Analysts, those solemn prophets of numbers, whisper that optimism is afoot, yet history-ever the unreliable narrator-offers no guarantees. The past, they remind us, is a dusty book with pages torn out by the hands of fate.

XRP Rebounds Above $2 Amid Shifting Market Sentiment

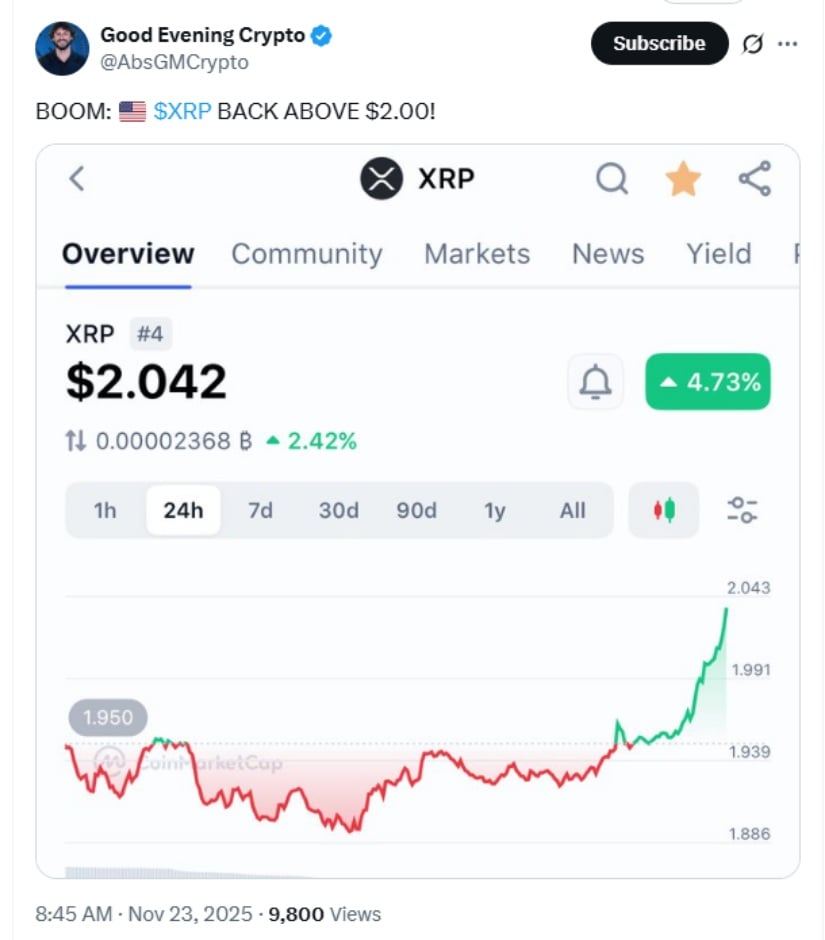

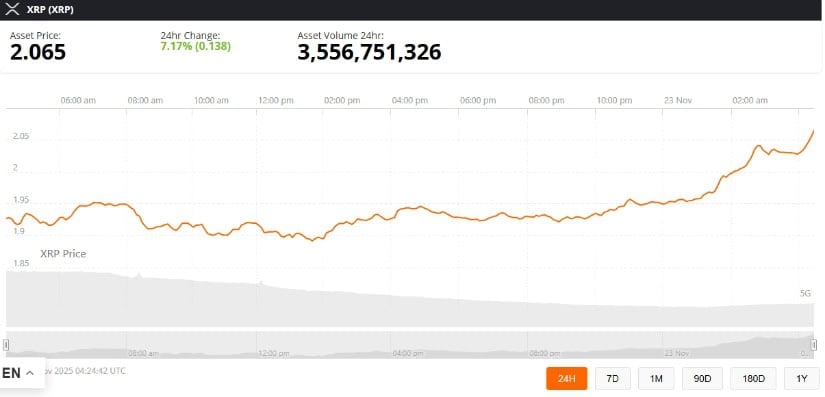

XRPUSD, that capricious flirt, has briefly returned to the $2.00 mark after a week of flirtations with $1.83. AbsGMCrypto, a self-proclaimed oracle of cycles, attributes this to institutional suitors and U.S. regulatory green lights, though the price only reached $2.04 before retreating like a guest at a party who forgets their own name.

Social media, that echo chamber of hope and hype, calls it a “boom,” while analysts sigh and mutter about weekend price swings being as predictable as a cat’s nap. Short-term volatility? Just another day in crypto’s madhouse. 🐾

Historical Comparisons: Contextualizing 2016-2017 Cycles

LunaMetrics, a trader with a penchant for nostalgia, compares the current dip to XRP’s 2016-2017 lows ($0.0054), but adds a disclaimer: today’s world is a different beast. Higher liquidity, stricter regulations, and fewer people wearing fanny packs full of cash. Progress, or just a more expensive form of confusion? 🤷

Disclaimer: History is not a crystal ball. It’s more like a broken compass pointing at a mirage. Current conditions include more suits in meetings and fewer tweets about moonshots. 🧑💼

ETF Inflows Strengthen Institutional Footing

XRP’s recent charm offensive coincides with U.S. ETF launches. Preliminary data shows:

-

Canary Capital XRPC ETF: $250M inflows. First-day volume: $58M. A splashy debut, or just a well-rehearsed encore?

-

Bitwise XRP ETF: $100M in assets. The crowd’s applause is polite, but the encore remains uncertain.

Farside Investors call these ETFs “new avenues for exposure,” but Santiment notes 200 million XRP fled exchanges in 48 hours-a reminder that liquidity is as slippery as a bar of soap in a crypto shower. 🚿

Regulatory Clarity: Ripple’s Legal Milestones

Judge Analisa Torres’ 2025 verdict declared XRP not a security (secondary sales, that is), giving banks permission to dance with Ripple’s ODL. Yet, as EconCrypto sighs, the broader market remains skittish-Treasury yields rise, and crypto’s party is winding down. The SEC may have left the room, but the ghost of uncertainty still lingers. 👻

ISO 20022 Integration: Utility Framework

RippleNet’s ISO 20022 compatibility is a “plus,” says ClaraFinTech, but not a magic wand. It’s like saying a bicycle has wheels but won’t carry you to Mars. Utility is a slow burn, not a fireworks show. 🚲

Technical Landscape: Channel Support and Indicators

XRPUSD remains trapped in a descending channel since August 2025. The RSI is at its lowest since 2024, a cry for help from a chart that’s seen better days. MACD histogram? Flat as a pancake dropped on the floor. If buying pressure kicks in near $1.80, maybe it’ll break free-but don’t hold your breath. 🥣

Resistance zones? $2.06-$2.15, then $2.20-$2.30. A breakout could lead to $4, according to ChartProX, who may or may not be paid by Ripple. 🎯

Institutional Dynamics: Whale Behavior and ETF Exposure

Canary Capital’s ETFs have ~$44M in long exposure, but in-kind creations make net exposure a riddle wrapped in an enigma. Meanwhile, the top 100 XRP wallets control 68% of the supply-enough to move markets like a herd of elephants in a china shop. 🐘

Disclaimer: Wallets and flows change faster than fashion trends. Trust no one, least of all a chart. 🛑

Outlook by Time Horizon

Short-Term (Days-Weeks):

-

$2.00 is a psychological barrier, but also a red herring. Traders watch $1.80 like hawks-will it hold, or crumble like a poorly baked soufflé? 🧁

-

Daily indicators hint at a rebound… if the market isn’t too busy panicking. Fingers crossed for a miracle. 🤞

Medium-Term (Weeks-Months):

-

ETF adoption and legal clarity may stabilize the ship-but only if the crew stops bickering. Resistance at $2.20-$2.30 is a test of wills. 🤺

Long-Term (Months-Years):

-

RippleNet’s ISO 20022 compatibility and Asian/African expansion could make XRP a cross-border star. Even 5% of the $685B remittance market? A dream, or a math problem? 🧮

Read More

- All Golden Ball Locations in Yakuza Kiwami 3 & Dark Ties

- All Itzaland Animal Locations in Infinity Nikki

- NBA 2K26 Season 5 Adds College Themed Content

- Elder Scrolls 6 Has to Overcome an RPG Problem That Bethesda Has Made With Recent Games

- What time is the Single’s Inferno Season 5 reunion on Netflix?

- Hollywood is using “bounty hunters” to track AI companies misusing IP

- Heated Rivalry Adapts the Book’s Sex Scenes Beat by Beat

- Unlocking the Jaunty Bundle in Nightingale: What You Need to Know!

- EUR INR PREDICTION

- BREAKING: Paramount Counters Netflix With $108B Hostile Takeover Bid for Warner Bros. Discovery

2025-11-24 00:22