XRP, once the cryptocurrency equivalent of a passive-aggressive roommate, is now showing signs of life-thanks to Flare Network’s data, which proves that even digital assets can have a midlife crisis. 🤖🌌

Flare Network Data: The Bullish Thesis for XRP and XRPL Just Got a Cosmic Upgrade! 🚀

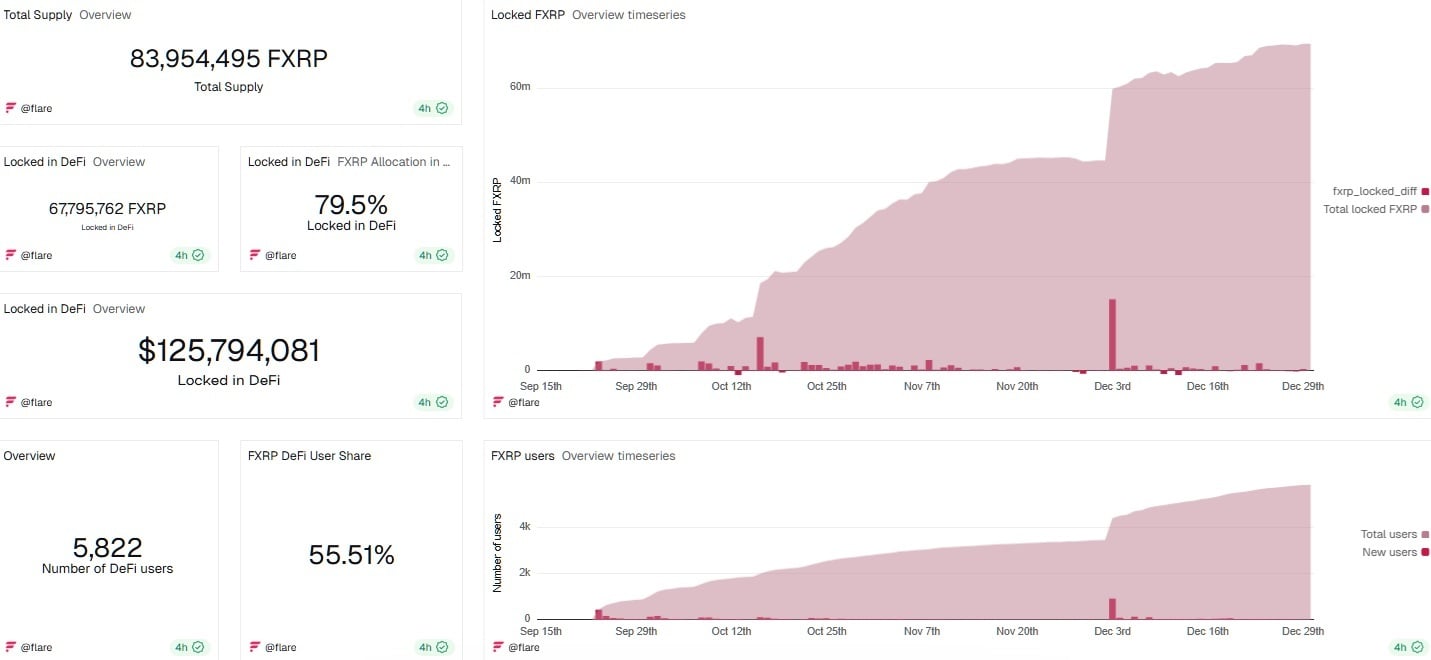

Momentum around XRP and the XRP Ledger (XRPL) is stronger than a supernova as on-chain data reinforces the case for sustained DeFi adoption. Blockchain infrastructure provider Flare Network shared on social media platform X on Dec. 29 commentary arguing that XRP holders are actively participating in decentralized finance, with detailed FXRP metrics pointing to growing usage, rising user activity, and deepening liquidity tied to XRPL-linked assets. 🌌💸

Flare stated:

XRP holders are often seen as passive and ‘not DeFi users.’ FXRP data tells a different story. 🤯

“Over 80% of FXRP is locked in DeFi – more than $124M actively deployed on Flare. Even more interesting: this growth happened during a weak market. User numbers kept rising, capital stayed locked, and adoption followed a steady, step-by-step pattern, not short-term yield chasing. Turns out the issue was never demand. It was infrastructure. Flare is unlocking XRP DeFi,” the team added. 🧠💡

According to Flare’s data as of Dec. 30, roughly 80% of the total FXRP supply is locked in DeFi, representing approximately $125.8 million deployed across Flare-based protocols during a weak market environment. Network dashboards show a total FXRP supply of about 83.95 million tokens, with nearly 67.8 million FXRP committed to DeFi applications. 🧮💰

User participation has continued to expand, with more than 5,800 DeFi users and FXRP users representing over 55.5% of total FXRP holders. Transaction activity has also remained robust, exceeding 1.2 million DeFi transactions, including more than 1.12 million FXRP swaps, alongside tens of thousands of liquidity additions and removals. Flare’s message framed this behavior as conviction-driven engagement rather than opportunistic yield rotation, emphasizing that capital has remained persistently locked while user counts trended steadily higher. 🚀📈

Additional data further supports a bullish outlook for XRP and the XRP Ledger by illustrating how infrastructure has unlocked previously inaccessible utility. FXRP functions as a 1:1 representation of XRP minted through Flare’s FAssets system, enabling non-custodial interaction with EVM-compatible decentralized applications while remaining economically linked to XRPL liquidity. 🌐🔒

Beyond core DeFi, related products such as stXRP are gaining traction, with over $4.17 million locked in Sparkdex, more than $1 million in Enosys, and additional allocations across Kinetic and other platforms. Within the Kinetic protocol alone, FXRP liquidity exceeds 37.4 million tokens, with total FXRP supply valued at over $72 million and borrowing activity approaching $2.7 million. These figures highlight growing composability and capital efficiency tied directly to XRP. The data underscores that XRP’s historical DeFi limitations stemmed from missing infrastructure rather than lack of demand. With Flare Network extending smart contract functionality and DeFi access, XRP and the XRP Ledger are increasingly positioned as scalable liquidity layers capable of supporting sustained decentralized finance growth. 📈🚀

FAQ 🧭

- Why is rising FXRP DeFi participation important for XRP investors?

With over 80% of FXRP locked in DeFi-about $125 million deployed-on-chain data shows sustained, conviction-driven utility that strengthens XRP’s long-term investment thesis beyond speculation. 💸🧠 - What does Flare Network’s data reveal about XRP holder behavior?

Contrary to the perception of passive holders, FXRP metrics show growing user counts, persistent capital lock-up, and steady adoption even during a weak market. 🚀📈 - How does FXRP expand the utility of the XRP Ledger?

FXRP enables XRP to interact with EVM-compatible DeFi applications via Flare’s non-custodial FAssets system while remaining economically tied to XRPL liquidity. 🌌🌐 - Why is this development considered bullish for XRP and XRPL?

The combination of deepening liquidity, rising DeFi users, and improved infrastructure signals scalable real-world usage that could support long-term network value growth. 📈🌠

Read More

- Movie Games responds to DDS creator’s claims with $1.2M fine, saying they aren’t valid

- The MCU’s Mandarin Twist, Explained

- These are the 25 best PlayStation 5 games

- SHIB PREDICTION. SHIB cryptocurrency

- Scream 7 Will Officially Bring Back 5 Major Actors from the First Movie

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- Server and login issues in Escape from Tarkov (EfT). Error 213, 418 or “there is no game with name eft” are common. Developers are working on the fix

- Rob Reiner’s Son Officially Charged With First Degree Murder

- MNT PREDICTION. MNT cryptocurrency

- ‘Stranger Things’ Creators Break Down Why Finale Had No Demogorgons

2025-12-31 02:14