

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- This free dating sim lets you romance your cleaning products

- All Songs in Helluva Boss Season 2 Soundtrack Listed

- Every Death In The Night Agent Season 3 Explained

- 4. The Gamer’s Guide to AI Summarizer Tools

2025-11-05 06:39